Research by accounting software provider MYOB reveals the economic confidence and overall business outlook of small to medium business operators (SMEs) is finally on the rise.

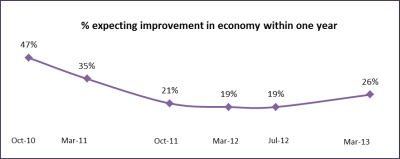

The March 2013 MYOB Business Monitor found over one quarter of SMEs expected the domestic economy to improve within 12 months (26%). This is a welcome increase of seven percentage points from the July 2012 report (19%).

In the latest study of 1,005 Australian business owners and managers, the proportion expecting an economic improvement to take one to two years is now 37%, down from 42%. Those who think it will take more than two years is now 22%, down from 24%.

This positivity was echoed in the expectations of revenue results for this year. Overall, 30% were anticipating a revenue rise, 42% expected revenue to be stable, 19% expected a fall and 10% weren’t sure.

CEO Tim Reed said: “72% of SMEs expect increased or stable revenue this year. Considering only 58% saw that occur last year, it indicates hope is springing back for Australia’s business coalface.

“However, 19% expect revenue to fall. Our advice to them is to seek assistance from a business mentor, coach or advisor such as an accountant. Draw on their expert knowledge accumulated through years of experience working with other businesses. There’s a lot to be gained from the lessons learned by other businesses and their tactics to combat pressures.”

Improved revenue results and next quarter’s work pipeline

Two fifths of respondents reported steady revenue when asked to look back over the past year (40%), a little more than those who saw revenue decline (39%). Last year respondents were more likely to see a fall than stability. The proportion who experienced a revenue rise was on par with July 2012 (18%). Operators in the manufacturing and wholesale industry were hit hardest – 52% experienced a revenue fall. The finance and insurance industry was the most likely to see a rise (29%) while the transport, postal and warehousing industry was the most likely to see steady revenue (49%).

Of the mainland states, Queensland and Western Australia were most likely to see a rise (22%). Western Australia was also the least likely to report a loss (32%). Both New South Wales and Victoria had the highest proportion who saw a revenue fall (40%). South Australians were most likely to have steady revenue (45%).

Mr Reed said: “I hope the recent floods don’t dent the performance expectations of Queensland businesses. They did well last year, with more than three in five seeing either rising or steady revenue. Their Western Australian counterparts had the best result, with almost two in every three seeing steady or rising revenue despite increasing talk of the mining sector slowing.

“Successful Australian business owners are known for digging deep, embracing change and adapting. They find opportunities in the challenges. Leveraging new technologies, new organisational structures and better systems could help our independent businesses improve their operational and financial performance.”

Nearly one third of the SMEs surveyed reported more work/sales in their pipeline for the next three months than anticipated (30%). 41% reported an expected pipeline, leaving 28% seeing less work than expected. This was on par with the July 2012 report, at 29%, 43% and 27% respectively.

Cash flow pressures drop while manufacturing and wholesale feel the currency squeeze

Fuel prices continue to be the top pressure point for SMEs, as it has been since March 2011. Attracting new customers has risen to second from tied fourth, swapping places with cash flow, which is now tied fourth with competitive activity. Price margins and/or profitability remains in third place. A notable exit from the top five was interest rates, which dropped one spot to sixth.

Mr Reed said: “While the rising cost of fuel continues to bite the hardest, cash flow is becoming less of a concern. Last year it was the second biggest pressure on SMEs, yet it dropped to fourth in this survey.

“Interest rates are also less of a concern. After five cuts since late 2011, the cash rate remains at its lowest since 2009. SMEs instead feel more heat from the need to bring in more customers. Many operators are hopeful of the exchange rate moving into more favourable territory to help boost consumer spending.

“Similar to retailers and tourism operators, manufacturing and wholesale operators continue to battle the impact of the strong dollar. Our research found over half the respondents in this sector experienced a revenue fall last year and their biggest pressure point is price margins and/or profitability, followed by fuel prices.

“The strong dollar benefits those who import or travel abroad for business, but is detrimental to those who produce locally and export. Australia’s manufacturers are finding it a challenge to be a competitive supplier to local and international buyers.”