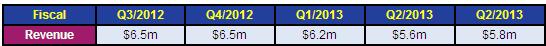

After falling 10% last quarter, for fiscal third-quarter 2013 (to 28 December 2012) Advanced Photonix Inc of Ann Arbor, MI, USA (which designs and makes APD, PIN, and FILTRODE photodetectors, HSOR high-speed optical receivers, and T-Ray terahertz instrumentation) has reported sales of $5.8m, up 4% on last quarter’s $5.6m though still down 10% on $6.5m a year ago.

Due to a favorable product mix and cost-reduction efforts, gross margin has rebounded from 35.3% last quarter to 42%, up on 41.3% a year ago.

Operating expenses have risen from $3.2m last quarter (52% of revenue) to $3.5m (59% of revenue), level with $3.5m a year ago (55% of revenue).

Adjusted EBITDA (earnings before interest, taxes, depreciation, amortization and stock compensation) has rebounded from negative $717,000 last quarter to negative $485,000, although this is still down on just negative $1000 a year ago.

“We continue to see signs of improving business condition, although further out than we expected,” comments CEO Richard Kurtz. “Because of the continuing supply issues we have experienced and continue to have in our 100G HSOR product platform, we now expect a flat second half of fiscal 2013 relative to the first half, with growth picking up in subsequent quarters,” he adds.

“In anticipation of the drop in revenue in this second half, we have secured an additional $2.5m in a credit facility to insure we can meet our growth plans this coming year,” continues Kurtz. “I would like to thank Partners for Growth for working with us to structure a financing deal that aligns our short-term and long-term debt and minimizes shareholder dilution,” he adds. “We plan to give our total revenue guidance for fiscal 2014 in June with our total year fiscal year 2013 results.”