1. The completion of real estate investment

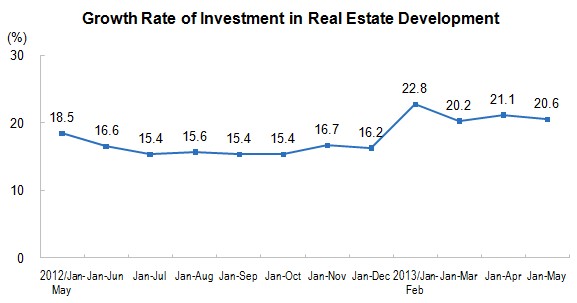

The total investment in real estate development in the first five months of 2013 was 2,679.8 billion yuan, up by 20.6 percent year-on-year in nominal term, 0.5 percentage points lower than that in the first four months. Of which, the investment in residential buildings was 1,836.3 billion yuan, up by 21.6 percent, 0.3 percentage points higher than that in the first four months, and accounted for 68.5 percent of real estate development investment.

In the first five months, the real estate investment in eastern region stood at 1,551.8 billion yuan, up by 19.0 percent year-on-year, the growth rate down by 1.2 percentage points over that in the first four months; the central region stood at 544.5 billion yuan, went up by 21.8 percent, and up by 1.4 percentage points; western region stood at 583.5 billion yuan, up by 24.0 percent, and a decrease of 0.5 percentage points.

In the first five months, the floor space under construction by the real estate development enterprises accounted for 5,234.31 million square meters, up by 16.0 percent year-on-year, decreased 1.2 percentage points over that in the first four months. Of which, the floor space of residential building construction area was 3,847.17 million square meters, up by 13.5 percent. The floor space started this year was 736.13 millions square meters, up by 1.0 percent, while that in the first four months was down by 0.9 percent. Specifically, the floor space of residential buildings started in the year amounted to 542.91 million square meters, up by 0.8 percent. The floor space of buildings completed stood at 287.45 million square meters, went up by 5.3 percent, decreased 1.3 percentage points, of which, the floor space completed of residential buildings stood at 287.45 million square meters, went up by 1.8 percent.

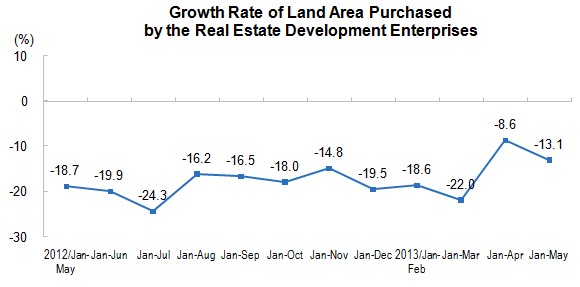

In the first five months, the land area purchased by the real estate development enterprises totaled 117.56 million square meters, a year-on-year decrease of 13.1 percent, and decreasing amplitude increased 4.5 percentage points over the first four months. The total transaction of land reached 271.8 billion yuan, increased 3.7 percent, decreasing amplitude narrowed 6.9 percentage points over the first four months.

2. Sales of Commercial Buildings

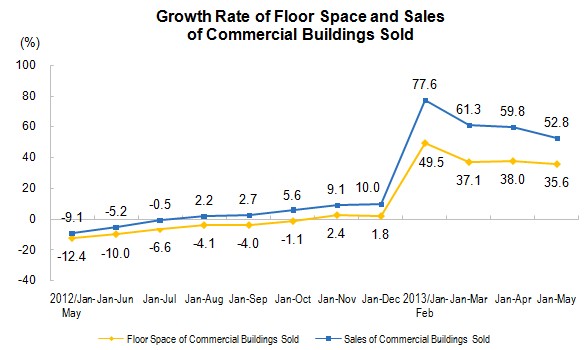

In the first five months, the floor space of commercial buildings sold stood at 391.18 million square meters, a year-on-year increase of 35.6 percent, and 2.4 percentage points lower over that in the first four months. Of the total, the floor space of residential buildings increased 37.6 percent, office building increased 35.5 percent, and buildings for business use increased 11.8 percent. The sales of commercial buildings amounted to 2,586.4 billion yuan, an increase of 52.8 percent, and 7.0 percentage points lower over that in the first four months. Specifically, the sales of residential buildings went up by 56.8 percent, office buildings up by 53.7 percent, buildings for commercial business up by 22.4 percent.

In the first five months, the sale of floor space of commercial buildings in eastern region amounted to 200.52 million square meters, a year-on-year increase of 42.2 percent, 4.8 percentage points lower than that in the first four months. The amount of sales stood at 1,648.2 billion yuan, went up by 60.7 percent, and decreased 9.2 percentage points. The sale of floor space of commercial buildings in central region amounted to 94.98 million square meters, increased 36.4 percent, an decrease of 1.3 percentage points. The amount of sales stood at 461.5 billion yuan, climbed 50.3 percent, a decrease of 5.3 percentage points. The sale of floor space of commercial buildings in western region amounted to 95.68 million square meters, an increase of 22.8 percent, went up by 0.5 percentage points. The amount of sales stood at 476.7 billion yuan, went up by 32.4 percent, a decrease of 2.4 percent.

At the end of May, the floor space of commercial housing for sale reached 429.24 million square meters, increased 3.36 million square meters compared with that at the end of April. Of which, the residential buildings for sale increased 0.91 million square meters, office buildings increased 0.14 million square meters, buildings for business use climbed 1.61 million square meters.

3. Sources of Funds for Real Estate Development Enterprises

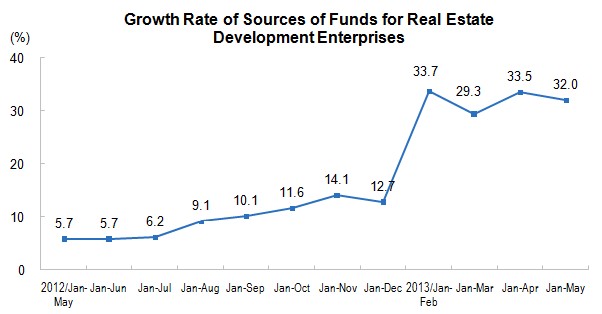

In the first five months, the sources of funds for real estate development enterprises reached 4,511.5 billion yuan, up by 32.0 percent year-on-year, 1.5 percentage points lower over that in the first four months. Specifically, the domestic loans stood at 805.1 billion yuan, increased 27.9 percent, foreign investment stood at 19.9 billion yuan, up by 18.2 percent, self-raising funds stood at 1,658.8 billion yuan, up by 14.3 percent, and other sources stood at 2,027.7 billion yuan, up by 53.7 percent. Among the other sources of funds, deposits and advance payments totaled 1,251.4 billion yuan, surged 57.9 percent, personal mortgage loans totaled 540.4 billion yuan, ballooned 61.7 percent.

4. National Real Estate Climate Index

In May, the national real estate climate index was 97.26, decreased 0.09 points over that in April.

Investment in Real Estate Development for January-May

| Indicators | Absolute Value | Growth Rate Year-on-Year (%) |

| ||||||||

|

|

|

|

| ||||||||

|

| Investment in Real Estate (100 million yuan) | 26798 | 20.6 | ||||||||

|

| Of which: Residential Buildings | 18363 | 21.6 | ||||||||

|

| Office Buildings | 1526 | 41.0 | ||||||||

|

| Buildings for Commercial Business | 3582 | 24.1 | ||||||||

|

| Floor Space under Construction (10,000 sq.m) | 523431 | 16.0 | ||||||||

|

| Of which: Residential Buildings | 384717 | 13.5 | ||||||||

|

| Office Buildings | 19206 | 24.9 | ||||||||

|

| Buildings for Commercial Business | 61826 | 21.7 | ||||||||

|

| Floor Space of Houses Newly Started (10,000 sq.m) | 73613 | 1.0 | ||||||||

|

| Of which: Residential Buildings | 54291 | 0.8 | ||||||||

|

| Office Buildings | 2405 | 1.8 | ||||||||

|

| Buildings for Commercial Business | 8860 | -1.4 | ||||||||

|

| Land Acquisition Area (10,000 sq.m) | 11756 | -13.1 | ||||||||

|

| Value of Land Transactions (100 million yuan) | 2718 | 3.7 | ||||||||

|

| Floor Space of Buildings Completed (10,000 sq.m) | 28745 | 5.3 | ||||||||

|

| Of which: Residential Buildings | 22204 | 1.8 | ||||||||

|

| Office Buildings | 687 | 14.8 | ||||||||

|

| Buildings for Commercial Business | 3431 | 17.1 | ||||||||

|

| Floor Space of Commercial Buildings Sold (10,000 sq.m) | 39118 | 35.6 | ||||||||

|

| Of which: Residential Buildings | 35166 | 37.6 | ||||||||

|

| Office Buildings | 868 | 35.5 | ||||||||

|

| Buildings for Business Use | 2232 | 11.8 | ||||||||

|

| Sales of Commercial Buildings (100 million yuan) | 25864 | 52.8 | ||||||||

|

| Of which: Residential Buildings | 21971 | 56.8 | ||||||||

|

| Office Buildings | 1186 | 53.7 | ||||||||

|

| Buildings for Commercial Business | 2279 | 22.4 | ||||||||

|

| Floor Space of Commercial Housing for Sale (10,000 sq.m) | 42924 | 39.6 | ||||||||

|

| Of which: Residential Buildings | 28230 | 43.1 | ||||||||

|

| Office Buildings | 1768 | 35.6 | ||||||||

|

| Buildings for Commercial Business | 8278 | 33.2 | ||||||||

|

| Sources of Funds for Real Estate Development Enterprises (100 million yuan) | 45115 | 32.0 | ||||||||

|

| Of which: Domestic Loans | 8051 | 27.9 | ||||||||

|

| Foreign Investment | 199 | 18.2 | ||||||||

|

| Self-raising Funds | 16588 | 14.3 | ||||||||

|

| Other Sources of Funds | 20277 | 53.7 | ||||||||

|

| Deposits and Advance Payments | 12514 | 57.9 | ||||||||

|

| Personal Mortgage | 5404 | 61.7 | ||||||||

Real Estate Investment in Eastern,

Central and Western Regions for January-May

| Regions | Investment (100 million yuan) |

| Growth Rate Y/Y (%) |

| ||||||||

| Residential Buildings | Residential Buildings | |||||||||||

|

|

|

|

|

| ||||||||

| National Total | 26798 | 18363 | 20.6 | 21.6 | ||||||||

| Eastern | 15518 | 10540 | 19.0 | 19.7 | ||||||||

| Central | 5445 | 3799 | 21.8 | 23.1 | ||||||||

| Western | 5835 | 4024 | 24.0 | 25.4 | ||||||||

Sales of Commercial Buildings in Eastern,

Central and Western Regions for January-March

| Regions | Floor Space of Commercial Buildings Sold | Sales of Commercial Buildings | ||||||||||

| Absolute Value | Growth Rate Y/Y (%) | Absolute Value | Growth Rate Y/Y (%) | |||||||||

|

|

|

|

|

| ||||||||

| National Total | 39118 | 35.6 | 25864 | 52.8 | ||||||||

| Eastern | 20052 | 42.2 | 16482 | 60.7 | ||||||||

| Central | 9498 | 36.4 | 4615 | 50.3 | ||||||||

| Western | 9568 | 22.8 | 4767 | 32.4 | ||||||||

Annotations:

1. Explanation of Indicator

The total investment in real estate development this year: refers to the investment of all construction projects for housing, land development projects, public welfare construction and land acquisition costs in the reporting period. The index is cumulatively statistical data based on the principle of image progress.

Area of commercial buildings sold: refer total areas sold of new commercial buildings in the contract during the reporting period (i.e. area of floor space designated in the formal contract signed by both sides). The indicator is cumulative data.

Value of commercial buildings sold: refers to the total contracted vale of new commercial buildings for sale during the reporting period (i.e. the total value of sales for selling of commercial building as designated in the formal contract signed by both sides). This indicator is cumulative data, as well as the sale of floor space of commercial buildings.

The sources of funds for real estate development enterprises in the year: refers to various currencies and sources of real estate development funds actually available by the real estate development enterprises in the reporting period. Specifically, it includes domestic loans, foreign investment, self-raised funds and other funds. The index is cumulative data.

Floor space of buildings under construction: refers to the total floor space of all buildings by the real estate development enterprises during the reference time. Including floor space newly started in current year, floor space of continued construction of the building from the former period, floor space of stopped or postponed in the previous period but recovered in current year, floor space completed during current year, and newly started floor space in current year but postponed. Floor space under construction of multi-storey buildings refers to the total floor space of all stories.

Floor space of houses newly started: refers to floor space of houses newly started by the e real estate development enterprises during the reference time, the unit project as the accounting object. Not including continued construction area of housing which started in the previous period, and restarted construction area in the current year but stopped or postponed in the previous period. Specific due date is subject to starts to housing officially began ground-breaking gouge (ground treatment or permanent piles). Floor space of houses newly started refers to the entire floor spaces of whole building; the calculation can not be separated.

Floor space of buildings completed: refers to housing construction during the reporting period have been completed in accordance with design requirements, achieved to living and conditions of use, acceptance of accreditation standards or to the final acceptance, total building areas could formally handed over to be used.

Land acquisition area: refers to land area by the real estate development enterprises in the year through various ways to obtain land.

Value of land transactions: refers to final amount of transactions of land use rights by the real estate development enterprises. In the primary land market, refers to the final section of land allocation, "auction" price and sale price; the secondary land market, refers to the finalize the contract price on land transfer, lease, mortgage, etc.. Price of land transactions and land acquisition area are the same scope, December calculate the average purchase price of land.

2. Statistics coverage

All real estate development and corporate business units.

3. Survey methods

Collected monthly with complete enumeration (no report in January).

4. Brief description on national real estate climate index

National real estate climate index fluctuations follow by the economic cycle theory, according to the business cycle theory and business cycle analysis, based on the use of time series, multivariate statistical, econometric analysis, use the real estate development and investment as the benchmarks, selected related indicators such as real estate investment, capital, area, sales, conducted by the seasonal factors and random factors, adopting the growth rate cycle method. National real estate index selected year 2000 as the base year, its growth rate set at 100. Typically, the most appropriate level of national real estate climate index is 100, the moderate level is between 95 and 105, the lower level is below 95, and the higher level is above 105.

5. Division on Eastern, Central and Western Regions

Eastern region includes Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan. Central region includes Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, and Hunan. Western region includes Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang.

6. Calculation on Growth Rate

The growth rate of real estate investment is nominal growth rate, due to the investment in fixed assets price index was calculated on quarterly, in addition to the January-March, January-June, January-September, and January-December was calculated on computable real growth rate, the other months only calculated the nominal growth rate.