INVESTMENT banks, suffering the softest period for takeover completions in almost a decade, are facing the prospect of another weak year of deal-making as companies remain cautious and shy away from big mergers and acquisitions.

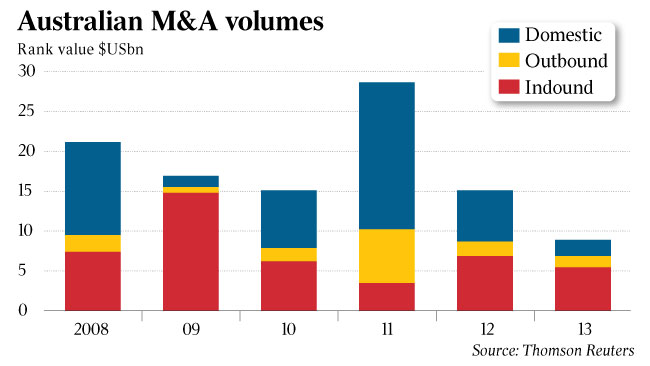

In contrast to bumper deals in the US and the buoyant mood in equity markets, announced M&A in Australia in the first quarter is down 54 per cent to $US8.9 billion ($8.57bn) compared with the same period last year, making it the weakest quarter since 2002, according to Thomson Reuters data exclusive to The Australian.

Activity is down a larger 67 per cent on the December quarter as companies focus on their own operations and cost-cutting.

Despite several companies reviewing assets and TPG signalling private equity's hunger in its $880 million purchase of Inghams, the soft start means M&A may struggle to top last year's $US84bn of announced deals, a horror 52 per cent fall from 2011.