The "stubbornly high" level of the dollar strengthens the case that the Reserve Bank will need to cut interest rates by as much as 100 basis points this year, according to ANZ Bank chief economist Warren Hogan.

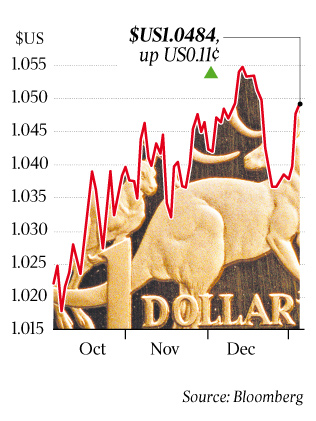

Despite the likelihood of lower rates, the dollar jumped almost a full US cent on Wednesday, the first trading day since the US resolved its "fiscal cliff" issue. It climbed again yesterday to close at $US1.049.

Traders said the US dollar eased against the Australian currency because nervous investors had used it as a safe haven in the closing days of last year, then dumped it as they moved back to a braver "risk-on" approach to investment.

"The big problem in Australia is that the persistent strength of our dollar has a slow-draining effect on the economy," Mr Hogan said, underpinning calls from business and union leaders that rates will need to drop.

He conceded that cutting rates alone would not do much to lower the dollar and said he was more concerned that the predicted tail-off in mining capital investment this year would create a "hole" in the economy that would make it necessary to have lower interest rates to cushion the impact.

Mr Hogan said he wanted there to be a discussion on whether the RBA should actively intervene to sell down the dollar. "This may be the year when we have to have that debate," Mr Hogan said, although he admitted: "We would need to cut rates by 100 basis points before we even consider intervention" -- unless the dollar climbed to $US1.10 or $US1.15.

Mr Hogan said cutting official rates by 100 basis points to 2 per cent "would help limit the prospective rise in the unemployment rate that recent, more pronounced weakness in job advertising is signalling".

Shane Oliver, head of strategy at AMP Capital Markets, agreed that interest rates had "some way to go down", although he picked a 50-basis-point cut from the current 3 per cent level, to replace the likely mining slowdown with a housing recovery.

Not that there was a mining bust looming, he said. "The iron ore price is back around $US144, from $US87 in September, so while it's well off the highs, it's well off the lows," Dr Oliver said.

He noted that there was still a lot of flow-through effect happening from the two previous RBA rate cuts last year, and said he disagreed with the notion that rate cuts were worse for the economy because they hurt fixed-income retirees disproportionately.

"There's already quite a huge saving for the 40 per cent of households with mortgages," he said, noting that borrowers were far more flexible in their spending habits than retirees and that deleveraging by borrowers would convert itself sooner or later to consumer spending and therefore improved economic conditions for all.

However, Mr Hogan said a housing recovery could be significantly reduced if there was "a continuing modest increase in the unemployment rate", as he believed was now occurring.

Chris Caton, chief economist at BT Financial Group, said he regarded the reduction in mining spending this year as "a pothole, rather than a slump" for the economy. He believed the apparent overvaluation of the dollar would correct itself in line with that adjustment, as overseas investors sought opportunities elsewhere.

"I've been spectacularly wrong on predicting currencies, but I'd be surprised to see the dollar holding up if the mining boom starts to be perceived as slowing down," Mr Caton said.