Fears of a possible global slowdown as US money printing tapers off sent Asian markets into a tailspin yesterday, pulling the Australian equities market back towards a level that has all but wiped off the gains it has made this year.

Markets across Asia suffered a bruising day as investors scrambled for the exits, with Japanese stocks falling more than 6 per cent and into a bear market, and heavy losses in China and across Southeast Asia.

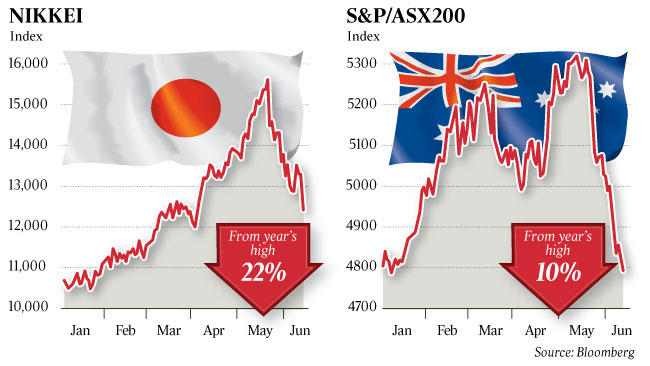

The S&P/ASX 200 index closed down 28 points at 4695.80. At one point it hit a calendar-year low of 4658.60, but recovered after investors waded into the market late in the day for what some described as bargain hunting, particularly among financials.

Investors fear, however, Australia will be caught in the global downdraft of a volatile international scene.

A sell-off has gripped global markets all week, fuelled by uncertainty over the direction of the Federal Reserve's monetary policy and signs of cooling growth in emerging economies.

THE big fear driving global markets is that growth will disappear as quickly as Ben Bernanke can say "no" to another stimulus. End of sidebar. Return to start of sidebar.

The mounting worries are sending cash to traditional safe haven assets of Treasuries, the yen and Japanese government bonds, while finance ministers and central banks across the region are taking steps to calm markets.

"It is a sentiment-driven fall that is feeding on itself," said Nader Naeimi, head of dynamic asset allocation AMP Capital Investors in Sydney who helps the firm manage more than $120 billion in funds.

"Investors seem to be taking profits wherever they can."

The most dramatic move was in Japan, with the Nikkei Stock Average falling 6.35 per cent and putting it 21.9 per cent down from the intraday peak reached on May 23, the day Japan's six-month rally turned south and began three weeks of wild trading.

"All of a sudden, ka-boom, markets have deflated heavily," said Matthew Sherwood, head of investment market research at Perpetual in Sydney which manages more than $25bn in funds.

Over the past five weeks investors had been disappointed both by the Fed suggesting it might pull back on its bond-buying program and by Japanese Prime Minister Shinzo Abe's long-term growth strategy, said Mr Sherwood.

The fear that the Fed could change its monetary policy, along with signs that the US economy is recovering, has encouraged investors to pull money out of emerging markets that are typically perceived as risky.

Fed chairman Ben Bernanke said on May 22 the US central bank "could" scale back stimulus efforts if the employment outlook showed "sustainable improvement".

Since then more than $US2.5 trillion ($2.6 trillion) has been wiped from the value of global equities, even though Mr Bernanke qualified his comments by saying that ending the stimulus prematurely would endanger the US economic recovery.

The resulting outflows have hit some of Asia's smaller markets the hardest.

The stockmarkets in The Philippines and Thailand were down 6.7 per cent and 3.6 per cent, respectively, yesterday. Along with Japan, these markets were some of the region's best performers before the sell-off started.

Moves so far by countries to stem the slide in markets and the exodus of cash have had mixed results. Indonesian stocks fell 1.2 per cent even after the central bank raised its benchmark interest rate yesterday to boost the allure of the falling currency.

Goldman Sachs' Richard Coppleson noted that the Australian market had officially entered a correction.

"Our market has now fallen 11.2 per cent from its May 15 (intraday) high of 5249," he said, adding the rises in the bank stocks in afternoon trading suggested the market slide might be easing. "Some banks are now at 7 per cent fully franked yields, which has to represent a trading buy," he said.

The other dampener to sentiment came from China.

Chinese stocks plunged after markets in the mainland reopened after a three-day public holiday, getting their first chance to react to signs the economy is slowing.

The Shanghai Composite Index hit a six-month low of 2126.22 in the session and finished down 2.8 per cent at 2148.36.

The Hang Seng China Enterprises Index, a measure of Chinese companies in Hong Kong, plunged 3.4 per cent, its worst percentage fall since May last year.