A noticeable slowing in the number of candidates and actual deals concluded for the week seemed to signal the start of the inevitable slowdown mat will likely characterize the Christmas and New Year period.

Indeed, many units that had been available since last week particularly, older handysize bulkers with poor age, cargoes and ownership, were left facing a Christmas all alone, without a home! All the while, Bangladesh and Pakistan failed to see any of their ideal VLCC / suezmax tankers and capesize bulkers enter the market, with which, to stock their yards over winter. As such, Bangladesh may have turned its hand to larger containers -perhaps explaining the lucrative price of USD 442/LT LDT paid by one bold cash buyer for the Taskos 14 kldt MSC BRASILIA 'as is' Singapore (with 350 T of bunkers).

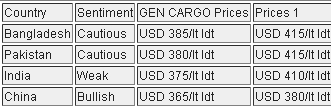

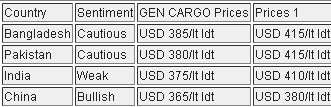

China was the one real market of the moment with prices on the rise there once again, without the impediment of the festive period and with Chinese New Year holidays on the horizon. This is perhaps the one market that may remain active up until the last moments of 2012. Finally, Turkish Buvers too remained busy this week taking home the Navibulgar controlled DIMITROVSKY KOMSOMOL (9,502 LDT) at a respective 309/LT LDT.

Cash buyers in the Indian market by contrast are still struggling to deliver their existing inventory with prices, demand, and sentiment still desperately subdued after a rocky finish to the vear. Still, with the volumes taken there and records already broken, local buyers in the sub-continent in general can perhaps be forgiven for taking a breather.

For week 51 of 2012, GMS demo rankings for the week are as below: