Twice as many businesses intend to increase their levels of capital investment in the months ahead compared to those which will reduce their spending, with Australia’s record low borrowing costs and steady levels of confidence about growth during this year encouraging executives to prepare for stronger trade.

According to Dun & Bradstreet’s latest Business Expectations Survey, the capital investment index for Q2 2014 has risen to 10.1 points, up from five points a year earlier. With nineteen per cent of businesses planning to lift their business spending, compared to the nine per cent that plan to invest less, the index has now risen for a fourth consecutive quarter.

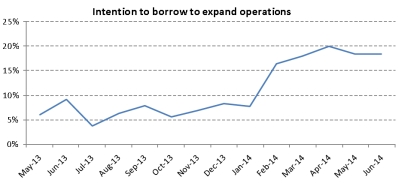

Corresponding to the lift in investment plans, D&B’s survey shows that borrowing intentions are being sustained at a healthy level, following a subdued 2013. D&B’s findings reveal that 18.4 per cent of companies plan to access new finance or credit in the next three months for the purpose of growing their operations, compared to nine per cent at the same time last year.

The more positive borrowing and spending outlook comes despite recent corporate requests for assistance, underscoring the resilience of the current level of business confidence. D&B has found that 64 per cent of businesses are more optimistic about growth this year compared to 2013. Additionally, when asked to identify their biggest barrier to growth this year, the most common response from business was ‘no major barrier’ (32 per cent), ahead of a slow demand for products (23 per cent) and online selling by competitors (11 per cent).

“After reining in their expenses through much of last year, businesses are showing a greater appetite for investment, which bodes well for the general performance of the economy this year,” said Gareth Jones, CEO of Dun & Bradstreet.

“We have recently seen sales expectations hit a 10-year high, and so it follows that businesses are also looking to borrow, invest and grow their operations to prepare for increased activity.

“While recent high profile corporate announcements on jobs and operations in Australia have highlighted the challenges that remain for a number of industries, we are still seeing year-on-year improvements in the general business outlook,” Mr Jones added.

A look across the survey’s indices shows there has been a continuation of the recent pick-up in business expectations through to the first half of 2014. D&B’s sales expectations index has continued to rise, reaching 36.9 points for Q2 2014, up from 13.5 points a year earlier and to its highest level since the December quarter of 2003.

According to the survey, 48 per cent of businesses expect increased sales in the next three months while 11 per cent anticipate reduced trade.

Actual sales activity for the December quarter of 2013 also increased year-on-year, up from 11.8 points to 18.8 points. While profit and employment expectations have both eased marginally on previous quarter, at 22.7 points and 8.7 points respectively, both measures are up from the same period a year ago. Meanwhile, the outlook for selling prices has lifted for a fourth consecutive quarter and reached its highest point since Q3 2009.

“The recent rebound in business expectations has consolidated in the first half of 2014,” said Stephen Koukoulas, economic advisor to Dun & Bradstreet.

“The business investment plans have increased, especially in the non-mining sector, which points to at a least a partial offset to the inevitable fall in mining investment.

“Expected sales are particularly robust, moving to a fresh 10-year high, which points to the economy moving to a trend pace of economic growth through to the middle of 2014.

“Having lifted appreciably in the last half year, expected profits and employment levels have eased marginally, but it is too early to be sure whether this is the start of a new trend in the series.

“All up, the business sector is moving into the middle of 2014 in sound shape with strong sales, improving capital expenditure plans and a steady view on profits and employment,” Mr Koukoulas added.