Australians are demonstrating a less cautious approach to spending money, with more consumers planning to use their credit cards this quarter, while savings will be less of a focus.

The Dun and Bradstreet Consumer Credit Expectations Survey of Q2 2013 shows that savings are set to decline as consumers look towards credit spending.

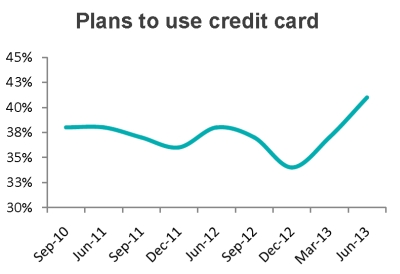

Shrugging off an enduring mood of financial conservatism, 41 per cent of consumers intend to use their credit card for purchases they couldn't otherwise afford in the months ahead. This is the highest level in three years and suggests that pockets of optimism in the economy are making consumers less cautious about how they spend.

In addition to increased spending on credit, Australians are expected to turn away from saving more money. With a five per cent fall from the previous quarter, 26 per cent of consumers now indicate they are more likely to save money compared to the same time last year, while 31 per cent are less likely.

While the economy's performance has been patchy in the post-GFC world, consumers appear encouraged by the absence of any immediate or pervasive negative news, with other consumer sentiment measures showing confidence levels increasing since the latter part of 2012.

The aggregate findings of other consumer sentiment measures show confidence levels have been improving since the latter part of 2012. With the RBA maintaining low interest rate levels, the unemployment rate relatively steady, house prices recovering, and a bullish sharemarket, consumers are signalling that the positives outweigh the negatives and consequently are willing to spend more freely on credit.

Although consumers plan to increase their use of credit cards, they are not expecting their financial position to be negatively affected. The Consumer Credit Expectations Survey also shows the number of people expecting difficulty meeting their credit obligations unchanged at 34 per cent for the third consecutive quarter. The number of people expecting their level of household debt to be higher during the quarter is also flat, at 19 per cent.

Consumers' plans for credit card use suggest the recent focus of debt reduction could be about to end, which bodes well for ongoing growth in consumer demand.