Concerns about the global economy and political unrest in Canberra are cruelling appetite for takeovers, with some of the nation's top dealmakers tipping companies to remain on the sidelines until economic clouds clear.

In a sign of the caution ahead of the September election, announced mergers and acquisitions this year are off 28.5 per cent to $US32 billion ($34.8bn) on the previous corresponding period, according to Thomson Reuters data exclusive to The Weekend Australian.

In contrast, global M&A is down 16 per cent to $US956bn, showing local companies continue to shy away from bold bets on acquisitions at a greater rate.

It comes as investors worldwide fret about the withdrawal of stimulus by the US Federal Reserve, which is already hitting companies' access to credit markets in a blow to debt-funded deals and boards' confidence.

Senior bankers said activity under the surface had cooled in recent months as the end of the mining investment boom hit home and the potential pullback of liquidity spooks boards after five years of cash being flooded into markets.

"It's a continuation of the subdued equity markets, the relatively uncertain outlook, obviously the commodity volatility and concern about a retraction of liquidity," the head of Macquarie Capital's Australian business, Robin Bishop, said. "We are pleased with our market share, but it is a quiet market."

The dearth of deals coming to market outside some bumper transactions in infrastructure such as the $5.1bn purchase of Port Botany bodes poorly for investment banks' second half.

Completed M&A deals are down 57 per cent to $US24.4bn, the lowest first-half since 2010, signalling the growing pressure on banks and other financial services firms to cut jobs.

"If you don't have them (deals) on the tarmac by now, then you're looking at 2014 most likely," said Tony O'Sullivan, head of investment banking in Lazard's Sydney office.

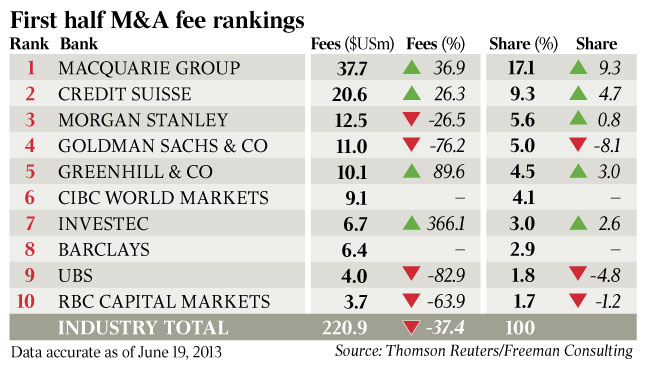

Macquarie is leading the banks' M&A fees table, ahead of Credit Suisse, Morgan Stanley, Goldman Sachs and Greenhill.

Mr O'Sullivan, who helped oversee Lazard's co-advising of the bidders for Port Botany, the biggest deal this year, said confidence was unlikely to improve in the short term as boards waited to see "where the economy lands" after the end of the mining investment boom.

"I see a lot of them, speak to a lot of them and they're very cautious because people just don't know," he said. Most companies were looking to organic growth rather than M&A.

Nick Sims, head of M&A at Goldman, said while there had been positives such as the surge in private equity deals and interest from foreign buyers in large deals, activity would pick up only when business confidence returned.

"We continue to think that many of the indicators for a positive M&A environment exist, but domestic economic and political uncertainty has clearly impacted business confidence, which is possibly the most important driver of M&A," he said.

According to Thomson, private equity-backed M&A has doubled, led by TPG's $900 million acquisition of poultry producer Inghams Enterprises.

Barclays co-head of investment banking Daniel Janes, who is advising ADM on its bid for GrainCorp, agreed a rise in sentiment and stability was needed but said more activity might come to market in the second half in industrials and healthcare.

Mr Janes added there was a large amount of pent-up activity from private equity groups.

"Funding markets both in Australia and abroad, particularly the US, have been in rude health. Despite the pullback in high-yield investor appetite in recent weeks, we expect to see markets remain very much available to support strategic ambitions," he said.

Cross-border transactions are down 28 per cent on last year to $US17bn, driven by a 35 per cent drop in in-bound activity. But Mr Janes said the presence of international acquirers in bid processes had helped create price competition, which would continue to be needed.

Mr O'Sullivan said cross-border was about half of M&A activity and foreign acquirers faced challenges such as often needing to use cash in bids and judging which way the local economy and currency were heading.

Outbound M&A made up just 18 per cent of cross-border flows but is up 41 per cent, suggesting more companies have ventured offshore with the dollar just as the currency is on the decline.

RBC's Dominic Hudson opined: "It's going to be a difficult end to the year, and a difficult 2014."