The anticipated Christmas / New Year slowdown has shown few signs of beginning Just yet as all markets continue acquiring tonnage and previous deals / cash buyer 'as is' tonnage continues to arrive respective demo locations at pace.

Indeed even yards in Vietnam and the ever-busy Turkish market (which has supposedly secured more units, not LDT, than Bangladesh this year) took vessels for the week as owners aimed to cut their losses and put money in the bank to appease financiers and balance sheets before the end of the year.

Even an upswing in charter rates (amidst a dearth of tankers of late) has failed to slow die number of candidates especially with many vessels approaching surveys in die early part of the coming year. The current supply seems largely to be from the container sector (up to mid 90s built and sometimes even younger) and a whole rait of 80s built handysize (and occasionally older) bulkers.

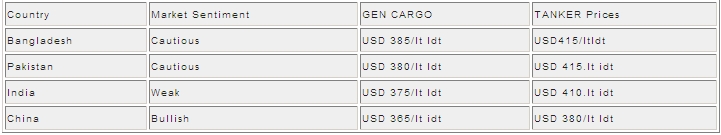

India struggled on for another week really only taking green candidates and favored units with keen end buyers backing respective purchases. The Indian Rupee was still trading at excess 54 to the dollar and a recovery in steel prices has yet to be seen. Notwithstanding the recent volatility reigning in India, Cash buyer speculation still seems to be teetering into ongoing negotiations on the back expectations of a firming January.

Pakistan and Bangladesh were other die two Indian sub-continent markets of the moment with enquiries emerging for die larger vessels on offer, yet not necessarily the supply (certainly on the tanker side) yet forthcoming to satisfy that demand.

China remains open to buy all types of vessels from reefers, to passenger vessels to general cargos to capesize bulkers and tankers (gas free for man entry only). Levels come the end of the week were once again on die rise off the back of an improving stock market, and for diose vessels positioned in the area, the voyage over to Bangladesh no longer justifiable.