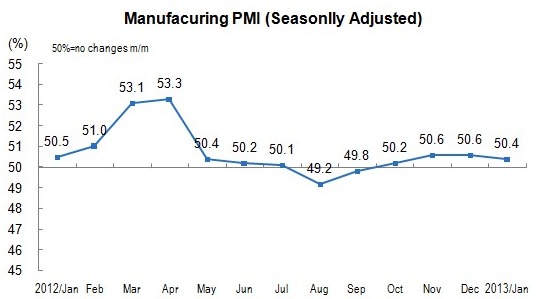

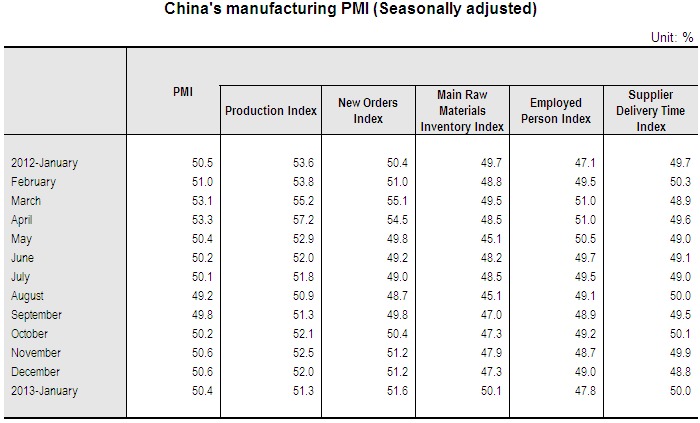

In January, China's manufacturing purchasing managers index (PMI) was 50.4 percent, down by 0.2 percentage points month-on-month, still above the threshold.

In view of the sizes of enterprises, the PMI of large-sized enterprises was 51.3 percent, increased 0.2 percentage points month-on-month, stayed above the threshold for five consecutive months. That of medium-sized and small-sized enterprises were 49.7 and 46.2 percent, decreased 0.2 and 1.9 percentage points month-on-month respectively, staying below the threshold.

In term of different areas, the PMI of eastern region and central region were 50.9 and 51.1 percent respectively, staying above the threshold, and 0.5 and 0.7 percentage points higher than that of national level respectively. The PMI of western region and north-eastern region were 48.1 and 49.9 percentage, both staying below the threshold.

In January, among the five sub-indices composing PMI, three sub-indices increased, while that of the other two sub-indices decreased.

Production index was above the threshold, which was 51.3 percent, decreased 0.7 percentage points month-on-month, continued to position above the threshold, which indicating that manufacturing production kept expanding, while the growth rate decreased. In view of different industries, the production indices of 10 industries including tobacco manufacturing, foods, liquor, beverages and fine tea manufacturing, automobile manufacturing, agro-food processing industry, paper, printing and cultural, educational, sporting goods manufacturing etc. were above the threshold, and the production increased, among which the industries related with consumer goods stood out. The production indices of non-metallic mineral products manufacturing, processing and coking of petroleum, processing of timber and furniture manufacturing, chemical fiber manufacturing, rubber and plastic manufacturing, computer communications, electronic equipment and instrumentation manufacturing, railways, ship, aerospace and other transportation equipment manufacturing were below the threshold, and the production dropped back.

In January, the new orders index was 51.6 percent, up by 0.4 percentage points month-on-month, and was the highest point since May 2012, which showing that the manufacturing market demand continued to get warm. In view of different industries, the new orders indices of 11 industries including tobacco manufacturing, foods, liquor, beverages and fine tea manufacturing, automobile manufacturing, agro-food processing industry, pharmaceutical manufacturing, manufacturing of general equipment etc. were above the threshold, and the market demand increased; the new orders indices of 10 industries including non-metallic mineral products manufacturing, processing of timber and furniture manufacturing, railways, ship, aerospace and other transportation equipment manufacturing, textile industry, processing and coking of petroleum, smelting and processing of non-ferrous metal ores etc. were below the threshold, and the market demand dropped back. The survey results showed that foreign new orders index which reflects the situation of foreign trade of manufacturing was 48.5 percent, decreased 1.5 percentage points, month-on-month, and was below the threshold, which showing the exports of manufacturing products decreased; the import index was 49.1 percent, increased 0.1 percentage points month-on-month, and still stayed below the threshold, which indicating that the imports of raw materials used in the production of the manufacturing continued to decrease.

Main raw materials inventory index was 50.1 percent, up by 2.8 percentage points month-on-month, positioned above threshold for the first time since May 2012, which indicating that the raw materials inventory turned to increase from decrease. In view of different industries, the main raw materials inventory indices of 8 industries including foods, liquor, beverages and fine tea manufacturing, processing and coking of petroleum, paper,printing and cultural, educational, sporting goods manufacturing, automobile manufacturing, special equipment manufacturing, manufacture of raw chemical materials and chemical products etc. were above the threshold, and the main raw materials inventory increased; the index of processing of timber and furniture manufacturing stayed at the threshold, and the main raw materials inventory almost kept at the same level over the previous month; the indices of 12 industries including textile wearing apparel manufacturing, railways, ship, aerospace and other transportation equipment manufacturing, tobacco manufacturing, chemical fiber manufacturing, rubber and plastic manufacturing, non-metallic mineral products manufacturing, computer communications, electronic equipment and instrumentation manufacturing etc. were below the threshold, and the main raw materials inventory decreased.

Employed person index was 47.8 percent, decreased 1.2 percentage points month-on-month, and stayed below the threshold for eight consecutive months, which indicated that the employment in manufacturing enterprises continued to reduce. In view of different industries, the employed person indices of 8 industries including foods, liquor, beverages and fine tea manufacturing, pharmaceutical manufacturing, automobile manufacturing, tobacco manufacturing, agro-food processing industry, smelting and processing of non-ferrous metal ores etc. were above the threshold, and the employment increased. The employed person indices of 14 industries including textile wearing apparel manufacturing, fabricated metal products manufacturing, computer communications, electronic equipment and instrumentation manufacturing, railways, ship, aerospace and other transportation equipment manufacturing, paper, printing and cultural, educational, sporting goods manufacturing, processing of timber and furniture manufacturing were below the threshold, and the employment decreased in varying degrees.

Supplier delivery time index was 50.0 percent, stood at the threshold, which indicated that the manufacturing supplier delivery time changed little compared with the previous month.

Main raw material purchase price index was 57.2 percent, a sharp rise of 3.9 percentage points month-on-month, stayed above the threshold for five consecutive months, which indicating that the raw material purchase price of manufacturing continued to rise, and the amount of increase in January enlarged obviously. In view of different industries, except for computer communications, electronic equipment and instrumentation manufacturing, the main raw material purchase price indices of other industries were all above the threshold. Of which, the main raw material purchase price indices of ferrous metal mining and processing, agro-food processing industry, special equipment manufacturing, chemical fiber manufacturing, rubber and plastic manufacturing positioned in a high place which above 60 percent.

Production and business activities expectation index was 55.9 percent, located above the threshold, indicating that manufacturing enterprises were optimistic for the production and business activities expectation within the next three months.

Annotations:

1. Explanatory Notes

Purchasing Managers Index (PMI) is an index summarized and compiled through the results of the monthly survey of enterprises purchasing managers. It covers every links of the enterprises, including purchasing, production, logistics, and so on. It is one of the leading indices which was commonly adopted by international society to monitor the macroeconomic trends, and played an important role in forecasting and monitoring. The threshold of PMI is usually using 50 percent as the cut-off point for economic performance. If PMI above 50 percent, it reflects the manufacturing economy is expanding; if less than 50 percent, it reflects the manufacturing economy is in recession.

2.Statistical Coverage

The survey involves 31 divisions of manufacturing sector in the "Industrial Classification for National Economic Activities" (GB/T4754-2011). The survey sample was expanded from 820 to 3000 since January 2013. Due to the small sample size and lack of representativeness, some industries have been merged according to the similar homogeneity of industry, and there are 21 industries after merging.

3. Survey Methods

PPS (Probability Proportional to Size) sampling method was adopted in manufacturing purchasing managers' survey. Using the divisions of the manufacturing sector as the selecting strata, the sample size of each division is proportional to its proportion of the value-added of the division to the total value-added of the manufacturing sector. Within the stratum, the samples are selected according to the probabilities proportional to their principal business revenues of the enterprises.

The survey was organized and conducted by staff members of survey offices, monthly through Online Reporting System of NBS by sending survey questionnaires to the purchasing managers of the selected enterprises.

4. Calculation Methods

The questionnaire of manufacturing purchasing managers survey covers 12 questions related to production, new orders, export orders, existing orders, finished goods inventory, purchase, import, purchase prices, raw materials, inventory, employees, suppliers, delivery time, production and business activities expectation and etc.. Diffusion index was calculated for each question, i.e. percentage of positive answers in number of enterprises plus half of the percentage in the same answers.

PMI is a composite index, which was calculated according to five diffusion indices (group indices) and their weights. 5 group indices and their weights are determined in accordance with their leading impact on the economy. Specifically, new orders index weighted 30 percent; production index weighted 25 percent; employees index weighted 20 percent; supplier delivery time index weighted 15 percent; raw materials inventory index weighted 10 percent. Of which, the supplier delivery time index is a converse index, and contrary calculation is needed when combines it into PMI.

5. Classification of Eastern, Central and Western Regions

Eastern regions including Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, Hainan; central regions including Shanxi, Anhui, Jiangxi, Henan, Hubei, Hunan; western regions including Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang; north-eastern regions including Liaoning, Jilin, Heilongjiang.

6. Seasonal Adjustment

The purchasing managers' survey is a monthly survey, the data of the survey fluctuates very much for the influences of seasonal factors. The released PMI composite index and sub-indices are seasonally adjusted data.