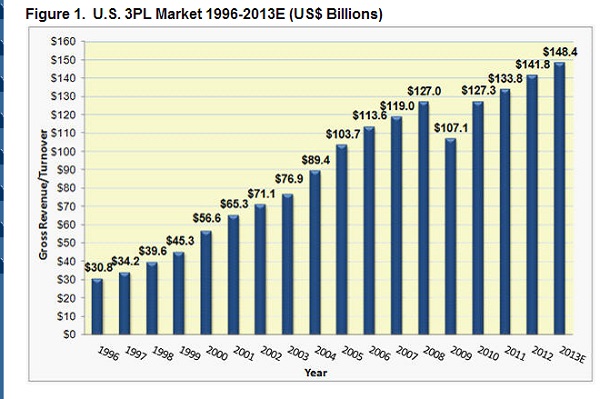

U.S. third-party logistics (3PL) market revenues increased modestly in 2012, mirroring U.S. gross domestic product (GDP). According to Armstrong and Associates' 2012 3PL Market Analysis and 2013 Predictions Report, U.S. 3PL market gross revenues increased by 6% to $141.8 billion.

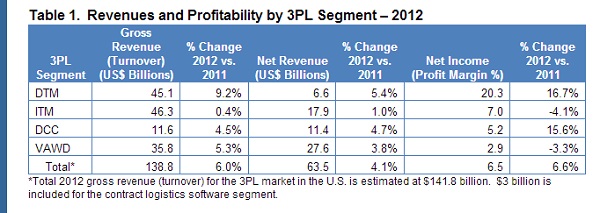

Value-added warehousing and distribution(VAWD), which traditionally enjoys smaller margins, posted a 2.9% net income, down 3.3% over 2011 figures. In a recent interview, Dick Armstrong, chairman of Armstrong and Associates, said the U.S economy just isn't hot enough. "There is a little bit of life with regard to new warehousing, but growth rates major markets like the inland empire, New Jersey, Dallas, Chicago, etc., are still very modest with some vacancy."

Armstrong said folks in real estate are quick to point to what's happening there as an indicator of coming improvement, but Armstrong disagrees. "When you're limping along like we are, contracts get renewed and there is organic growth, but the pressure on the demand side is not great. This means customers generally have a stronger hand when negotiating."

The plus side in terms of VAWD, said Armstrong, is the e-commerce boom. "As business to consumer activity continues to grow, we'll see business to business e-comm grow as well," he said. "That's helpful, but we need some of the old-fashioned things to pick up too."

More insights from the report:

The 3PL market compound annual growth rate (CAGR) from 1996 to 2012 fell 0.3% to 10%. With U.S. governmental "sequestration" spending cuts kicking in, it is unlikely that the U.S. economy and 3PL market results will break the trend in 2013. A temporary budget surplus has taken pressure off of politicians to find solutions for huge, long-term U.S. deficit challenges. "As John Maynard Keynes turns in his grave," said Armstrong, "the U.S. economy will grow slowly until the next major crisis."

Domestic transportation management (DTM) led financial results for 3PL segments again in 2012. Gross revenues were up 9.2%. At the same time, the cost of purchasing transportation, increased competition, and slackened demand are pressuring DTM gross margins and net revenues. As a result, net revenues increased by only 5.4%. Overall gross margins were 14.6%. In 2011 they were 15.2%. 3PL earnings before interest and tax (EBITs) and net income margins remained strong. They were 33.2% and 20.3% of net revenue respectively.

The largest negative in 3PL segment results was international transportation management (ITM). The results in ITM reflect the global economic malaise. Gross revenues grew 0.4% and net revenues were up 1%. Profit margins held as ITM 3PLs controlled costs. EBITs were 12% of net revenues. Net incomes were 7% of net revenues. For Expeditors International and Kuehne + Nagel (including its non-vessel operating common carrier Blue Anchor), EBITs exceed 30% of net revenue. Net incomes are also significantly higher. First quarter 2013 results for Expeditors were nearly identical to first quarter 2012—a good indication of what 2013 results could look like.

The complete report and other A&A market research reports can be found .

Source: Armstrong and Associates

Source: Armstrong and Associates