Bewildering tax structures begone; Facebook is finally going straight in the UK.

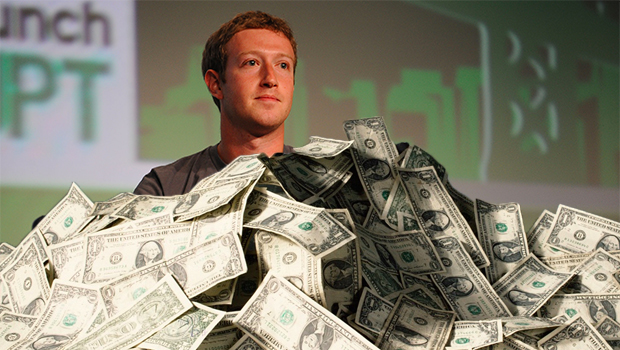

Facebook has agreed to pay “millions of pounds more in tax” in the UK, according to a new report.

The social network giant is said to be overhauling its tax structures to book more profits – and thus pay more tax – in Britain.

That’s according to the BBC, which reveals the company will no longer route advertising revenue through Ireland.

“On Monday, we will start notifying large UK customers that from the start of April, they will receive invoices from Facebook UK and not Facebook Ireland,” an internal note seen by BBC reads.

“What this means in practice is that UK sales made directly by our UK team will be booked in the UK, not Ireland. Facebook UK will then record the revenue from these sales,” it continued.

Facebook now has over 1.5 billion monthly active users globally

Facebook is reported as saying it hopes the change will "provide transparency to Facebook’s operations in the UK”.

It’s not yet clear how much more tax Facebook will pay exactly, but corporate tax on profits in the UK is currently set at a rate of 20%.

The news comes amidst investigations into Google tax structures, and two years after the 2014 controversy surrounding the revelation that Facebook paid just £4,327 in corporation tax in the UK for the year.

The figure led to criticism of Facebook, a company that turns a profit of £1 billion globally every three months.

Facebook will be changing its tax structures in April at the start of the new tax year, which means the first bill will be paid in 2017.

Earlier this week we reported that Facebook users in the UK are finally set to become a majority of the population.

Analysts at eMarketer forecast 50.5% penetration in Britain – exactly 33.2 million users – for the social network in 2016.

That’s up from 49.5% last year, signalling the first time Facebook abstainees will be a minority.