. Global LED bulb shipment volumes doubled from 520 million in 2013 to 1.1 billion in 2014. Tube lighting also increased with 2013 shipment volumes rising from 230 million to 400 million in 2014, according to data revealed by Epistar during the East Asia Pacific Standards and Spec Development Conference. LED chip design still maintains a 6-12 month transition period while LED package technology undergoes changes every 1-2 years.

Epistar gave an analysis of the different lighting trends in 2014 during the conference. The company pointed out that for G9 luminaries, luminosity has increased from 100lm to 200lm and 250lm. Following the increase in luminosity, heat dissipation has become a major challenge for many manufacturers. Candle luminaries are also becoming a trend, with luminosity having increased from 150lm to 400lm and soon up to 600lm.

In the bulb application market, 40W equiv. and 60W equiv. bulbs are currently the mainstream. Factory price for 40W equiv. bulbs with a luminosity of 450lm is around US $2-3 (NT $60-90) and US $3-5 for 60W equiv. bulbs with luminosity of 800lm. Sales price are higher than factory price by 2-2.5 times, indicating sales price have continued to decline as production prices slide downwards. Prices have reached originally estimated sweet spot.

For LED tubes, the mains specs are 1200lm, 1600lm, and 2200lm. For 1200lm LED tube with a system luminous efficiency of around 70lm/W, factory price is US $3-5. Factory price for 1600lm LED tube with system luminos efficiency of 90lm/W is US $6-8. High-end 2200lm tube lighting has a factory price of US $10-15 and system luminous efficiency of 100lm/W.

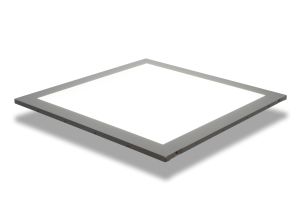

Factory prices for 2’x2 panel lighting and slot-type lighting depends on luminosity. Generally speaking, products with 3000lm and system luminosity efficiency of 100lm/W will have a factory price of about US $40-60. Products with 2500lm and system luminos efficiency of 90lm/W will have a manufacturer price of US $30-40.