Cost cutting is tipped to continue to be the focus of Australian companies when they release earnings results next month with investors looking for a more disciplined approach to growth plans after recent job losses and writedowns.

Pengana Capital fund manager Tim Schroeders said resources companies would be closely watched this earnings season, with investors no longer willing to support growth at any cost.

"Marginal decisions have been made in the hope of capturing future growth rather than showing some form of discipline about waiting for the right time in the cycle and doing additional work on existing, producing assets," he said.

"The market is now demanding that that is the case -- get your house in order today in terms of your existing asset base and when you show that is in order, we'll back you in future growth endeavours."

He said there was unlikely to be a lot of "tailwind" from commodity prices, so companies would be forced to fine-tune and improve efficiencies at existing operations to protect margins.

"The market is not prepared to reward growth sometime in the future given the uncertainty of commodity prices and experiences with capital expenditure blowouts and timing delays," he said.

"It's very much a more mature part of the cycle where people are focused on return on capital and as a result companies will be forced to enhance existing operations rather than grow in the hope that commodity prices mask an inability to control costs."

This month there has been a series of "confessional" announcements across a range of industries, led by the resources sector, which has upped its focus on costs.

The highest-profile case was Rio Tinto, which ousted its chief executive Tom Albanese and strategy boss Doug Ritchie in the wake of $US14 billion worth of fresh writedowns.

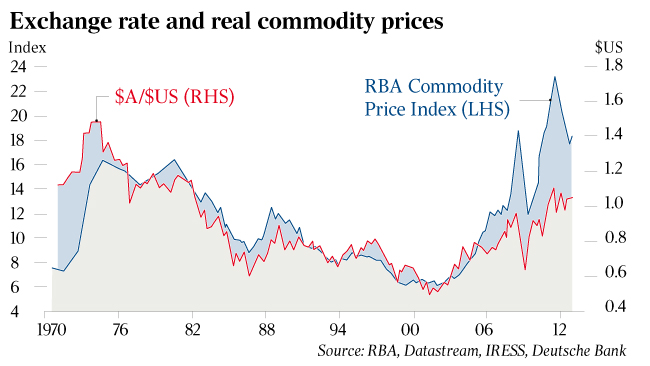

The market expects BHP Billiton to write down the value of its Australian aluminium and nickel assets by about $US4bn next month, as the strong dollar and weak prices extinguish any hope of a rebound in returns in the short term.

Earlier this month, BlueScope Steel announced 170 job losses at its Western Port facility in Victoria. This was followed by Boral announcing 700 job losses across its Australian building materials business.

Nufarm topped off a month of bearish news, announcing the loss of a distribution deal worth almost 10 per cent of its Australian and New Zealand revenues. The company also warned that trading conditions in Australia had been more challenging than previously flagged at the annual meeting.

UBS chief strategist David Cassidy said he expected a fairly downbeat and subdued profit season, but the market was already factoring expectations of further bad news, so negative sentiment was unlikely to greatly affect shares.

"Broadly, people are going to be talking a subdued story but that is not a disaster for the market, given the expectations are pretty subdued anyway," Mr Cassidy said.

"We have a sluggish domestic economy, strong Australian dollar and subdued credit growth . . . it's not boom times for profits."

He said further cost cutting announcements could be made, as there was likely to be a continuation of the restructuring theme that had gathered momentum in the market.

"There could be further cuts announced, given some companies have been rewarded on the back of those sorts of announcements with share price moves," he said.

The chief strategist added that media companies were likely to have a tough earnings season, but it should be positive for healthcare.

Mr Schroeders also said that the resources companies' results would be closely examined this earnings season, as a dip in commodity prices had a significant impact on market sentiment and investors want to know the outlook.

"There is going to be a focus around not just the earnings, but where to from here," he said.

He said that while BHP and Rio were focused on costs, that would not be reflected in these results.

"It does take a long time to implement new cost-control measures," he said.

"We're not going to see that impact the bottom line meaningfully until the second half of the year."

Philip Parker, managing director of Parker Asset Management, said while he expected to see further cost cutting initiatives, there would be less than last year.

"Post-GFC companies have been cutting costs aggressively," Mr Parker said.

"My feel is that revenues are gradually improving. So cost cutting is important but revenue growth is more vital."