With the LED TV backlight market slowing, and the general lighting market yet to take off, LED makers are looking to all sorts of innovative ways to improve cost and performance to drive adoption — from disruptive new technologies to incremental improvements to manufacturing yield. If the lessons from the camera and the telephone industries are any indication, the solid state transformation of the lighting industry will mean disruptive changes to just about everything in the sector.

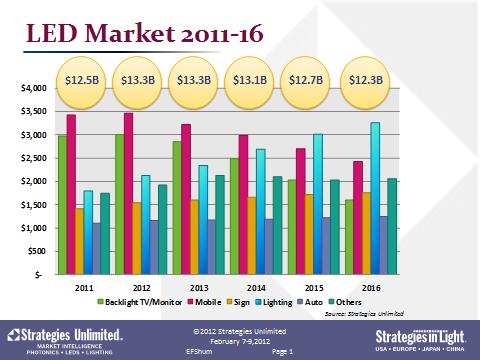

Sales of packaged high-brightness LED devices will be essentially flat for the next five years, predicts Strategies Unlimited, as growth in LED lighting balances out declines in other applications. Sales of LEDs for lighting jumped 44 percent in 2011, but the explosive growth in LED backlights slowed to 5 percent, as the TV market matured and ASPs declined. Appreciation of Asian currencies helped push total LED sales up nearly 10 percent to $12.5 billion in 2011, and 2012 can expect 6 percent growth. However, then the market will level off through 2016, forecasts Ella Shum, director of LED research. In display markets, LED backlights are being replaced by OLEDs in mobile devices and the new generation of lower-cost LED TVs are using fewer LEDs. The automotive market is also reducing the number of LEDs used in headlights. However, the demand for LEDs for general illumination will continue to expand, driving 13 percent CAGR for the packaged chips for lighting applications, from $1.8 billion in 2011 to $3.3 billion by 2016.

LED market flattens out, as fast growing lighting applications balance slowing TV and mobile phone demand. (Source: Strategies Unlimited, February 2012)

This slowdown is in part a function of the remarkable progress in getting LED brightness up and cost down in recent years, enabling systems makers use fewer, lower cost units. The average high-brightness LED now emits 100lm/W — up to 140lm/W from leading producers — and costs $6/Klm, considerably ahead of the U.S. Department of Energy (DOE) consensus forecast roadmap goals. But a quality LED light bulb still costs $20, probably twice the price necessary to compete with fluorescents, so more innovative solutions are needed to drive wide adoption.

Gains from Disruptive Manufacturing Technologies: GaN-on-GaN, GaN-on-Si, and Semiconductor Industry Process Control

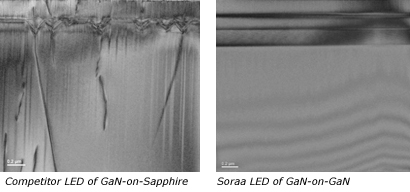

One alternative is to rethink the entire manufacturing process — as Soraa Inc. does with its new M-16 halogen replacement bulb. The new bulb claims better quality light to show off retailers’ merchandise, while saving enough energy when on for long operating hours for payback in less than a year. The Fremont, California startup uses costly GaN-on-GaN substrates, but CEO Eric Kim says it makes up for the cost with tiny die that take more current and give out more light per area, and a relatively simple fabrication process.

One alternative is to rethink the entire manufacturing process — as Soraa Inc. does with its new M-16 halogen replacement bulb. The new bulb claims better quality light to show off retailers’ merchandise, while saving enough energy when on for long operating hours for payback in less than a year. The Fremont, California startup uses costly GaN-on-GaN substrates, but CEO Eric Kim says it makes up for the cost with tiny die that take more current and give out more light per area, and a relatively simple fabrication process.

The GaN-on-GaN drastically reduces defect density and significantly mitigates the usual effect of droop, enabling current density of 250A/cm2 in the initial product. Kim also argues that the volumetric emitter produces more light than thin film, the fabrication process requires no substrate removal, an unusual triangular die design allows a large surface area to junction area, and silicon-based packaging helps manage heat. The device uses a violet wave-length emitter instead of the usual blue, and a combination of three phosphors to convert the color to something that looks much like halogen. The company avoids talking about lumen output, but says instead that its bulb has the highest center beam candle power. The tiny single-point light source also gives crisper shadows than an LED array or the halogen. Soraa is currently ramping up to commercial production at its new fab in Fremont.

The potential for GaN-on-silicon substrates is also a hot topic, though the jury is still out. Osram Opto Semiconductors CTO Ulrich Steegmueller reported Osram was getting 60 percent EQE from 1mm2 devices made on six-inch silicon wafers and in standard packages — very similar to the efficiency of those on sapphire. But, he noted, it’s still open today how much this R&D stage work will translate to production devices. More directly applicable, he noted that Osram improvements in the brightness and efficiency of red InGaAlP LEDs now mean they can be used to create warm white light with 25 percent better efficiency than with just phosphors.

Aiming to take advantage of the processing efficiencies of 8-inch silicon tools and the more developed data collection and process control of the semiconductor industry, TSMC’s Jacob Tam, president of TSMC Solid-State Lighting, reported that TSMC is growing GaN-on-sapphire. However, they are dicing the unpatterned wafers after the epi step and redistributing the die on to 8-inch substrates for wafer processing and wafer-level packaging, using semiconductor industry-type practices like run-to-run control and fault detection.

Another option is to eliminate the AC-DC converter, with a direct AC device and a single-chip controller, argued Seoul Semiconductor CEO Chung Hoon Lee. He said getting rid of the converter improves cost, efficiency and lifetime, as the capacitors in the converters add heat and often fail before the LED itself. “All of this is junk — why do we need it?” asked Lee, holding up a jumble of converters. Brian Wilcox, VP sales, North America, suggested that the simpler AC bulbs about to be introduced to the U.S. market cut out the converter and need less heat management, bringing costs down to the $15 range.

Gains from Volume Production Basics too: Yields, Standards, Optimized Materials

The rapid ramp up of LED backlight demand transformed LEDs into a volume manufacturing industry, with capacity expanding 12-fold over the last decade, to about 1.6 million 4-inch equivalent wafers per month, according to SEMI’s Opto/LED Database. The data indicates shipments of some 70 billion leadframe units, and $2.4 billion in equipment spending in 2011, according to Karen Savala, president of SEMI Americas.

That puts manufacturing standards on the fast track, as the industry evolves quickly towards automated production, and away from low volume, custom equipment and materials. In a little over a year since forming the first committee, participants from across the industry have hammered out initial drafts of agreements for discussion on common physical and software interfaces for equipment and carriers, and on common fiducials, ID marks, and flatness parameters for 6-inch sapphire wafers. A new committee has recently formed to discuss what impurities and defects are critical for sapphire wafers, and how they can be best measured consistently by users and suppliers. Another group is working on sharing best practices for environmental health and safety in LED fabs.

Serious penetration of the lighting market will mean even higher volumes and lower costs, which some now target for about two years out — provided prices drop to around $8 for a 60W-equivalent bulb. “The inflection point for the lighting uptake will be about 2014,” predicted Jed Dorsheimer, Canaccord Genuity managing director of equity research, lighting and solar. “If the industry has a price competitive product by 2014, then LED lighting will be a no brainer.” That $8 bulb with 20-30 percent losses in the system will need 1,000 lm output for about $2 from the LED device, or about 500lm/$, up from about 200lm/$ currently. He noted that where utility rebates brought LED bulb prices down to under $15, Home Depot reports they become >15% of its lighting sales. What’s the best option to get there? “Yield stacking,” says Dorsheimer, flashing a chart showing the cumulative potential for improvement.

Sapphire wafer makers argue that larger boules and larger wafers can improve yields. Rubicon Technology CEO Raja Parvez suggested that less edge loss and less dead space between wafers can mean a 10 percent higher yield with 6-inch wafers compared to 2-inch wafers in the same MOCVD chamber. Though 6-inch wafers currently make up less than 5 percent of the total sapphire wafer market, he expects the majority of the market to be 6-inch by 2020. Parvez reported Rubicon has shipped 230,000 6-inch wafers to date, as well as some volume of 8-inch wafer for research. GT Advanced Technologies meanwhile argued that consistent stress profile in the sapphire core was more important that etch pit density in determining wafer yields, with 4 percent more good wafers out (with acceptable warp, bow, roughness) from cores with more consistent annealing time and temperature throughout, despite more etch pit defects.

The push for better yields, as well as easier averaging across die for better color consistency, is driving a trend towards arrays of small chips, instead of single large chips, particularly for general illumination and display applications, said Daniel Doxsee, VP Nichia America Corp.

Materials suppliers are proposing new solutions to some of these issues as well. Higher currents per die and higher temperatures mean a hunt for new thermally stable materials that remain transparent or reflective under light and heat for up to the 35,000 hours required for Energy Star certification for lighting. That will drive a changeover in materials in the next twelve months, argues Geoff Gardner, Dow Corning marketing manager, lighting, as reflector cups will need to replace PPA at >0.3W-0.5W. He suggested the most viable alternative is silicone, already in wide use for the phosphor domes. Dow Corning is working on new processing options like screen printing and injection molding to bring down costs for further applications of silicone through the lamp and luminaire.

Capitalizing on the Digital Disruption of the Lighting Sector

Look for more disruption to come to this emerging sector. The introduction of solid state technology always transforms an industry, noted Mike Watson, Cree senior director of markets and applications. Watson pointed to the examples of telephones and cameras. He argued that digital technology always comes in with higher costs, meets resistance of the incumbent technology, and takes a while to develop the right business models and the supporting ecosystems — and solid state lighting needs to recognize that it will be no exception. Instead he suggested the industry needs to focus on the added value of digital lighting in appropriate systems that take advantage of its wider potential for intelligent control and better light quality and energy savings, not just making cheaper light bulbs. That will mean more focus on systems, not light bulbs, and on commercial and industrial, not consumer applications. “This will be disruptive,” he says. “We have to understand that we have to move fast or die.”

There will likely be more consolidation and vertical integration for one thing, noted Strategies Unlimited’s Shum. “We follow 85 (LED component) companies now,” she said. “That number will decrease next year.”

Meanwhile, big consumer electronics players may enter the lighting market. TV makers who started making LED BLUs for their television sets are now starting to supply those same chips and packages to the lighting market. Other consumer electronics companies are expanding into the LED lighting market as well, bringing big players like Samsung, Sharp, Panasonic, Toshiba and even Visio into the lighting market. “There is no barrier to entry for electronics companies,” says Nichia’s Doxsee. “It’s a challenge to the lighting players.” Seoul Semiconductor’s Lee similarly noted the impact of entry of high-volume manufacturers from the electronics industry. “Lighting companies are making low volumes of only 10,000 or 100,000 units per month,” he said. “Chip companies will make 1 billion packages per month.”