China's natural gas industry will continue to grow at a high speed through 2025 with clean energy-driven power generation showing increasing importance, bringing opportunities to both foreign and domestic companies.

As the economy grows and the government carries out policies to raise clean energy use, China's natural gas demand will increase at an annual rate of 8 percent, reaching almost 400 billion cubic meters a year by 2025 when the market will become 2.5 times larger than it is today, according to an industrial white paper titled China's Age of Gas, released on Monday by General Electric Co, a US multinational conglomerate.

It says China's share of gas in the primary energy consumption mixture is expected to double from 4 percent at present to 8 percent in 2025 and non-hydrocarbon resources are expected to grow to 17 percent of primary energy in 2025.

By then, natural gas will account for about 26 percent of the global energy supply and China's natural gas demand growth will contribute 20 percent to global growth by 2025.

"During China's natural gas development, GE can contribute from four sectors including exploration, technology, transportation and distributed power generation," said Jeffrey Immelt, chairman of the board and chief executive officer of the company.

GE to invest in, and the company would like to share the advanced technology that the company owns with its Chinese partners in the energy sector.

As air pollution becomes a serious issue in China, the government has been working on reducing carbon emissions and carrying out stricter standards for industrial sectors in terms of emissions during and after production, which has brought opportunities to distributed power generation programs that the government encourages.

China's annual electricity demand is expected to double by 2025, up from about 4,200 terawatt hours today. About half of the new electricity supply in China comes from coal power, and the other half will come from gas and all other generation sources, according to the white paper.

Compared with 75 percent of electricity generated from coal-fired power plants at present, it will be a more diversified electricity outlook than that during the last decade.

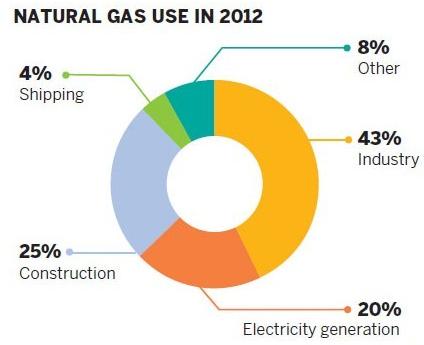

During this transition period, GE believes the annual natural gas share of China's power market will triple by 2025, reaching 6 percent of the total generation and natural gas demand in the power sector will increase to 117 billion cubic meters, representing 30 percent of total demand in 2025.

This can explain why GE formed a joint venture with Huadian Corp, one of the country's top five power generators, in 2011, investing in equipment, technology and services for the distributed power generation business.

The company said it will support China's plan for more than 1,000 distributed energy combined heat and power plants by 2015.

Although it is essential for China's natural gas industry to embrace a future with soaring demand, consumption and investment, Immelt said there are also challenges for the country with the biggest one being pricing.

"Natural gas prices are artificially low, which has not created enough incentives for technology innovation in the industry," said Immelt.

Mark Hutchinson, president and CEO of GE Greater China, added that China can learn a lot from the United States, which allows the market to freely control the price in the shale gas sector, leading to great success.

Affected by the falling price of coal and increasing demand for natural gas, the government is actively carrying out measures to enlarge the natural gas supply, said Wang Xiaokun, an industrial analyst at Sublime China Information Co Ltd, a domestic commodities consultancy.

She said the technology for shale gas is not mature enough for large-scale production at the current stage.