In a new report on plastics & packaging mergers and acquisitions (M&A) over a twelve year period from 2001-2012, Blaige & Company has identified four consolidation mega-trends associated with the plastics industry:

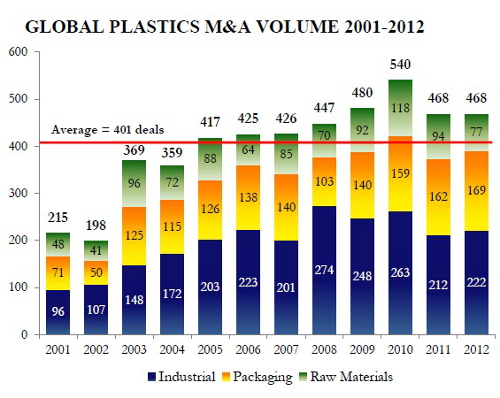

Globalization Driving Growth: Plastics M&A deal volume has continued steady growth, increasing from approximately 200 to 500 deals annually since 2001. This growth has been primarily driven by globalization and strategic motivations which account for over 80% of the transactions.

Big Getting Bigger, Widening "Gap": Fifty-eight percent of the segment leaders have merged or sold within the past decade, with a focus on critical mass and driving economies of scale.

Sellers' Market - Quality/Size Matter: Capital availability shows a tenfold increase and valuation multiples are back to near record levels. Both corporate and financial sellers have embraced the favorable market conditions, while private sellers appear ready to "jump in" in 2013.

Lead, Follow or Get Out of the Way: Global consolidation is expected to accelerate, further changing the competitive landscape, and recent "shocks to the system" never before seen, such as 9/11, the financial crisis, foreign competition and skyrocketing material prices will be permanent game changers for succession planning.

It is a sellers' market, but CEOs must develop and effectively execute consolidation in order to survive and thrive. They must Lead (acquire), Follow (Merge) or Get Out of the Way (Sell). Based upon all of the facts analyzed for this study, Blaige recommends that plastic processors and converters commit to grow $100 million or more in order to secure a solid competitive position for future success. Further, institutional practices are mandatory for small and mid-sized players to access financing and M&A markets.

As seen in the chart, global plastics deal activity has more than doubled over the past decade, increasing from 215 in 2001 to 468 in 2012. Despite the global financial crisis, plastics M&A activity in recent years has remained well above the long-term average level, implying that the industry has unique characteristics and thus, does not mirror general industrial M&A activity trends. This has many implications for buyers and sellers of plastic processors, including unique opportunities for those small to mid-sized companies which make up the majority of the industry.

Based on twelve years of proprietary research conducted by on the plastics and packaging industries, this study includes a detailed analysis of the six major processing segments and key end markets of the plastics industry, a thorough investigation of global plastics M&A growth, and a summary of private equity investment in the industry. The analytics found in this report are intended for institutional investors, plastics industry members and other interested parties to help make informed business and investment decisions. Please contact Blaige & Company, Chicago, IL, USA, for more information.