Unseasonably strong gasoline demand is proving for US refiners to be the gift that keeps on giving this holiday season, as support from seasonal diesel demand is tamped down by record high temperatures across much of the US.

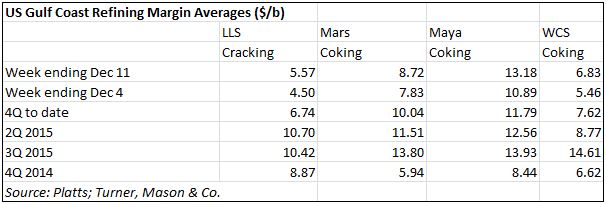

Gasoline prices are keeping margins healthy, as prompt pipeline unleaded gasoline in the US refinery hub along the Gulf Coast was assessed by Platts at $1.2752/g last Friday, up 15 cents/gal from the $1.1242/gal last Monday.

Prices of ULSD, on the other hand, fell 11.5 cents last week to $1.005/gal.

"Expect this theme of strong gasoline/weak diesel to persist into 2016, but given that US refineries have average yields of 49% gasoline and 33% diesel/jet, it's a theme the group will happily accept," wrote Tudor, Pickering Holt analyst Chi Chow Monday in a research note.

Over the past four weeks, demand for gasoline averaged 9.169 million b/d over the past four weeks, or 0.7% from the 9.106 million b/d a year earlier, a trend that shows no signs of abating and supporting an uptick in prices, US Energy Information Administration data for the week ended December 4 showed.

Conversely, during the same time frame, distillate demand averaged 3.69 million b/d, below the five-year average of 4 million b/d, and 1.2% lower than the earlier year's 3.73 million b/d, EIA data shows.

This lack of US demand for diesel is pushing down prices, but support from exports appears to be on the wane. Even though the ULSD export price from the USGC ended the week down 13.7 cents/gal at $1.007/gal, spot prices for CIF Northwest European cargoes fell as well. After factoring in USGC/NWE medium range clean tanker freight, basis 38,000 mt, the arbitrage between the two regions was closed last week by more than $7/mt.

US refiners traditionally benefit from the low cost of crude as well as abundant and cheap natural gas as a fuel to power energy-intensive refineries. This dynamic has kept barrels flowing into Europe despite high stocks there.

"Arbs are closed but it doesn't mean anything anymore, it doesn't stop cargoes," a trader said.

But exports to Europe were just 255,000 mt last week, down from around 385,000 mt the week ended November 30, according to Platts cFlow shiptracking software, as US refiners feel the pinch from another low cost producer in Saudi Arabia.

But European refinery shutdowns due to work stoppages and unplanned work will provide some support for imports of US diesel cargoes.

ExxonMobil is expected to shut down its 320,000 b/d Antwerp, Belgium, refinery for safety reasons as the company was unable to reach an accord on pay and work conditions with its union workers.

Meanwhile, Total's 247,000 b/d Gonfreville refinery in Normandy, France, started winding down operations due to a strike by one of the labor unions, also over disagreement on the annual negotiations over working conditions. ExxonMobil also reported a fire in a CDU at its 235,000 b/d Port Jerome, France, refinery, during maintenance that could impact ongoing operations.

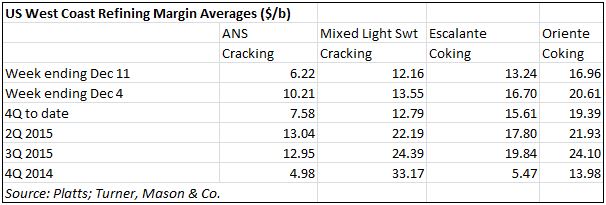

West Coast refinery outages helped cracking margins rise in the major California markets of Los Angeles and San Francisco, helped by support from secondary West Coast markets. CARBOB 84 Los Angeles pipeline values rose 10 cents/g on the week to $1.484/gal Friday while San Francisco barrels gained 13 cents/gal to end the week at $1.485/gal.

Bad weather Wednesday caused a power outage in Anacortes, Washington, which briefly shut down two refineries: Tesoro's 120,000 b/d plant and BP's 225,000 b/d Ferndale, Washington, refinery. Seattle suboctane pipeline gasoline rose 10 cents over the week to $1.473/gal, while Portland, Oregon, suboctane gasoline gained 14 cents/g on the week to $1.75/gal, Platts assessments showed.

Support for strong regional cracking margins is ongoing, as Tesoro is expected to keep the state's largest gasoline-making FCC unit at its Los Angeles complex, which was shut late November, down through January, trade sources said. Also down is the 73,800 b/d FCC at Chevron's 269,000 b/d El Segundo, California, refinery, after a fire two weeks ago.

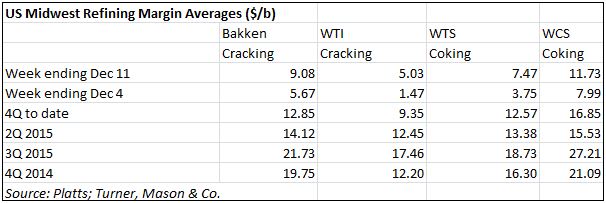

In the Midwest, BP's shutdown of a reformer at its Whiting, Indiana, refinery pushed up gasoline prices in both Midwest price hubs, supporting the rise in cracking margins for North American domestic crudes, Bakken and WTI, by $3.41/b and $3.56/b, respectively.

Chicago CBOB pipeline values bounced 16% higher week on week to $1.2622/gal, Platts assessments show, reflecting the important role played in Midwestern supply by the 413,500 b/d refinery, one of region's largest.

A knock-on impact also seen in the Group 3 hub, where unleaded suboctane in Group 3 rose almost 9% over the last week to reach $1.244/gal on Friday, Platts assessments shows.

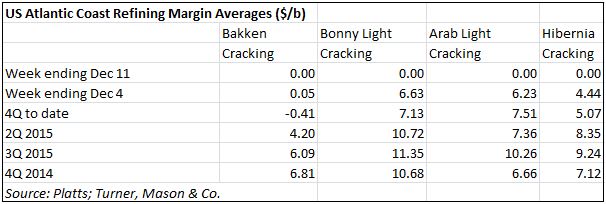

Cracking margins along the US East Coast are mostly softer, despite an uptick in gasoline prices which was not strong enough to counter a weakness in diesel prices.

The price of NYH RBOB barges rose 7 cents/gal over the week to end at $1.2842/gal, while the price of a NYH ULSD barge fell 9.65 cents/gal to end last week at $1.0923/gal, Platts assessment data shows.

Hibernia is an exception as buyers are finding Eastern Canadian grades unattractive, pushing the outright price of the crude to levels not seen in a decade, Platts data shows. Last Friday, the outright price of Hibernia was $36.55/b, down from the week earlier average price of $38.59/b.

The return to full gasoline production at Canada's largest refinery, the 300,000 b/d Irving, New Brunswick, plant, after a major turnaround are also seen weighing on US East Coast refiners.

Quarter-to-date, Bakken is in negative territory, as it superseded by waterborne crudes which have cheaper transport costs than rail. This could presage the future of the East Coast plants if the crude export ban is lifted.

"For East Coast players, narrow Bakken spreads would shut down the vast majority of rail deliveries to the region and movement of Gulf Coast-sourced barrels would become uncompetitive relative to foreign refiners without a concurrent lifting of the Jones Act, which isn't going to happen," wrote Tudor, Pickering Holt analyst, Chi Chow Monday in a research note, adding "This would generally force East Coast refiners to source light crude almost exclusively from foreign producers."