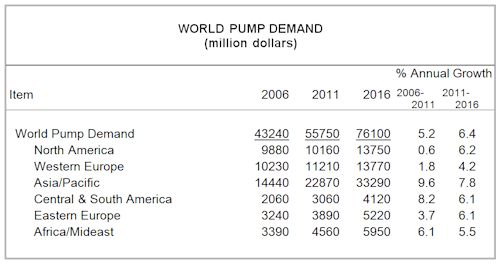

Global demand for pumps is forecast to rise 6.4 percent per year through 2016 to $76.1 billion. Although growth will be healthy across the globe (spurred by recovery from the recent economic downturn), the drivers of growth will vary by region.

Advances in developing areas such as China and India will result from industrialization, as investment in water infrastructure and electricity generation grows. In developed areas, continued advances in manufacturing output will provide growth in the process manufacturing market. Oil producing nations such as those in the Middle East will see gains due to rising drilling activity. In the US, demand will benefit from the boom in hydraulic fracturing in the oil and gas market, as well as from the improved economy. These and other trends are presented in World Pumps, a new study from The Freedonia Group, Inc., a Cleveland-based industry market research firm.

Process manufacturing will post strong gains in pump demand, driven by growing output, especially in the chemical, pulp and paper, and food and beverage industries.

Advances in pump demand in the water infrastructure market will result from two key factors: in developing nations, access to water supply and sanitation will be increased; in developed nations, aging water infrastructure will need repair and upgrade. Pump demand in the oil and gas market will benefit from increased drilling activity and oil production. The development of shale plays in nontraditional energy producing areas (such as the Bakken Shale in the US) will create the need for new oil pipeline construction to connect these fields with existing energy infrastructure.

China has emerged as the largest producer of fluid handling pumps, with 22 percent of the global total in 2011. China has developed a trade surplus in recent years, one that is expected to grow through the forecast period. Large pump industries exist in advanced nations, which traditionally had dominated the industry. The US, Japan, and Western Europe have large, well-developed home markets and technical expertise in manufacturing higher-value products. Over 40 percent of global pump shipments in 2011 were accounted for by the US, Germany, Italy, and Japan. The largest net exporters of fluid handling pumps are Germany, Italy, and Japan.