Small brands with turnovers of Rs 10 crore to Rs 25 crore and mid brands with turnovers of Rs 25 crore to Rs 100 crore were affected by low sentiments, reveals the Clothing Manufacturers’ Association of India (CMAI’s) Apparel Index for the January to March 2015 quarter.

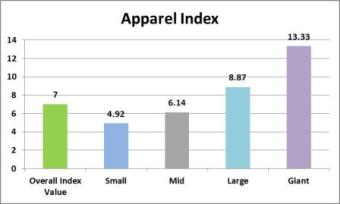

Although mid brands performed a little better than small ones, their performance was lower than the overall Index growth of 7 points, which was mainly owing to big brands.

The Index value for small brands was 4.92 points and for mid brands was 6.14 points, compared to large brands’ index value of 8.87 points and giant brands’ index value of 13.33 points.

The overall Apparel Index figure of 7 points has been arrived at after accounting for individual index values. Sales turnover at 5.4, sell through at 1.9, and investments at 2.4 in Q4 fiscal 2014-15 contributed positively to the overall performance whereas inventory holding at 2.6 contributed negatively, CMAI said.

The substantial increase in sales turnover (8.44) and control in inventory (-0.83) worked most for giant brands. This indicates bumper End of Season Sales (EOSS) and earlier stock clearance.

For large brands, even though inventory holding increased (2.85) and is much higher than others, the impact is offset by the high increase in sales turnover (6.15). For small brands, the increase in inventory holding and a modest increase in sales turnover led to failure. Mid brands however, show better control over inventory holding compared to small brands, though the increase in sales turnover was almost the same, according to CMAI analysis.

Explaining the impact of inventory, Sandeep Jain, executive director, Monte Carlo, says, “The garment industry is at an average state as of now and is not performing too well. In such a situation, lesser inventory works better for any organisation. We sold much lesser T-shirts and denims on discounts this quarter, resulting in improvement in overall performance.”

According to the Index, the sales turnover of the apparel industry in the first three months of 2015 grew by 5.4 points—a reasonably good growth, considering the quarter does not include any peak season, being a pre-summer quarter. However, the EOSS was much bigger compared to the June-July period, as winter merchandise was cleared out to make way for summer products.

Speaking about Jack & Jones’ stellar performance, Aditya Nadkarni, brand manager – Retail Administration, says, “We had the right product mix, which was priced right this season. The ambiance, store layout et al added up to boost sales turnover significantly. Besides we didn’t discount our denims at all.”

While small brands continued to report loss in sales turnover, only one large brand reported a loss, and none of the giant brands surveyed reported a loss. Explaining this turnover loss, Amit Tanna, proprietor, Custom Jeans, says, “Since Diwali, sales were not good and unsold stocks had to be carried over to the January-March quarter. Hence, we didn’t build enough fresh stock, affecting sales in this quarter. The other reason was that the price of denim increased, hiking the retail prices of jeans and affecting sales turnover.”

The survey reveals that about 40.7 per cent brands believe the next quarter (April-June 2015) will be good, 37.5 per cent believe it will be average, 18.7 per cent believe it will be excellent, and 3.1 per cent believe it will be below average—an an indication of the definite improvement in consumer sentiment and market conditions.

The annual Apparel Index for fiscal 2014-15 grew by 7.28 points. Experts term this as good growth considering the low sales even around Diwali, which usually helps brand make up for turnover losses owing to upbeat consumer sentiment.