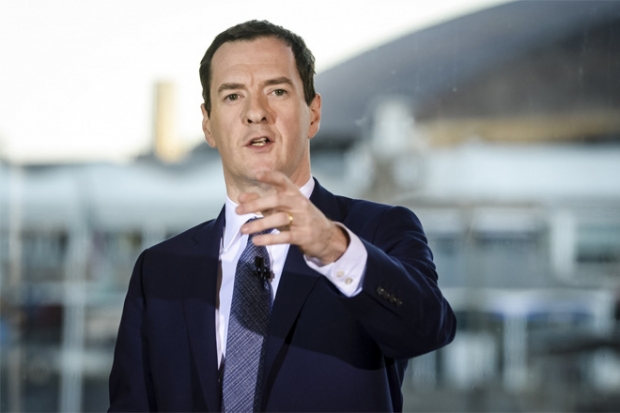

Chancellor of the Exchequer George Osborne delivered his eight Budget today, with some of the main points outlined as such:

Business

- The headline rate of corporation tax, which is currently at 20%, will fall to 17% by 2020

- Anti-tax avoidance and evasion measures are to raise £12b by 2020

- The yearly threshold for small business tax relief is to be raised from £6000 to a maximum of £15,000, which will exempt thousands of firms

- £9b is to be raised by closing corporate tax loopholes and tax minimisation schemes

- The use of 'personal service companies' by public sector employees to reduce tax liabilities is to end

- Commercial stamp duty will have a 0% rate on purchases of up to £150,000, 2% on the next £100,000 and a 5% top rate above £250,000. There will be a new 2% rate for high-value leases with a net present value of above £5m

Economy

- Growth forecasts have been revised down for the next three years – growth forecast to be 2% in 2016

- GDP is predicted to grow 2.2% and 2.1% in 2017 and 2018

- The UK is expected to grow faster than other Western economies

- 1m jobs to be created by 2020

- Inflation of 0.7% is forecast for 2016

Public borrowing/deficit/spending

- Spending cuts of £3.5b by 2020

- Spending as a share of GDP to fall to 36.9% by 2020

- Debt to be £9b lower in 2015-16 in cash terms

- The deficit as a share of GDP is expected to fall to 2.9% in 2016-17, 1.9% in 2017-18, and 1% in 2018-19

Personal tax

- Threshold at which people pay 40% tax will rise from £42,385 to £45,000 in April 2017

- Tax-free personal allowance is to rise to £11,500 in APpril 2017

- 0.5% rise in insurance premium tax

Pensions and savings

- The annual ISA limit is to rise from £15,000 to £20,000

- New 'lifetime' ISA to be put into place for under-40s, with Government putting in £1 for every £4 saved

- New state-backed savings scheme for low-paid workers to be launched, which is worth up to £1,200 over four years

Further details on the Budget to come.