Computerworld - Booming sales of tablets, smartphones and solid-state drives (SSDs) are taking a toll on hard-disk drive (HDD) sales, revenue from which is expected to drop by about 12% this year.

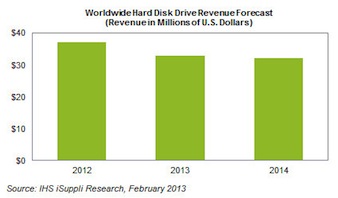

According to a market report from research firm IHS iSuppli, HDD revenue is set to drop to about $32.7 billion this year, down 11.8% from $37.1 billion last year.

HDD revenue will be flat the following year, amounting to $32 billion in 2014, iSuppli said.

The number of HDDs shipped has dropped from 659.7 million in 2010 to 626.3 million in 2011 to 578.1 million in 2012, according to Fang Zhang, an analyst for storage systems at iSuppli.

Worldwide hard drive revenue forecast

"The HDD industry will face myriad challenges in 2013," Zhang wrote in a report on storage. "Shipments for desktop PCs will slip this year, while notebook sales are under pressure as consumers continue to favor smartphones and tablets. The declining price of SSDs also will allow them to take away some share from conventional HDDs."

Even with the revenue decline, because of their huge cost advantage over SSDs, HDDs will continue to be the dominant form of storage this year, especially as demand for ultrabooks picks up and hard drives remain essential in business computing, Zhang added.

HDDs overall will maintain market dominance because of their cost advantage over SSDs, particularly when higher densities are involved and dollars per gigabyte are calculated, iSuppli said. HDD costs and pricing are significantly lower than SSDs. And, the average selling price for HDDs is expected to decline further 7% this year.

On average, HDD prices have dropped from 50 cents per gigabyte of capacity in 2007 to 10 cents per gig in 2012, according to Zhang. SSD prices have dropped from $8.79 per gigabyte of capacity in 2007 to $1 in 2012.

"It is still too early to see the SSD price in 2013. But it will be down," Zhang said.

By comparison, NAND flash prices have been stabilizing since the third quarter of 2012, according to market research firm TrendForce. NAND flash manufacturers continue to have reservations about the market after several volatile years.

HDDs will also continue to be part of storage systems even in ultrabooks that also use SSDs as a type of cache. HDD use will continue to grow in businesses, including the enterprise space, cloud storage, big data and big data analytics, IHS said.

Bearing the lowest cost of any storage medium on the market other than tape cartridges, HDDs will remain the final destination for the majority of digital content that needs to be filed away, the research firm said.

Also expected to boost sales is Western Digital's helium HDD near the end of this year.

Helium-filled drives will be used in data centers where the new HDDs will drastically reduce internal friction, lowering power consumption by 23% and increasing capacity by 40%.

"Helium HDDs could propel Western Digital to the top enterprise HDD spot, dethroning Seagate in the process," Zhang said. Seagate holds 50% of the enterprise market share for HDDs.

At the same time that SSDs and new HDDs are finding growth, the PC optical disk drives that use CDs and DVDs, is expected to continue to plummet.

The declines stem from a number of reasons, including smaller chassis sizes for PCs, a shift in preference among consumers toward video streaming instead of using physical discs, and cost-cutting from PC manufacturers that have lost interest in using optical drives.

"In what appears to be a grim scenario, the optical disk drive industry is expected to encounter continued challenges this year, such as those presented by thinner PC designs. Optical drives could eventually be abandoned by PC makers altogether," IHS stated.