Global industrial machine vision sales to hit $2bn by 2018 27 Jun 2013 Analyst Yole Développement publishes new MV technology and market forecast, identifying nine key market types.

Yole Développement, Lyon, France, has published its latest report on machine vision technology and market trends. The report provides comprehensive analysis on machine vision markets, including segmentation and market forecast for 2013-2018, detailed value chain and supply chain. It also focuses on some key MV technology “evolution” sectors: CCD vs. CMOS, 3D imaging, BSI and hyperspectral techniques.

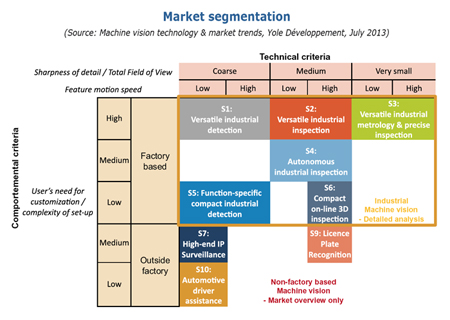

The company notes that the machine vision market is “complex, composed of myriad niche applications that are either industrial or non-industrial”. To simplify the market’s structure and dynamics, Yole devised a novel market segmentation approach that cross-references technical and behavioral criteria. By cross-referencing technical and behavioral needs, the analyst has identified nine homogeneous groups of key machine vision customers.

Yole observes that from an industrial perspective, “versatile detection and inspection, and compact 3D inspection will fuel most of the machine vision industrial market’s growth over the coming five years, driven by new low-end applications.” From a non-industrial standpoint, all identified segments are expected to sustain steady, high growth at a 15% plus CAGR; namely high-end IP surveillance, license plate recognition and automotive safety sectors.

The report includes a structuring segmentation to help facilitate MV market comprehension. It also highlights key growth areas and the available strategies to gain profitability or market share.

Visionary: Yole has defined nine distinct MV market sectors. $2bn in sales by 2018

Paul Danini, Technology & Market Analyst, Imaging Technologies & MEMS Devices, at Yole Développement, comments, “Total industrial MV sales accounted for 1.2 million cameras in 2012, a sales value expected to reach $2bn in 2018, at an 8% CAGR.”

”After moderate 1% growth in 2012, an upturn is expected in the future, thanks to the automation trend in Asian factories, new capital expenditures in the semiconductor industry and the emergence of new low-end applications,” he added. “Growth in the low-end segments will be driven by strong price erosion stemming from the commoditization of machine vision subsystems.”

Machine vision players’ main challenge will be how to gain market share in the dynamic low-end market segments while maintaining sustainable profitability.

Over this period, non-industrial applications are expected to boom at double-digit rates, driving future growth. Yole Développement’s report includes market insights in the form of units and revenues for market segments in industrial and non-industrial MV.

Consolidation

Yole further notes that MV applications’ complex diversity has resulted in the emergence of a multitude of small MV camera manufacturers. Therefore the machine vision market is “very fragmented at the camera level”. On the flip side, the MV image sensor market remains quite concentrated due to the requirement for strong technical know-how in designing specialized sensors.

Danini concludes, “From a technological standpoint, industrial machine vision is mostly characterized by incremental innovations: subsystem manufacturers increasing resolution, frame rate and subsystem capacity. The market’s technological maturity makes disruptive innovation challenging, and minimizes any unique selling proposition.

”The combination of high fragmentation and limited product differentiation has led the machine vision market to unavoidable commoditization, driven by strong price competition from companies like Point Grey Research and Basler. Now that the market has attained significant manufacturing volume, it’s highly probable that a consolidation will occur at the low-end through successive acquisitions by market leaders strategically positioned there.”