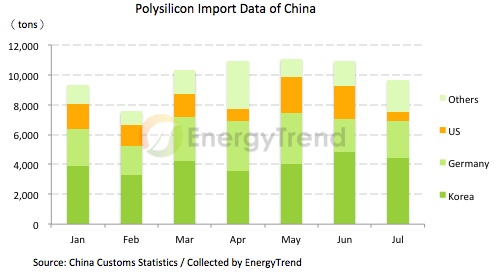

China’s polysilicon import volume has declined month by month after the total import volume peaked in May, according to the polysilicon import data in China. As China begins to close a loophole that permits duty-free polysilicon from the U.S., EU and South Korea in September, let’s see what will happen next – OCI’s tariff rate of 2.4% and Hankook Silicon’s 2.8% will allow them to be the biggest winners after the suspension of the polysilicon OEM trading business. In fact, Korea has imported more than 4,000 tons of polysilicon into China every month; Wacker is still very important to the Chinese market because it has signed a power purchase agreement with China long time ago; and China has imposed a higher tariff rate on REC, hence the company will completely lose its competitiveness in China.

However, reduction in overseas polysilicon supply did not result in much higher Chinese polysilicon prices. It’s because China’s polysilicon production each reached 14,000 tons in July and August, respectively. In addition to that, there is 9,000 tons of polysilicon import per month, which means there is a total of 23,000 tons every month. To calculate using 5g polysilicon per watt, the existing polysilicon supplies can produce wafer capacity up to 4.5W each month.

According to EnergyTrend’s silver-member monthly report, polysilicon prices will remain at RMB115-118/kg in September. Starting from October, demand for utility-scale projects will continue to increase in China and demand will be stronger in the US and Japan. Under the circumstances where polysilicon imports will reduce further, polysilicon prices may start to rebound in the end of September and beginning of October. However, price increase is limited due to the following factors – Chinese manufacturers’ large amount of supplies and the continuous imports from OCI and Wacker. It’s expected that prices will keep rising until it reaches RMB125/kg.

Thanks to higher cell prices in China, Taiwan, and the third countries, multi-si wafer prices have slowly increased in China. But wafer prices in Taiwan will remain stable at US$0.82-0.825/pc in September since tier-two Chinese manufacturers have lowered the selling prices.

Downstream clients usually request for higher efficiency products, thus cell prices have increased the most within the entire PV supply chain. The price quote for cells with efficiency above 17.8% stayed flat at US$0.32/watt in Taiwan, while it’s between RMB 2.25-2.3/watt for top-tier Chinese manufacturers. Yet, PERC cell prices remained weak as end-user demand has not yet emerged.

Because of growing demand for Chinese power plants, module prices have increased slightly. In fact, the purchase price for individual power plant has exceeded RMB 4/watt recently.