While there is still some interest in digestive health claims on food products globally, changes in legislation around such claims have meant that food manufacturers have started to focus more on specific ingredients with a ‘healthy’ image, according to findings from market research organisation Innova Market Insights.

More than 3.2 per cent of food and drinks launches recorded by Innova Market Insights carried digestive health claims of some kind in 2014, up from 2.7 per cent five years previously. According to Innova Market Insights, this indicates that there is still ongoing interest in the sector, particularly in the US, where the share rose from 3.3 per cent to over 3.6 per cent.

However, launches of new products using a digestive health claim in the EU fell from 2.4 per cent to 2.2 per cent over the same period.

“There is clearly still interest in products for digestive or gut health,” said Lu Ann Williams, Director of Innovation at Innova Market Insights. “This is reflected in ongoing levels of product activity, despite some of the current regulatory issues affecting health claims, particularly in Europe,” she said.

Health claims focusing on specific ingredients

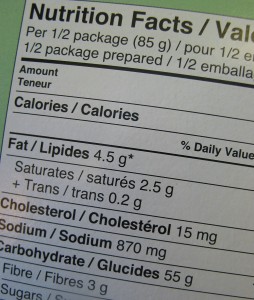

With the claims situation becoming more difficult, Innova Market Insights said companies were also focusing on the use of specific ingredients, such as wholegrains and fibre, which may already be linked with digestive health in consumers’ minds.

Ms Williams said food and beverage companies were tending to move to a more general health and wellness positioning for their products.

“They are relying more on existing consumer awareness of ingredients such as probiotics and fibre, the health benefits that they offer and the kinds of food and drinks products that they can be found in,” Ms Williams said.

High-fibre or source-of-fibre claims were used on nearly 3.4 per cent of food and drinks launches recorded by Innova Market Insights in 2014, rising to 4.6 per cent in the US. Wholegrain claims were used on 2 per cent of global launches, rising to 3.4 per cent in the USA.

Wholegrain claims most popular on cereals and bakery products

Wholegrain claims were particularly popular in categories such as cereals and bakery products, according to Innova Market Insights. Bakery products lead globally, accounting for 21 per cent of food and drinks launches using this type of claim, although this was equivalent to less than 6 per cent of total bakery introductions. In addition, 5.5 per cent of bakery launches used wholegrain claims.

The two claims combined featured on 9 per cent of bakery launches, rising to 16 per cent in the US.

Biscuits and bread most likely to carry fibre-related claims

Within the bakery market, biscuits accounted for nearly half of launches using fibre-related claims (excluding wholegrains), ahead of bread. In terms of significance however, bread was a clear leader, with products featuring a high-fibre positioning accounting for 15 per cent of bread launches, compared with just over 9 per cent in savoury biscuits and just 5 per cent in sweet biscuits.

Breakfast biscuits trend

In the biscuits market, the key area of activity in high-fibre products in recent years has been in breakfast biscuits. Almost all breakfast biscuits have been promoted as high in fibre and/or whole grains. Many also have variants such as ‘fruit and fibre’ in their ranges.

Innova Market Insights said this started in the UK in 2010, creating a new breakfast biscuits sub-category featuring a raft of new brands. It also heralded a welter of activity in other countries, including Germany, the US and Australia, as well as a revitalisation of existing breakfast biscuit markets in countries such as France and Spain.