Lululemon Athletica Inc. reported second-quarter earnings declined slightly but came in better than planned with same-store sales on a currency-neutral rising 11 percent. The yoga-themed retailer raised its guidance for the year.

For the second quarter ended August 2, 2015:

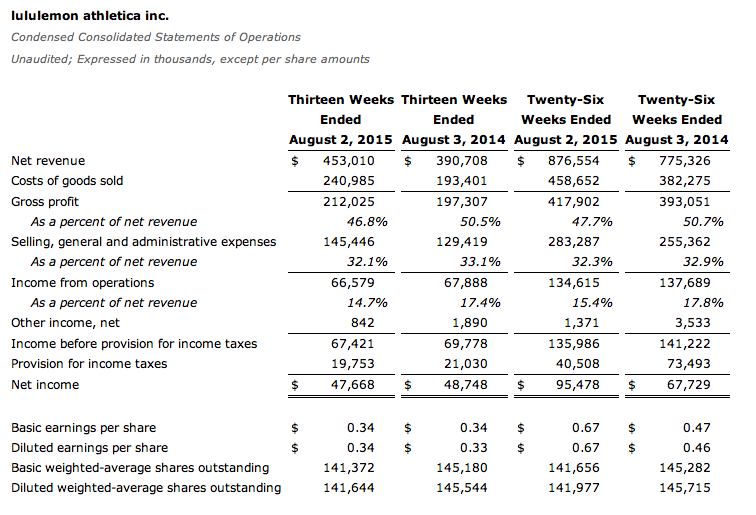

Net revenue for the quarter increased 16 percent to $453.0 million from $390.7 million in the second quarter of fiscal 2014.Total comparable sales, which includes comparable store sales and direct to consumer, increased by 11 percent for the second quarter on a constant dollar basis.Comparable store sales for the second quarter increased by 6 percent on a constant dollar basis and direct to consumer revenue increased 35 percent on a constant dollar basis.Direct to consumer net revenue increased 30 percent to $82.2 million, or 18.2 percent of total company revenue, in the second quarter of fiscal 2015, an increase from 16.2 percent of total company revenues in the second quarter of fiscal 2014.Gross profit for the quarter increased by 7 percent to $212.0 million, and as a percentage of net revenue gross profit was 46.8 percent for the quarter compared to 50.5 percent in the second quarter of fiscal 2014.Income from operations for the quarter decreased by 2 percent to $66.6 million, and as a percentage of net revenue was 14.7 percent compared to 17.4 percent of net revenue in the second quarter of fiscal 2014.The effective tax rate for the quarter was 29.3 percent compared to 30.1 percent in the second quarter of fiscal 2014.Diluted earnings per share for the quarter were $0.34 on net income of $47.7 million, compared to diluted earnings per share of $0.33 on net income of $48.7 million in the second quarter of fiscal 2014.During the second quarter of fiscal 2015, the company repurchased 1.0 million shares of the company's common stock at an average cost of $63.96 per share.The company ended the second quarter of fiscal 2015 with $541.3 million in cash and cash equivalents compared to $725.1 million at the end of the second quarter of fiscal 2014. Inventory at the end of the second quarter of fiscal 2015 totaled $280.6 million compared to $180.5 million at the end of the second quarter of fiscal 2014. The company ended the quarter with 336 stores.

Laurent Potdevin, Lululemon's CEO, stated: "We exceeded our revenue targets for the past quarter, supported by strong performance from both our store and e-commerce channels. Looking to the remainder of the year, our team is laser focused on meeting our strategic key goals: grow our global collective, relentlessly innovate our product lines and continue to create transformational experiences for our guests." Potdevin continued: "As our momentum continues to build, we are excited by the progress made with our international expansion, the launch of our new women’s pant wall last week, and successful brand-building events occurring around the globe."

Updated Outlook

For the third quarter of fiscal 2015, we expect net revenue to be in the range of $477 million to $482 million based on total comparable sales in the high single digits on a constant dollar basis. Diluted earnings per share are expected to be in the range of $0.35 to $0.37 for the quarter. This guidance assumes 141.6 million diluted weighted-average shares outstanding and a 30.2 percent tax rate. The guidance does not reflect potential future repurchases of the company's shares.

For the full fiscal 2015, we now expect net revenue to be in the range of $2.025 billion to $2.055 billion based on total comparable sales in the high single digits on a constant dollar basis. Diluted earnings per share are expected to be in the range of $1.87 to $1.92 for the full year. This guidance assumes 141.8 million diluted weighted-average shares outstanding and a 30.2 percent tax rate. The guidance does not reflect potential future repurchases of the company's shares.