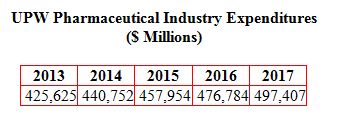

The pharmaceutical industry demands for UPW for injection (WFI) and UPW for cleaning process equipment and other uses will result in purchases close to $500 million in 2017 up from $425 million this year. This is the latest forecast in the continually updated Ultrapure Water: World Markets published by the McIlvaine Company.

The forecast includes hardware such as filters, piping, pumps and instruments. It also includes consumables such as membranes and ion-exchange resins. In general, the contamination prevention demands are so high that specially designed hardware and consumables are needed.

The largest growth is coming in Asia where there is a construction boom centered around generic drug manufacture. The major drug companies of the world are building generic production facilities in China, India and other Asian countries.

There are four trends driving the rapid growth in the Asian UPW market:

Increasing ability to pay for drugsLow per capita expenditures in the pastNew focus on health careTighter restrictions forcing more UPW expenditures per unit of productionOne of the areas of greater investment is in measurement and control. Better instruments to measure contaminants and flow along with software to optimize processes are allowing pharmaceutical plants to achieve better contamination control at reasonable cost. So called smart pumps and valves which report their condition further the optimization potential.

There are equipment improvements such as electrodeionization and membrane contractors for gas removal. There are consumables improvements such as reverse osmosis membranes which achieve greater efficiency at comparable energy consumption.