Opple Lighting, which is in the process of applying IPOs in China, has seen its revenues reach RMB 3.9 billion (US $630 million) in 2014, according to a report by Chinese-language media The Time Weekly.

The lighting industry is entering a rapid transition phase, industry restructure has sped up. In the short term, LED lighting market is still chaotic and disorderly. With the industry heavily relying on OEM models, Opple’s product quality issues has been exposed by media on several occasions.

Product quality issues combined with the companies rising management costs and expenditures is eating away the company’s profits, according to the report.

Opple's new LED products launched in June 2015. (Opple/LEDinside)

From 2012 to 2014, Opple Lighting’s revenue was respectively RMB 3.14 billion, RMB 3.39 billion, and RMB 3.84 billion.

Although, Opple’s revenues has increased from RMB 3.14 billion to RMB 3.84 billion, its net profits have dropped from RMB 427 million to RMB 293 million.

Lighting industry’s transition spurs Opple Lighting to expand its management in 2014, and strengthen R&D investments. The company has expanded its sales team to promote its products to tier three, tier four cities and rural areas in China. The company has also scaled up its online and offline services and management, which has eroded its profits.

Additionally, Opple expanded oversea investments and set up offices in Europe, Brazil, India, and South Africa. Yet, among its oversea offices, only the Dubai office is profiting. Other subsidiaries in Brazil, South Africa, Netherlands, and India have all reported losses. The company’s subsidiary in Netherlands has incurred the most losses of RMB 28.39 million.

“Opple’s performance has been affected by its unprofitable oversea markets,” said a LED analyst.

Worth noting is Opple’s residential lighting business revenue share from 2012 to 2014 was 37.66%, 43.52% and 38.72% respectively. The residential lighting sector has been the company’s main source of revenue, and aside from meeting residential lighting product demands, it also meets home renovation market demands. Additionally, residential luminaire upgrades are mostly affected by the real estate market conditions.

Issues arising from OEM business models

Opple lighting’s market position is a green lighting manufacturer, and from its fundraising items it can be seen that LED is still high on its development agenda.

According to the company’s investor relations statements, LED lighting products growth soared. LED lighting product revenues for 2012-2014 was respectively RMB 53 million, RMB 720 million and RMB 2.16 billion with sales respectively 1.71%, 21.24%, and 56.17%. In this recent investment, Opple Lighting will also be investing RMB 567 million in green lighting manufacturing facilities and plants. The new factories is estimated to manufacture 22.74 million LED lighting products.

(Source:The Time Weekly; organized by: LEDinside)

Despite becoming a leading manufacturer in the LED lighting industry, Opple is still mostly an OEM.

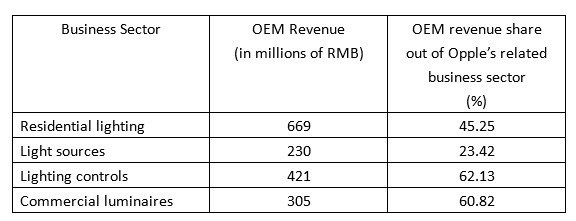

In 2014, Opple’s OEM residential lighting, light sources, lighting controls, commercial luminaires and other products revenue was respectively RMB 669 million, RMB 230 million, RMB 421 million, and RMB 305 million. Out of these lighting sectors, lighting controllers and other commercial lighting OEM products had the largest revenue shares of 62.13% and 60.82% respectively.

Lighting controls and other products are mostly used in electronic products and integrated ceiling lights. Commercial products comprise of basic lighting products, such as downlights and standardized commercial lighting products. Opple has been using OEM models in the past. Compared to 2012, the company’s OEM revenue has declined in 2014, with the company increasingly focusing on strengthening R&D.

Although, OEM models has made Opple lighting more economic, the drawback has been product quality risks.

On May 4, 2015 the Administration of Industry and Commerce of Guangzhou found four-bit digital to analog converters manufactured by Opple Lighting (Zhongshan) did not meet thermal dissipation requirements.

Opple admitted in its investment statement that within the reporting period, government inspecting officers found some of its products did not meet product quality requirements.

Once Opple is listed on China’s bourse it will continue to use the same OEM business model. Some of its in-house produced products will be those with high requirement standards fit for automated production, and are more profitable. Other products will also continue to use OEM production models.

“Product quality issues can seriously harm a company’s brand and market image,” said the LED analyst. “In more serious cases, it can cause large revenue decline. Manufacturers need to confront these issues.”

Opple responded with this statement: “The company values the recent product quality issues, and has taken effective measures. We have sent the products to related departments for further tests to ensure Opple’s high product quality.”

Founded in August, 1996 by couple Yaohai Wang and Xiuhui Ma, the Chinese lighting company started off with small eight member team in a workshop. In the following 19 years, the small workshop would develop into an enterprise with 6,000 employees globally. The company factories are located in Shanghai, Zhongshan, Wujiang, and other regional industrial parks in China. Opple’s product line covers LEDs and traditional light sources, luminaires, electronic appliances, ceiling lights and other products.