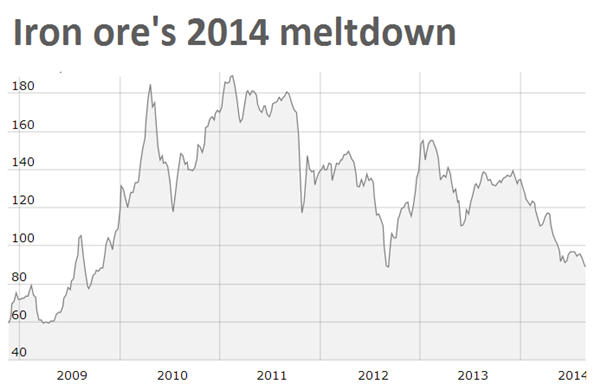

Long held assumptions about the direction and dynamics of the iron ore market have been severely tested in 2014.

After hitting a high of $158.90 in February, the industry was jolted on March 10, when iron ore suffered the worst one-day decline since the 2008-2009 financial crisis, cratering 8.3% in a single session.

The recovery from there was swift, but by June 16 the steelmaking raw material was sliding again, hitting a low of $89 a tonne.

Iron ore slowly clawed back some of those losses for a 2% gain in July breaking a six-month losing streak.

But August brought renewed selling and on Tuesday, the price of benchmark Northern China 62% Fe imports slid to $88.90, the lowest since September 5, 2012.

Iron ore touched $86.70 then, but quickly recovered to end 2012 above $150.

The market seems very different now.

The commodity is set to trade below $100 on a quarterly basis for the first time since 2009.

The more than 33% slump in the price this year is blamed on a surge in supply and a slowdown in China which consumes more than two-thirds of the 1.2 billion seaborne trade.

No-one is predicting a move back to the early days of the iron ore trade when the price, set during secretive annual contract negotiations, never strayed from $10 a tonne for more than 20 years.

But it is worth noting that back in 2007 the commodity was still trading at $36 a tonne.

And the all time high of $192 in February 2011 now seems like nothing more than an aberration