Despite some austerity measures, recent trends suggest a reason for optimism for the U.S. economy and its manufacturing sector. The quarterly Manufacturers Alliance for Productivity and Innovation (MAPI) U.S. Industrial Outlook, a report that analyzes 27 major industries, indicates that industrial production will increase 2.2 percent in 2013, which is slower than last year’s 4.2 percent. A further pickup is likely in 2014, where growth is anticipated to be 3.6 percent.

Daniel Meckstroth, MAPI chief economist and author of the report’s analysis, said in a recent interview that several historical trends are not bearing out in recent numbers. As opposed to a traditionally gradual ebb and flow, seasonally adjusted data for industrial production is instead characterized by huge spikes from quarter to quarter. Winter tends to be strong, followed by a flat spring or summer, then acceleration again in the fall.

“I don’t know why this is occurring, but we’ve seen it the past two years and it looks like it’s occurring again,” Meckstroth said. “It seems like inventory swings are driving this. Firms accumulate inventory when they see a pickup in the fourth quarter, then you get into the second or third quarter and find that the economy is just not growing as fast as planned.”

Generally, said Meckstroth, it was not a strong year for manufacturing. The only place to find more demand is overseas, he said, where uncertainty is more prevalent than at home. “All this uncertainty translates into firms no making investments. We should be in an investment boom right now,” said Meckstroth, citing high profitability, low interest rates, and high-capacity utilization. “But we’re not. Investments not driving the economy, which it should. Really, the consumer is driving the economy and the consumer is constrained.”

Additionally, Meckstroth said the trade situation is deteriorating. “We expect no export contribution to growth this year, so the trade deficit is going to get worse, which doesn’t help manufacturing.”

While GDP declined at a 0.1 percent rate in the fourth quarter of 2012, manufacturing output grew at a 1.9 percent rate, in line with the spikes Meckstroth described. Over the long term, however, Meckstroth said manufacturing production will not consistently outperform GDP growth, but will tend to to track with it. MAPI estimates GDP growth will be 1.8 percent in 2013 and 2.8 percent in 2014.

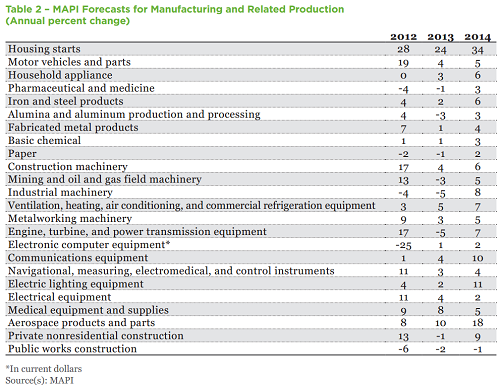

The report offers economic forecasts for 24 of the 27 industries. MAPI anticipates that 16 of these will show gains in 2013, and eight will decline. The outlook improves in 2014, with growth likely in 23 of 24 industries, led by housing starts at 34 percent.

Seventeen of the 27 industries MAPI monitors had inflation-adjusted new orders or production above the level of one year ago (two more than reported last quarter), eight declined, and two were flat. Housing starts grew by 27 percent in the three months ending January 2013 compared with the same period one year earlier, while construction machinery improved by 16 percent in the same time frame. The largest drop came in electronic computer shipments, which declined by 34 percent.

Meckstroth reported that six industries are in the accelerating growth (recovery) phase of the business cycle; 11 are in the decelerating growth (expansion) phase; six are in the accelerating decline (either early recession or mid-recession) phase; and four are in the decelerating decline (late recession or very mild recession) phase.