The market surge was driven mostly by MOCVD reactor shipments to new Chinese entrants, who benefited from the generous subsidies of the Chinese central and local governments in a bid to stimulate domestic chip production. Financial investors have also invested a huge amount of money in these companies, matching the governmental funding.

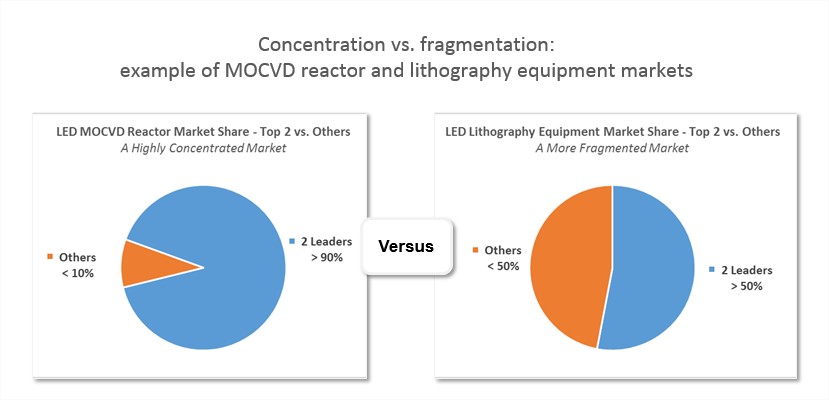

The market is now slowly recovering and will experience another investment cycle in 2014-2016 driven by demand for general lighting applications. But nothing will be similar from now. The improvement of equipment throughput and yields is also impacting the equipment sales: better equipment means better yield means less investments. Also, except for the MOCVD business still in the hands of only Veeco and Aixtron, the others equipment markets for the main process steps (lithography, etching…) are highly fragmented, with many players trying to get a piece of the remaining market.

As a result, the equipment market will peak at nearly $580M in 2015 with MOCVD reactors representing more than 80% of the business: the bulk of these reactors are still being shipped to Chinese manufacturers or Taiwanese players transitioning to 4" diameters. Lithography, plasma etching, PECVD, and PVD equipment will follow a similar trend.

Yole Développement LED Front-End equipment market report presents major equipment used in LED Front-End manufacturing. It describes market size and volume (2009 - 2020), trends per process steps (performance, ASP, emerging technologies…), key suppliers, and much more!

The LED epitaxy equipment market (MOCVD reactor) is very concentrated under the control of the Big 3 (Aixtron, Veeco and Tayo Nippon Sanso) who represented nearly 97% of market share in 2013.

New entrants have missed the first 2 LED growth cycles (small display and large display applications) that have allowed leaders to build their expertise and know-how as well as their networks (sales office, training center…). Even big names, such as Applied Materials, did not achieve access to these markets.

Revenue collected during the 2010 - 2011 investment cycle (a total of more than $2 billion for MOCVD reactors, with > 90% going to Aixtron and Veeco) have allowed Veeco and Aixtron to slash ASP and initiate a price war to lever further market entry barriers.

The current LED Front-End industry is largely driven by cost reduction (as technological evolutions are reaching their saturation point). The main strategy developed by a new MOCVD reactor supplier is to focus on decreasing Cost of Ownership through a new heating system, new gas flow design, and increased automation (…). However, even if this is the best and only strategy to adopt, we do not expect these new entrants to affect supremacy of leaders (Aixtron, Veeco and Tayo Nippon Sanso). Main winners of such competition will be LED manufacturers who will see commercialization of next generation MOCVD reactor earlier than expected.

At short term, only 2 types of suppliers (outside of the Big 3) will survive: suppliers that develop collaboration with some big LED manufacturers or Chinese suppliers that are able to scrape together bits and pieces of the huge local market.

Comparatively, the lithography, plasma etching, PECVD, and PVD equipment markets are much more fragmented with several players battling to enlarge their market share. As an example, the top three suppliers of LED lithography equipment represented nearly 70% of market share in 2013 with the remaining 30 % in the hands of more than 10 competitors.

This situation is due to specificities of the different LED Front-End manufacturing process steps:

• LED epitaxy is quite specific and requires dedicated tools supplied by companies that have developed strong know-how.

• Other LED Front-End manufacturing processes can use older or refurbished semiconductor systems designed for other applications. And with the growth of the LED industry, suppliers of LED-dedicated systems have also appeared. This has further fragmented these markets, now both traditional semiconductor equipment suppliers and new LED-dedicated equipment suppliers compete.

As a conclusion, we can also highlight that the LED manufacturing still uses methods and practices that would be considered outdated in most semiconductor industries (e.g.: manual wafer handling, with operators moving wafers with tweezers in (not so) clean rooms…). However, emergence of LED "giants" (such as Cree, Osram, Lumileds, Samsung or LG) have facilitated and speed up adoption of manufacturing paradigms from the IC industry to reduce overall manufacturing cost and increase products quality:

• Batch processing is moving to Single wafer processing.

• Automation, cluster tools, full cassette to cassette (…) are now implemented in the top LED manufacturers

• Statistical process control, defect management (…) is following the same way

• Reduction of SKU and enterprise Management Systems (EMS) are also implemented.

As a matter of fact, gap will widen between Tier-1s and other players, pushing forward for industry consolidation: the bigger are getting stronger and more efficient, weakening the position of the tier 2 and Tier 3 LED maker.

So this industry will be again under strong changes and big consolidation in the next 3 years. Yole Développement LED reports and the LED analysts' team at Yole Développement will track such changes in the next months.