Since the 21st century, China has seen rapid development of the welding equipment industry, and become the world's largest producer and exporter of welding equipment. In 2013, the enterprises with the annual sales revenue of over RMB20 million in the welding and cutting equipment industry achieved the revenue of RMB41.18 billion, representing a year-on-year increase of 19.49%. From January to October of 2014, these enterprises earned the revenue of RMB34.29 billion.

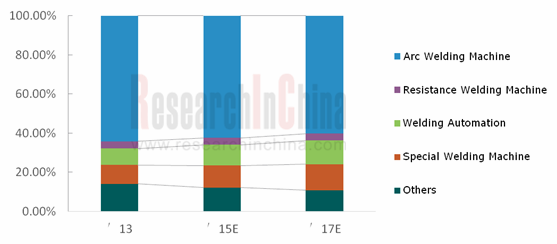

China welding machine industry mainly involves arc welding machine, resistance welding machine, welding automation (special machine automation + welding center automation), special welding machine, auxiliary equipment and fittings. In 2013, arc welding machine, resistance welding machine, welding automation (special machine automation + welding center automation) and special welding machine occupied 68.14%, 3.68%, 8.39% and 9.69% market share respectively by revenue. Automation equipment and welding robots have developed radically in recent years.

China's Welding and Cutting Equipment Market Structure, 2013-2017E

Source: China Welding Equipment Industry Report 2014-2017, ResearchInChina

The competitive welding machine industry has a moderate concentration rate. At present, there are approximately 1,500 enterprises in Chinese welding and cutting equipment industry, and more than 20 ones of them each realize annual output value of over RMB100 million. The market players embrace foreign companies -- Panasonic, OTC, ITW and ESAB Group and domestic counterparts -- Riland, Jasic Technology, Beijing TIME Technologies and Shanghai Hugong.

Foreign companies target medium and high-end markets. Tangshan Panasonic has always ranked the forefront in the Chinese market by revenue, with a wide range of products covering almost all sectors of the industry. As a leader in the field of welding robots, OTC has two sales and service companies in China, two production bases (Mudanjiang and Qingdao) and four training centers. ITW’s Beijing Miller mainly produces DW and DS series gas protected welding machine, and manages marketing and services of ITW welding products in the domestic market. ESAB Group has established four factories and a process center in Zhangjiagang, Yantai, Wuxi and other places of China, involved with welding machine, welding materials, automation and cutting machine, and giving priority to the development of such sectors as energy, construction machinery, transport, shipbuilding and offshore platform.

Chinese companies highlight medium and low-end markets, and they have gradually replaced foreign brands in the traditional arc and resistance welding machine markets. Riland, Jasic Technology and Beijing TIME Technologies have extensive product lines and take leading positions in the domestic market. Some manufacturers have tapped into the field of welding automation and robots, for example, Jasic Technology, Huayilong and Shanghai Hugong produce welding robots through the cooperation with ABB, Kawasaki Heavy Industries and other foreign companies.