The private hospital sector is an emerging part of China’s healthcare market, and is expected to maintain double-digit growth over the coming years, driven by regulatory changes, market demand and capital investments. Specialty hospitals have been leading the growth amongst the private hospital market, and different specialties – including mainstream specialties like gynecology & eye care and others like oncology, cardiovascular and psychiatry – have unique opportunities. Among the most successful in the sector is Wenzhou Kangning Hospital, which has achieved tremendous growth over the past 15 years and now is the leading private psychiatry hospital group in China.

However, the operational management of China’s private hospitals is lagging, and at L.E.K. we have identified three core management principles that can be applied to help remedy this deficit: Standardization, expansion and optimization. Financial performance standardization in particular is key whether growth is sustainable, and private hospitals need to develop and implement systematic financial management to overcome this challenge.

The number of private hospitals in China increased from about 5,400 in 2008 to roughly 9,800 in 2012. This growth is expected to continue at an average pace of 15% annually, reaching 15,000 by 2015. In addition, the number of inpatient visits at private hospitals has surged from 5.2 million in 2008 to 12.3 million in 2012, representing a Compound Annual Growth Rate (CAGR) of 24%. This is expected to further accelerate to a CAGR of 30-40% in 2015, reaching an annual inpatient visit total of 25-35 million.

Favorable governmental policies, increasing patient affordability and growth in investments are the three major factors driving the growth of China’s private hospitals. First, both the central and provincial governments have introduced new policies and regulations to support the development of private hospitals. Some of the key policies introduced include allowing multi-site practice by physicians, relaxing the restrictions on public reimbursement, giving for-profit private hospitals three years of tax exemption and allowing complete foreign ownership, among others. Authorities have also allowed private hospital groups to centralize the registration of individual chain hospitals into a single account, greatly simplifying the registration process and increases operational efficiency.

As China’s economy continues to grow steadily, the disposable income of many Chinese has also increased, leading to a rise in medical affordability. According to various estimates, the share of families in China with annual disposable income greater than RMB220,000 is expected to increase from 2% in 2012 to 6% in 2020. Total expenditure in private medical insurance is also expected to treble from today’s level, meaning the number of patients who can afford premium medical care should surge.

Finally, the amount of capital invested in private hospitals has been increasing. With growing interests from private equity investors, the number of deals involving private hospitals has experienced unprecedented growth, and 55% of all such capital invested is in specialty hospitals. At the same time, large public-listed pharmaceutical companies have also been actively making acquisitions in the private hospital market. The ongoing privatization of public hospitals and growth of foreign-invested hospitals have also contributed to a conducive investment environment.

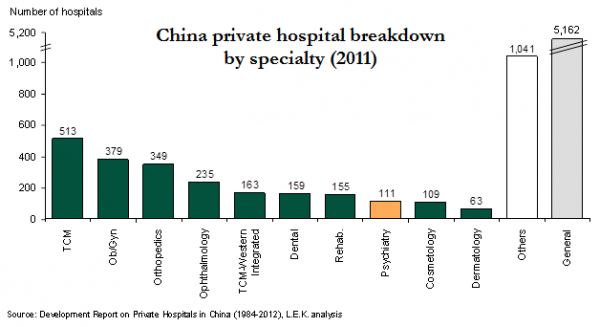

Although more than half of the 9,000 or so existing private hospitals are general hospitals, specialty hospitals have been leading the sector’s growth, especially those with specialties that are more easily replicated.

Private hospitals with different specialties have seen accordingly varied growth trajectories and strategies to date. Recent years have witnessed the rapid growth of premium gynecology private hospitals, exemplified by United Family Hospital’s gynecology department, Amcare, American-Sino and Angel. Other specialty private hospitals such as Aier Eye Hospital and Arrail Dental Clinics are also experiencing steady growth.

We believe that there are opportunities in other specialties, such as oncology, cardiovascular treatment and psychiatry. Psychiatry specialty hospitals, for example, have seen increased government support and stand to benefit from huge unmet need across the country, which should provide excellent growth prospects going forward.

In 2012, the central government published a draft for consultation of the National Mental Health Plan (2012-2015), introducing new mental health oversight and management guidelines for local governments to follow, including allowing reimbursement for mental health expenses. Subsequently, many local provincial governments were spurred to introduce local policies of their own. In addition, to combat the issue of limited mental healthcare practitioners, the government has planned to increase the number of psychiatry doctors and nurses to a ratio of 25 and 50 per million, respectively, by 2015, a step closer to the global averages of 40 and 130 per million.

According to Chinese Center for Disease Control and Prevention, there are currently approximately 100 million people with some kind of mental health illness in China, including 16 million having serious mental problems. Incidence rates have risen for mental illnesses such as anxiety and depression, but the diagnosis rate of mental illness remains at only 30-50%, while the treatment rate is still a mere 10-20%, significantly lower than U.S.’s treatment rate of 80%. Driven by advances in diagnosis and medical treatment in China, as well as increased affordability, both diagnosis and treatment rates are expected to increase sharply, leading to an enormous demand for psychiatric medical services.

Changes in societal norms will also contribute to the growth in market demand as more patients and their families understand and accept mental illness. Also key is a trend towards adopting a more systematic treatment protocol for psychiatric patients, with more receiving proper medical and rehabilitative treatment at hospitals, rather than at home.

Among the hundreds of different psychiatry specialty hospitals in China, Wenzhou Kangning Hospital is a prime example of success. Kangning was founded in 1998 and had an initial capacity of 200 beds and about 100 medical professionals. After 15 years of growth, Kangning has become a full-fledged hospital management group with a portfolio of five hospitals across six geographical sites and a total inpatient capacity of over 2,000 beds. The flagship hospital of Kangning in Wenzhou has 1,060 beds and more than 700 medical professionals alone. In 2012, Wenzhou Kangning became the first private psychiatry hospital to be granted 3A status in China. The key market differentiation for Kangning has been its end-to-end medical solutions, customer service and advanced clinical treatments, and in June 2013, private equity firms CDH Investments and GL Capital invested RMB200 million in the group.

Looking back at the historical growth of private hospitals in China, opportunities and barriers both become apparent. It is evident that there are currently many problems with the management of private hospitals, such as low profitability, lack of good management systems, and low operational efficiency. At L.E.K. we believe the three core management principles of standardization, expansion and optimization can help overcome these issues, particularly for specialty private hospital chains.

Hospital management standardization is a key step towards private hospital growth and a necessary measure in bringing consistently high-quality healthcare services to patients. Standardization mainly applies to finance, operation and clinical practices. Using the latter as an example, standardization entails providing standard clinical treatments and medical guidelines for all patients. It also means using standard clinical indicators and reports to evaluate diagnosis and treatment results, and consistently using an evidence-based approach to improve the medical care that is provided to patients.

With standardization in place, private hospitals can move to the expansion stage to quickly replicate a successful operating model. However, each expansion strategy needs to be tailored to the specific circumstances of an institution and will require varied implementation. For example, with geographical expansion, there is a need to consider the market demand in the area of expansion and to choose a suitable local partner before entering the market.

In hospital management, continued optimization is a key to improving operating performance. This includes providing better service to meet patient needs, increasing patient volume and reducing cost. In order to remain ahead of the competition, it is imperative for hospital management to begin optimization after standardization and expansion by optimizing both financial and non-financial key performance indicators (KPIs). This can ensure both operational efficiency and steady growth.

Of these three key principles, standardization, particularly financial performance standardization, is currently a key challenge facing many private hospitals in China. Most hospital management personnel in the country come from a medical background and have historically been focused on building a strong clinical service team. However, as hospitals expand in scale or number, financial and operational standardization become central to success. In order to succeed, private hospital management should consult with experts to develop and implement a systematic financial management solution, including financial KPI classification, financial data reporting, a customized financial IT system, and detailed, standard operating procedures for each function and role involved in the financial management process.

Private hospitals are only beginning to experience a phase of rapid growth, and the market potential is immense. However, so long as operational management lags behind it will continue to pose potentially serious managerial problems. It is thus vital for private hospitals to consider how to improve operational management in a systematic way in order to continue growing sustainably.