Mainstream PV products are currently struggling against sameness and virulent price competition. To become outstood over others, solar companies have to develop differentiated and competitive products. The trend is triggered by the EU’s announcement of a new project “X-GWp,” which aims to develop next generation N-type HIT PV cells. However, strategic allocation for downstream market is also vital for companies if they hope to maintain or upgrade their competitive advantages.

EU-made PV cells’ global market share had topped 25% in 2008, yet the ratio has dropped down to 7% in 2014 due to the emergence of China-made products. Although European makers predominate over fields include technology, research and equipment, higher production costs and lower manufacturing scales make less and less room for them to compete with Chinese makers. To break the deadlock, the EU launched its on-processing X-GWp project – the main objective of the project is to bring next generation high-efficiency (22% - 25%) c-Si N-type HIT PV cells to massive production. The project aims to set up a competitive gigawatt-scale production of PV cells and modules in Europe using a new generation of silicon-based technology and ensuring permanent innovation. As part of the project, EU plans to set a manufacturing facility with up to 1GW of N-type HIT PV products production capacity by 2017.

By 2017, the global production capacity of N-type cells could exceed 5GW, representing approximately 7% of global demand for PV cells, projected EnergyTrend.

Chinese first-tier PV manufacturers also take part in the efficiency rivalry. By the end of this July, Trina Solar unveiled the world’s first 6-inch large-sized IBC PV cells production line, which will produce PV cells with efficiency up to 21%. If the IBC cell’s production capacity were completely realized, EU’s N-type HIT cells might again be challenged by China-made low-cost PV products sicne 2017. Moreover, given facts that Japanese rooftop market is not as strong as expected, European market remains flat, and PERC will become the leader of mainstream products, it is uncertain whether the 2017 market would completely consume all these super high efficiency products or not. As a result, it will not be everything predicable for EU to win back its global market share only through the X-GWp project.

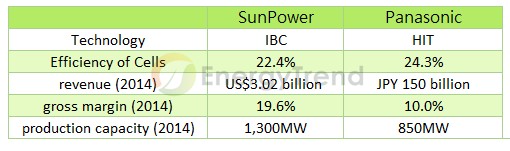

Furthermore, strategic allocation in the downstream market counts a lot for profits of manufactures -- and it can be more crucial than next generation technologies. SunPower and Panasonic, the only two manufacturers which produce super high efficiency PV cells (>22%), unveiled different financial results. SunPower’s gross margin was higher than Panasonic’s, and the superiority is from SunPower’s PV system business. The financial results show the importance of system-integrated business for the downstream market over cutting-edge technologies.

This Week’s Spot Prices

During the week, buyers of polysilicon were looking on the effects of China’s to-be-ended processing trade loopholes. The spot price consequently stuck at around US$16.1/kg. On the contrary, demand for high efficiency multi-si wafers remained strong, so quotes of them were risen 0.24% to US$0.83/pc. Nonetheless, demand for mono-si wafers were flat, and the spot price dropped to US$0.945/pc.

Spot price of PV cells with efficiency from 17.8% to 18% was raised because of strong demand for high efficiency multi-si cells. Yet demand for mono-si cells was as weak as prior weeks, and the quote decreased to US$0.347/W.

PV module order visibility was high. However, the spot prices climbed slightly due to more supply from second-tier manufacturers. Spot price of high efficiency multi-si 260W modules was US$0.538/W, while mono-si modules’ price decreased to US$0.608/W along with the price reduction of mono-si cells.