2013 had crackling opening in China with steel leaping by 1%on the first working day.Even though it was not a surprise since the tempo had been set at the beginning of Q4 with the resounding economic pouring in.Ensuing optimism on raw material market has already kindled the biggest rally in iron ore price in an year with price ascending by over 20%within a month's time.

Government drive to spruce up infrastructure through an ambitious USD 158 billion stimulus package has come to pass with consumption PMI climbing 6.3%in December.Likewise new order index jumped 13.5 percentage points to 60 in December,a fresh high seen last year while that for export orders increased just by 4.8 percentage points,which suggested that domestic demand was significantly better than that overseas.Reality sector too showed improved transactions giving a glint to the fading glamour.Steel inventory in major cities remained below 12 million tonnes a low level.

Rampaging production has been the nemesis of market revival attempts in the China for long but off late regulation has come to stay as they take hit on the bottom line.Even though steel production 2012 is expected to grow by 6%over 2011 it is significant descent from 2011.In September-Nov,the daily crude steel output was above 1.9-1.93 million tonnes all the time,yet still a low level compared with the whole-year production last year.National daily crude steel output came at 1.9-1.95million tonnes in December indicating production far cry from the traditional nearly 2 million tonnes per day earlier.

Effervescence in the market is unlikely to fade before the Lunar Holiday in early February.

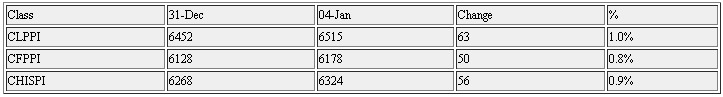

CLPPI-Chinese Long Product Price Index

CFPPI-Chinese Flat Product Price Index

CHISPI-Chinese Steel Price Index