In 2012, affected by the economic slowdown, shipping market slump, shipbuilding order contraction and other factors, the global marine diesel engine market shrank by 12.9% year on year to 67.27 million horsepower. In 2013, it's expected that the global shipping market will continue to face difficulties, and the marine diesel engine market size will keep decreasing, to 65.91 million horsepower.

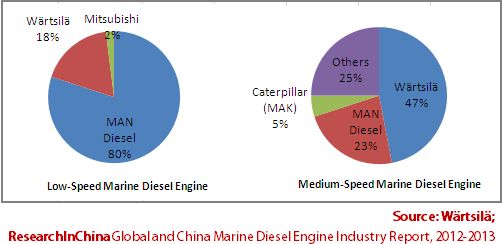

MAN and W?rtsil?, two global marine diesel engine giants, share 98% of the global low-speed marine engine market and 70% of the global medium-speed marine engine market.

Global Marine Diesel Engine Market Structure, 2012

At present, although China is the world's largest shipbuilding country, the development of marine diesel engines is relatively slow, and the production is mainly carried out through technology licensing of companies like MAN and W?rtsil?. As of the end of 2012, MAN has authorized more than 19 companies in China, while W?rtsil? authorized nine (including a joint venture).

Global and China Marine Diesel Engine Industry Report, 2012-2013 analyzes current status of the global and Chinese marine diesel engine market, sheds light on low-speed and medium-speed marine engine market segments, and delves into four international companies and 16 Chinese enterprises.

Hudong Heavy Machinery is the largest manufacturer of low-speed marine diesel engine in China, with annual output of 145 marine diesel engines (1.551 million kilowatts), including 125 low-speed ones (1.418 million kilowatts); in 2012, due to the shipping market downturn, the company's marine diesel engine output fell to 140 units (1.446 million kilowatts).

Zhenjiang CME is a key medium-speed marine diesel engine manufacturer in China, and its output has repeatedly hit record highs in recent years, surpassing 400 units in 2009, 600 units in 2010, and 700 units in 2011, but dropped to 410 units in 2012 due to the industry downturn.

Affected by the sluggish shipbuilding industry, Chinese marine diesel engine enterprises, especially private firms like Hefei RongAn Power Machinery, ZGPT Diesel Heavy Industry and Jiangsu Antai Power Machinery, have seen sharp decline in order intake, run under capacity, and suffered increasing pressure. These companies began to expand their business scope for long-term development.

Hefei RongAn Power Machinery has implemented a "marine engine-led co-development of multiple businesses" transition strategy since the end of 2011. At present, apart from strengthening its cooperation with shipyards, the company is developing medium-speed diesel engines and generator sets for marine equipment, and is actively engaged in the dual-fuel main engine and pure LNG-fueled main engine technology R&D and production.

ZGPT Diesel Heavy Industry has set foot in the field of natural gas power generation besides the marine diesel engine business. In 2013, the company and Mitsubishi Heavy Industries reached a consensus on KU-type gas engine technology transfer, and signed a manufacturing license agreement on April 10.