Australians are continuing to cut back on owning shares directly and, most particularly, through managed funds, according to an Australian Securities Exchange survey out yesterday.

The survey, conducted every two years, reveals that more than half a million people -- or almost 3 per cent of the adult population -- walked away from owning shares in one or other way between 2010 and last year. That reinforces the notion that the horrors of the global financial crisis of 2008, when many listed shares lost 40 per cent of their value, have left a lasting impact.

Admittedly, the survey does not cover shares owned by pooled superannuation funds, which would include almost everyone of working age, but it does include the shares owned by the almost one million members of self-managed super funds, who account for close to one-third of the $1.5 billion superannuation pie.

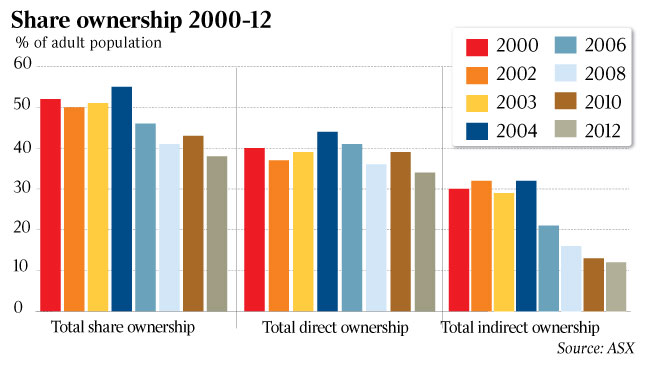

The survey of 3000 Australians shows direct-share ownership, which peaked at 44 per cent in 2004, dropped from 39 per cent to 34 per cent in the two years from 2010 to last year.

Total share ownership, which includes managed funds, peaked at 55 per cent in 2004 and dropped back in the last two years from 43 per cent to 38 per cent.

One of the biggest losers in the survey is the managed funds industry, which copped a shellacking through the GFC for the fact its fees were in many cases out of alignment with the indifferent performance provided by fund managers. Its support among Australian adults slipped from 32 per cent in 2004 to only 12 per cent last year.

The survey concludes that many investors have decided they may be able to obtain better performance by investing direct and not paying a manager.

"Many investors articulated a desire to be more in control of performance, or lack thereof, and to not pay high fees for indirect shares," the survey says. The biggest group of people owning shares directly is higher-income households, with 58 per cent of those with annual household incomes above $200,000 being direct shareholders.

The state with the highest direct-share ownership is Western Australia tied with the ACT, at 45 per cent, as against Queensland at 26 per cent.

After shares, the most popular investment class is residential property, in which 22 per cent of Australia's adult population have invested in some way.