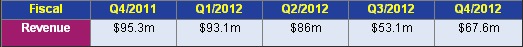

For its fiscal fourth-quarter 2012(to end-March),optical module and component maker Opnext Inc of Fremont,NJ,USA has reported revenue of$67.6m,up 27%on$53.1m last quarter.This was due mainly to revenue from 40Gbps-and-above products rising 58.8%from$20.2m to$32m as demand improved across most 40Gbps and 100Gbps product lines.

However,revenue fell short of the expected$70-75m.It was also down 29%on$95.3m a year ago.Although 40Gbps-and-above products were down 16.2%from$38.2m,the decline was due mainly to 10Gbps-and-below products falling 40.9%from$48.9m to$28.9m as a result of last October's flooding at the Chokchai facility of primary contract manufacturer Fabrinet in Thailand(where most of the firm's 10G products are assembled and tested).However,in February Opnext re-started 10G manufacturing in Thailand at Fabrinet's Pinehurst campus,and by the end of March it had returned to pre-flood production capacity.Revenue from sales of 10Gbps-and-below products was hence up 10%on$26.2m last quarter.

Revenue from industrial&commercial products was$6.7m,level on last quarter but still down 18.1%on$8.2m a year ago.

Cisco Systems Inc,FiberHome Technologies,and Nokia Siemens Networks each represented 10%or more of total revenue(comprising 47%collectively).

On a non-GAAP basis,although down on 21.3%a year ago,gross margin rose from 7.1%last quarter to 15.7%,due mainly to the overall revenue increase,the increase in 40Gbps-and-above product revenue as a percentage of total revenue,and lower excess and obsolete inventory and product discontinuation charges(partially offset by lower average selling prices).

R&D expense of$13.3m was$0.4m up on last quarter,due mainly to the timing of prototype builds.SG&A(selling,general&administrative)expense of$11.5m was down$0.7m on last quarter.

Adjusted earnings before interest,taxes,depreciation and amortization(EBITDA)was negative$10.4m,an improvement on negative$16m last quarter but still down on negative$2.2m a year ago.

Compared with$2.1m a year ago and$1.4m last quarter,cash used in operations has risen to$5.2m.This hence contributed to cash and cash equivalents falling during the quarter from$85.2m to$76.2m.Net of short-term debt,cash and cash equivalents were$58.1m.

Although Opnext is currently experiencing supply constraints that will impact its 40G-and-above products,for the June quarter the firm expects to continue to recover displaced 10G business now that its 10G production capacity is back online.The firm hence expects total revenue to rise to$70-80m.

"We were also very pleased to have entered into an agreement[in late March]to merge with Oclaro,"says chairman&CEO Harry Bosco."The merger will create a new industry leader in the fast-growing optical components and modules market,bringing together over 30 years of combined telecom and datacom optical technology innovation,"he adds.