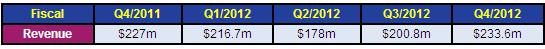

For full-year 2012, RF RF front-end component maker and foundry services provider TriQuint Semiconductor Inc of Hillsboro, OR, USA has reported revenue of $829.2m, down 7% on 2011’s $896.1m due mainly to a decrease in Mobile Devices revenue. Nevertheless, TriQuint achieved record Optical sales, fuelled by the firm’s 40G and 100G modulator drivers.

However, fourth-quarter revenue was $233.6m, up 3% on $227m a year ago and 16% on $200.8m on Q3/2012 (and above guidance of $220–225m).

Q4 revenue was split by end-market as Mobile Devices 64%, Networks 22%, and Defense & Aerospace 14%. Defense & Aerospace revenue was up 36% sequentially on Q3/2012, while Networks revenue grew just 1% sequentially. Mobile Devices revenue grew 19%. The company commented that there was “strong demand” for 5GHz WLAN, which drove 66% sequential growth in connectivity in smart-phones. Also, the firm set an “industry record” for its gallium nitride reliability.

On a non-GAAP basis, gross margin for Q4/2012 was 31.7%, up on 31% a year ago but down from 32.5% last quarter. Sequentially higher revenue was offset by inventory reductions, leaving factory utilization down slightly. Gross margin for the whole of 2012 was 30.7%, down from 37.2% for 2011. Utilization fell as TriQuint completed long-planned capacity additions during the year, had lower revenue, and reduced inventory.

Operating expenses for Q4 were $66.6m (29% of revenue), up by $4.6m from last quarter. Operating expenses for full-year 2012 were $254.4m (31% of revenue), up from $244.4m in 2011. The increases were due mainly to higher engineering expenses.

Full-year 2012 saw a net loss of $2.2m ($0.01 per diluted share), compared with net income of $87.3m ($0.51 per diluted share) for 2011. However, although down on $13.3m ($0.08 per diluted share) a year ago, net income for Q4 of $6.2m ($0.04 per diluted share, above guidance of $0.01-0.03) was up from $2.5m ($0.02 per diluted share) last quarter. During Q4, total cash and investments fell by $5.6m to $139m.

Outlook

For Q1/2013, TriQuint expects revenue to fall to $180-190m (although the firm is already 98% booked to the midpoint of this guidance). Gross margin should fall to 25-27% due to lower revenue and utilization. Operating expenses are expected to grow further, to $67-69m. Non-GAAP net loss should be $0.12-0.14 per share.

“I expect a slow start to the year due to seasonality and customer program timing, and our investments in capacity and R&D will remain a financial headwind during the first half of the year,” said president & CEO Ralph Quinsey.

“We are continuing to expand capacity specifically for high-performance filters in anticipation of strong demand in the second half of 2013 and beyond,” said Quinsey. “We are entering the new fiscal year with one of our healthiest new-product and design-win pipelines in place,” he added. “I believe these investments will lead to improved financial results to the company in the second half and position us well for 2014 and beyond in what remains an opportunity-rich marketplace.”

Considering the mobile technologies marketplace, Quinsey noted, “Our approach to the mobile market is three-fold: We offer a broad suite of RF capabilities to address the complete RF front end, including amplifiers, switches, filters. Secondly, we develop differentiated products that offer our customers improved size, cost and performance… we continue to invest in critical technology such as advanced BAW and SAW filters, wafer-level packaging, flip-chip interconnect, BiHEMT and highly integrated high-performance broadband amplifiers for our solutions,” he added. “Lastly, we are investing in capacity for long-term growth, but we’ll avoid filling up factories with undifferentiated products that tend to be low margin. Our duplexers and high-performance SAW filters have limited suppliers worldwide, and these products are currently the fastest-growing portion of the market. TriQuint’s ability to supply hard-to-find advanced filters is binding us closer to our customers.”

“Additionally, we are in production with our second generation of gallium nitride,” said Quinsey. “This updated technology has best-in-class reliability and has achieved manufacturing yields equivalent to GaAs while delivering top RF performance,” he added. “We remain closely involved in a portfolio of contracted R&D programs sponsored predominantly by AFRL (Air Force Research Lab) and the Office of Naval Research (ONR).” Contract awards and funding was up 16% in 2012, due mainly to the development and manufacturing of GaN technologies for future Department of Defense programs.

Scrap issue

Quinsey also drew attention to what he described as a potential scrap issue – “We are currently investigating a potential scrap issue related to the ramp up of new GaAs capacity. This issue impacts a small number of mobile customers, none of which are greater than 10% of revenue. We are dual sourced and have kept capacity to support demand while we work through this issue. We expect to have resolution in Q1, and we are alerting investors to a potential charge of roughly $5m that is not included in our guidance.”

Concluding his remarks, Quinsey said, “Low factory utilization remains the dominant financial headwind to TriQuint’s near-term performance. Seasonal swings are getting larger but I see a solid opportunity for profitable growth in coming quarters. More crowded spectrum is driving high demand for high-performance filters such as BAW. RF complexity is increasing. As discreet components give way to integrated modules, the list of competitors that are able to fully support this market is shrinking and the value proposition for those that remain if they have the right products, is improving.”