Cree has announced revenue of$306.8 million for its fourth quarter of fiscal 2012,ended June 24,2012.This represents a 26%increase compared to revenue of$243.0 million reported for the fourth quarter of fiscal 2011 and an 8%increase compared to the third quarter of fiscal 2012.

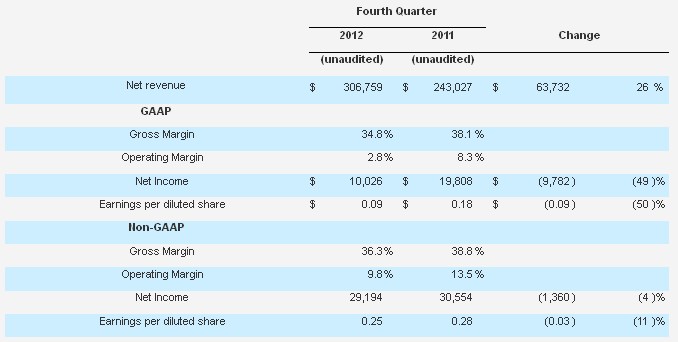

GAAP net income for the fourth quarter was$10.0 million,or$0.09 per diluted share,a decrease of 49%year-over-year compared to GAAP net income of$19.8 million,or$0.18 per diluted share,for the fourth quarter of fiscal 2011.On a non-GAAP basis,net income for the fourth quarter of fiscal 2012 was$29.2 million,or 0.25 per diluted share,a decrease of 4%year-over-year compared to non-GAAP net income for the fourth quarter of fiscal 2011 of$30.6 million,or$0.28 per diluted share.

For fiscal year 2012,Cree reported revenue of$1.16 billion,which represents an 18%increase compared to revenue of$988 million for fiscal 2011.GAAP net income was$44 million,or$0.39 per diluted share,a decrease of 70%compared to$147 million,or$1.33 per diluted share for fiscal 2011.On a non-GAAP basis,net income for fiscal year 2012 was$109 million,or$0.95 per diluted share,a decrease of 42%compared to$187 million,or$1.70 per diluted share,for fiscal 2011.Cree generated$242 million of operating cash flow and$130 million of free cash flow(cash flow from operations less capital expenditures)during fiscal 2012.

"We finished the year strong in our fiscal fourth quarter with record revenue and non-GAAP earnings per share on the high end of our target range,"stated Chuck Swoboda,Cree Chairman and CEO."Overall,LED lighting adoption continues to increase and we remain focused on being the leader in innovation to grow our business by enabling our customers to realize the tremendous benefits of LED technology.While we are encouraged by our progress,the macroeconomic environment is impacting our growth outlook in the near term."

Q4 2012 Financial Metrics

(in thousands except per share amounts and percentages)

•Gross margin decreased 10 basis points from Q3 of fiscal 2012 to 34.8%on a GAAP basis and increased 70 basis points to 36.3%on a non-GAAP basis.

•Cash and investments increased$34 million from Q3 of fiscal 2012 to$745 million.

•Accounts receivable(net)decreased$16 million from Q3 of fiscal 2012 to$152 million,with days sales outstanding of 45.

•Inventory decreased$8 million from Q3 of fiscal 2012 to$189 million and represents 85 days of inventory.

Recent Business Highlights

•Released our new CS Series LED linear luminaire to deliver fast payback to low bay lighting applications;

•Introduced the XLamp®XP-G2 LED to deliver luminaire manufacturers up to 20 percent more lumens per watt and 2.5 times the lumens-per-dollar over the original XP-G LED;

•Expanded our CR Series LED downlights,offering high performance and low prices for mainstream residential and commercial lighting applications;

•Raised the industry standard with a new 170 lumen-per-watt prototype LED light bulb which leverages breakthrough innovations to optimize performance,lower cost and drive LED lighting adoption;

•Enabled the largest municipal street lighting project in China,as the Beibei district of Chongqing recently completed the installation of 20,000 street lights featuring 1.9 million Cree LEDs;

•Settled our patent infringement litigation with SemiLEDs.As part of the settlement,SemiLEDs agreed to the entry of an injunction effective October 1,2012 that prohibits the importation and sale of the SemiLEDs accused products in the United States and has made a one-time payment to us for past damages.

Business Outlook:

For its first quarter of fiscal 2013 ending September 23,2012,Cree targets revenue in a range of$305 million to$325 million with GAAP gross margin targeted to be 36%+/-and non-GAAP gross margin targeted to be 37%+/-.GAAP gross margin targets include stock-based compensation expense of approximately$2.1 million,while non-GAAP targets do not.Operating expenses are targeted to increase by approximately$2 million on a GAAP basis and approximately$1 million on a non-GAAP basis.The tax rate is targeted at 19.0%for fiscal Q1.GAAP net income is targeted at$10 million to$16 million,or$0.09 to$0.14 per diluted share.Non-GAAP net income is targeted in a range of$27 million to$33 million,or$0.23 to$0.28 per diluted share.The GAAP and non-GAAP net income targets are based on an estimated 116.0 million diluted weighted average shares.Targeted non-GAAP earnings exclude expenses related to the amortization of acquired intangibles and stock-based compensation expense of$0.14 per diluted share.

Source:

http://www.ledinside.com/news/2012/8/cree_financial_results_q4_20120808