For its fiscal first-quarter 2015 (ended 27 September 2014), JDSU of Milpitas, CA, USA has reported revenue of $433.6m (exceeding the high end of the $405-425m guidance range). This is down 3.3% on $448.6m last quarter but up 1.1% on $429m a year ago (or up 8.7%, excluding about $30m of 3D sensing and last-time-buy revenue a year ago).

The Americas ($193.9m), Asia-Pacific ($134.7m) and EMEA ($105m) represented 44.7%, 31.1% and 24.2%, respectively, of total revenue, compared with 48.3%, 29.3% and 22.4% last quarter.

By application sector, revenue for Network Enablement (NE) was $132.8m (30.6% of total revenue), down 19.8% on $165.5m last quarter and 8.5% on $145.1m a year ago. Revenue for Service Enablement (SE) was $48.2m (11.1% of total revenue), up 10.6% on $43.6m last quarter and 79.9% on $26.8m a year ago. Revenue for Optical Security and Performance Products (OSP) was $43.3m (10% of total revenue), down 17.5% on $52.5m a year ago (reflecting the exit of the lower-margin businesses, which contributed about $6m a year ago) but up 1.6% on $42.6m (9.5% of total revenue) last quarter (reflecting growth in anti-counterfeiting business and a slight increase in government business).

Revenue for Communications and Commercial Optical Products (CCOP) was $209.3m (48.3% of total revenue), up 6.3% on $196.9m (43.9% of total revenue) last quarter and 2.3% on $204.6m a year ago (and near the top of the $200-210m guidance range).

Of this, CCOP’s Commercial Laser revenue rose to its second consecutive record of $42.2m, up 3.7% on $40.7m last quarter and 48.6% on $28.4m a year ago. Growth was driven by fiber-laser revenue rising by 12.7% from $11m last quarter to $12.4m as partner Ramada continues to ramp use of the Gen2 kilowatt fiber laser for industrial cutting applications.

CCOP’s Optical Communications revenue was $167.1m, up 7% on $156.2m last quarter but down 5.2% on $176.2m a year ago, reflecting lower 3D sensing revenue (down by more than $4m sequentially to about $22m) partially offset by higher revenues for Telecoms and Datacoms. In particular, in Telecoms, 40G and 100G modulator revenue grew 29% sequentially. Datacom revenue grew 2.4% year-on-year and 14.8% sequentially (with 40G and 100G transmission growing from 41% of overall transmission revenue last quarter to 48%). Sales mix was 75% Telecom, 18% Datacom and 7% consumer and other (compared with 66%, 17% and 17%, respectively, a year ago).

The quarter-on-quarter decline in the average selling price (ASP) for Optical Communications components was 3.8%, higher than typical first quarters. However, JDSU continues to expect that the decline in ASP through fiscal-year 2015 will be consistent with its recent range of 10-14%.

On a non-GAAP basis, gross margin of 49%, down from 50% last quarter but up from 46.3% a year ago, reflecting continued operational discipline, favorable product mix from SE, strength in Commercial Lasers, and OSP’s last-time-buy product exits last year.

In particular, CCOP gross margin was 32.5%, down from 33.3% last quarter but up from 32% a year ago. This was due mainly to higher product mix of Commercial Lasers (for which gross margin rose from 47.5% a year ago and last quarter’s record of 49.9% to a new record of 50.7%). In contrast, Optical Communications gross margin has fallen from 29.5% a year ago and 28.9% last quarter to 27.9%, due mainly to lower fab absorption from the decline in 3D sensing revenue.

Although up from $163.1m a year ago, operating expenses have been cut from $185.1m last quarter to $173m, with R&D expenses falling from $76.1m to $72.6m and selling, general & administrative (SG&A) expenses falling from $109m to $100.4m, driven by benefits from restructuring activities initiated in fiscal 2014. Operating margin has hence risen from 8.3% a year ago and 8.7% last quarter to 9.1% (exceeded guidance of 6-8%).

Net income was $33.8m ($0.14 per share), down from $34.2m ($0.14 per share) last quarter but up from $30.2m ($0.13 per share) a year ago (significantly exceeding guidance).

“JDSU’s strategy to diversify in non-telecom markets drove a solid first quarter as we exceeded revenue and EPS guidance and saw sequential growth in solutions for the enterprise and commercial lasers markets,” says president & CEO Tom Waechter. “Enterprise market performance included growth in Datacom and Service Enablement, which generated an operating profit ahead of schedule,” he adds. “We are pleased with the performance of these growth drivers for CCOP, NE, and SE, and remain on track for the planned separation of SpinCo (CCOP) and NewCo (NE/SE/OSP) by calendar third quarter 2015.”

Cash flow generated from operations was $40.8m, down from $50.2m last quarter but continuing JDSU’s eight straight years of positive cash flow. Nevertheless, total cash and investments fell slightly during the quarter from $881.3m to $880.9m.

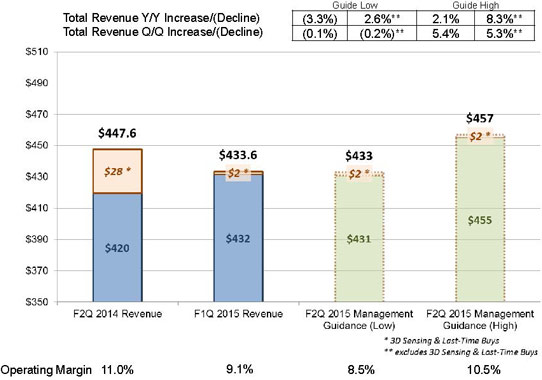

Graphic: JDSU’s guidance for the December quarter.

For fiscal second-quarter 2015 (ending 27 December 2014), JDSU expects revenue of $433-457m (up 5.6% year-on-year in core business). Operating margin should be 8.5-10.5% and earnings per share $0.12-0.18. In particular, JDSU expects CCOP revenue of $200-210m (up 3.5% on $198m the prior year), driven by Commercial Lasers, telecom and datacom revenues and offsetting about $15m lower 3D sensing revenue. CCOP operating margin should be low (at 10.5-12.5%), reflecting lower Commercial Laser revenue along with continued growth in R&D.

JDSU’s quarterly operating model targets include CCOP revenue of over $210m, gross margin of 33-35%, and operating margin of 12-14%.

On 10 September, JDSU announced plans to separate into two publicly traded companies (to be named at a later date): an optical components and commercial lasers company (‘SpinCo’) consisting of JDSU’s Communications and Commercial Optical Products (CCOP) segment, and a network and service enablement company (‘NewCo’) consisting of JDSU’s Network Enablement (NE), Service Enablement (SE) and Optical Security and Performance Products (OSP) segments. The separation is expected to occur through a tax-free pro rata spinoff of CCOP to JDSU shareholders, although the structure is subject to change based on various tax and regulatory factors. JDSU expects the separation to be completed by calendar third-quarter 2015.