- Cash flow reflects durability of the integrated portfolio amid continued industry volatility

- Strong Chemical results highlight sustainable competitive advantages

- Advancing attractive new investment opportunities across the value chain

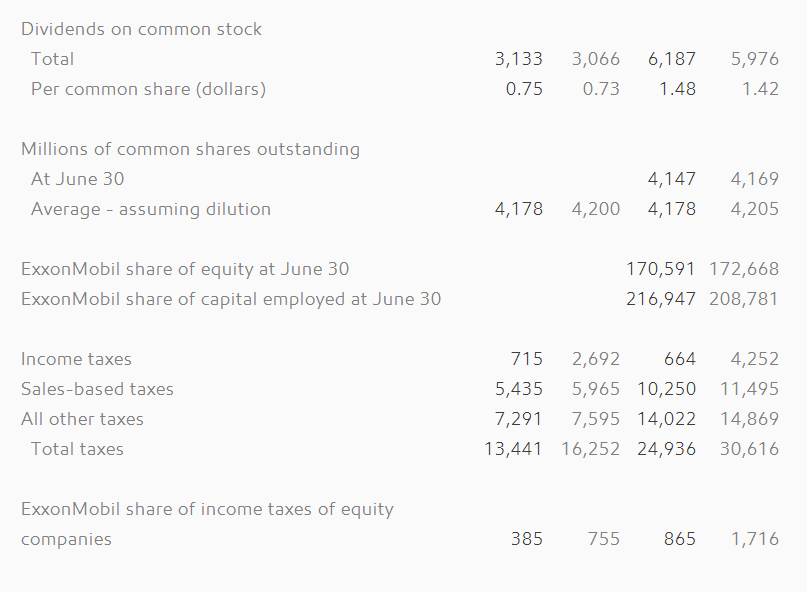

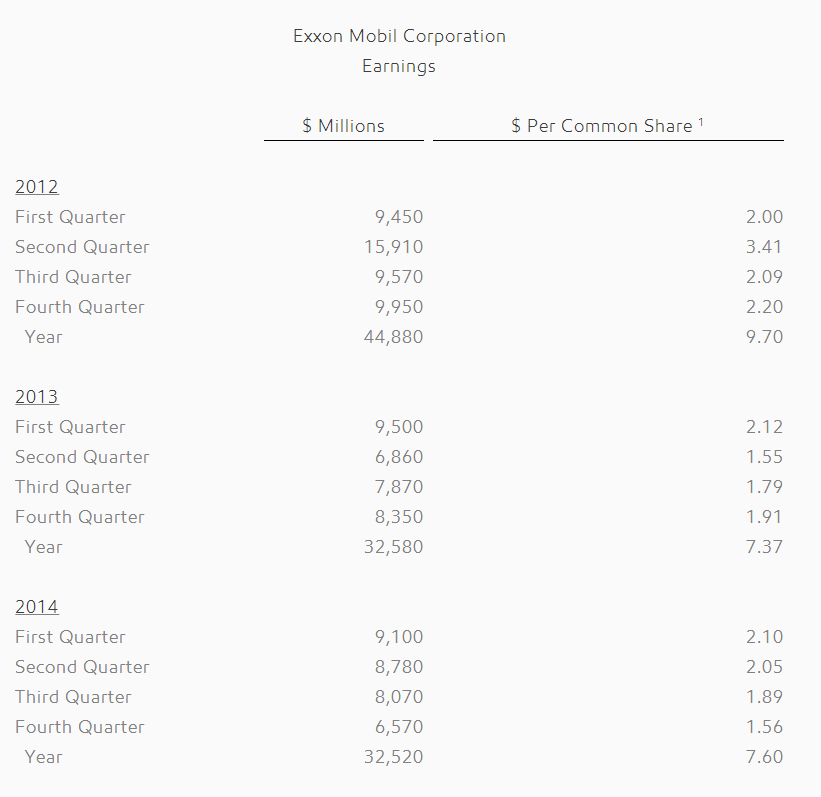

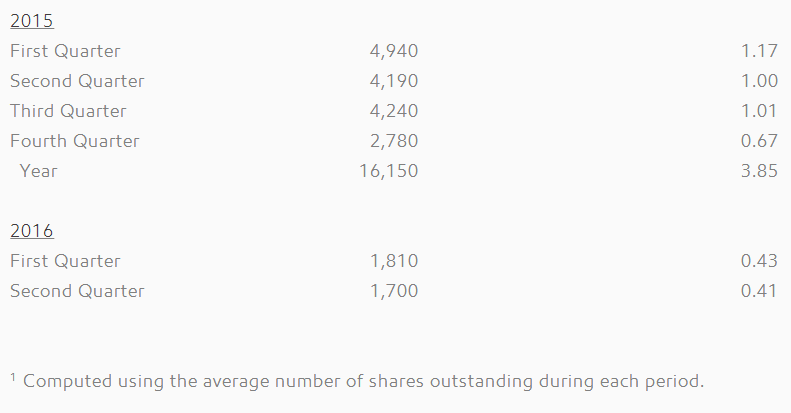

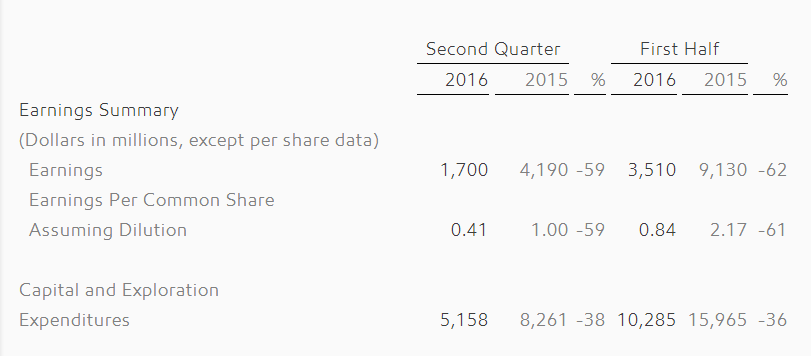

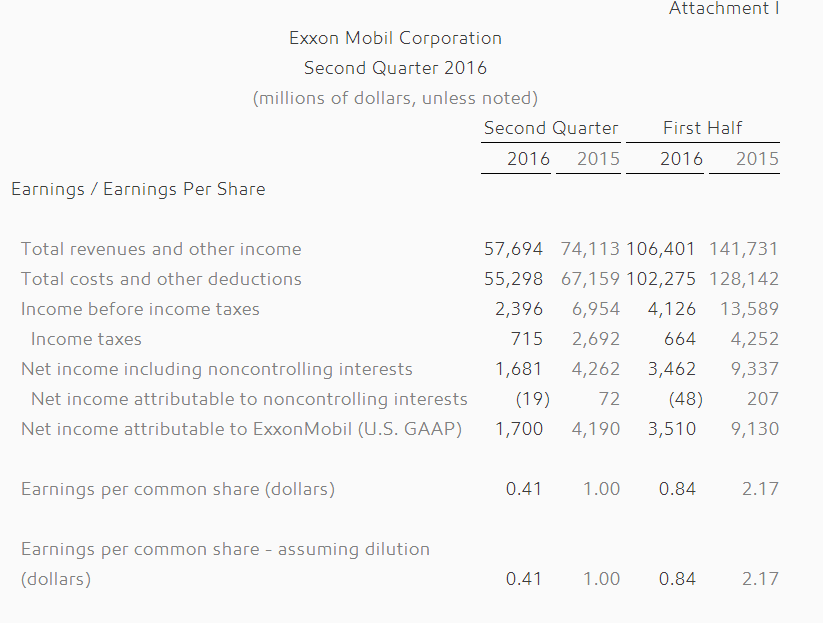

Exxon Mobil Corporation (NYSE: XOM) announced estimated second quarter 2016 earnings of $1.7 billion, or $0.41 per diluted share, compared with $4.2 billion a year earlier. The results reflect sharply lower commodity prices, weaker refining margins and continued strength in the Chemical segment.

“While our financial results reflect a volatile industry environment, ExxonMobil remains focused on business fundamentals, cost discipline and advancing selective new investments across the value chain to extend our competitive advantage,” said Rex W. Tillerson, chairman and chief executive officer. “The corporation benefits from scale and integration, which provide the financial flexibility to invest in attractive opportunities and grow long-term shareholder value.”

During the second quarter, Upstream earnings were $294 million. Production volumes were essentially unchanged at 4 million oil-equivalent barrels per day. Liquids production growth from recent start-ups more than offset the impact of field decline and downtime events, notably in Canada and Nigeria.

Chemical earnings remained strong at $1.2 billion, reflecting continued benefits from gas and liquids cracking as well as growing product demand. The Downstream segment earned $825 million despite significantly lower global refining margins versus the prior year quarter.

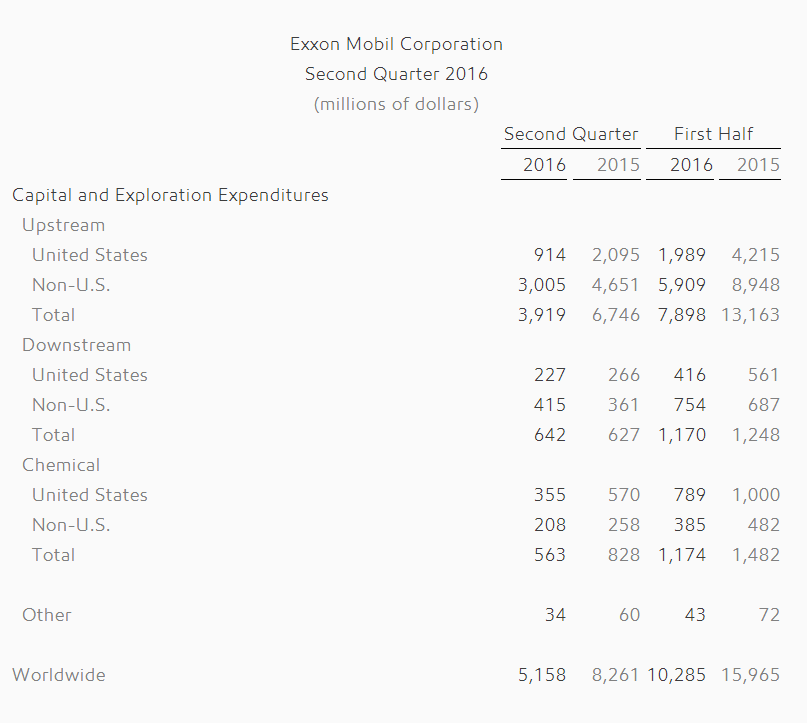

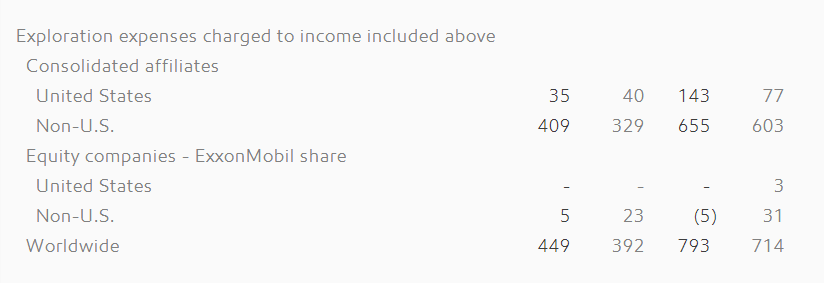

Capital and exploration expenses were reduced by 38 percent to $5.2 billion.

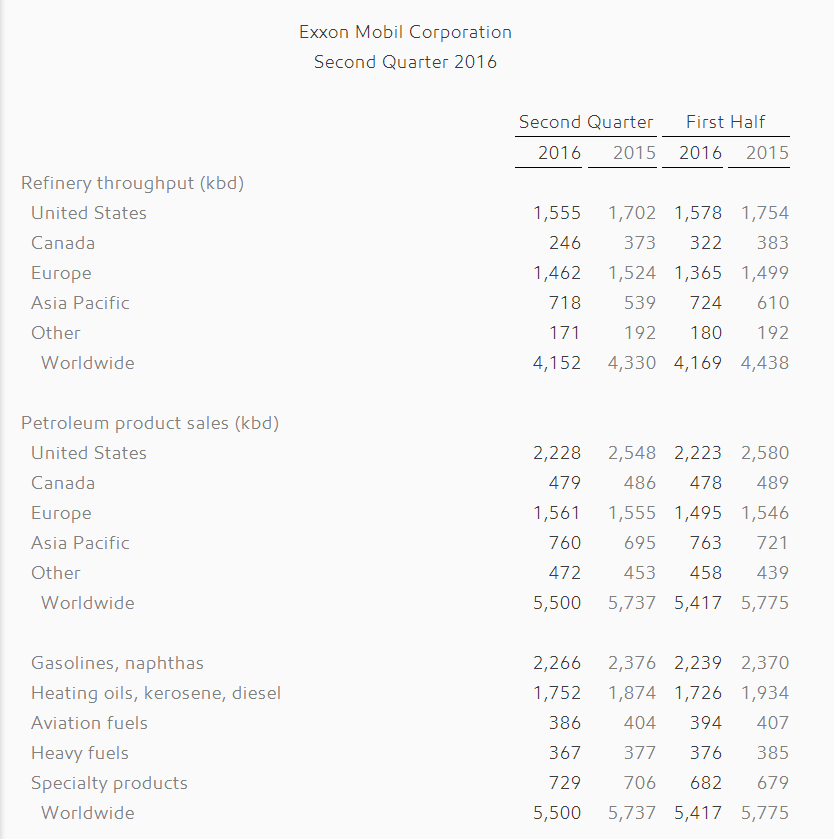

During the quarter, the corporation distributed $3.1 billion in dividends to shareholders.

Second Quarter Highlights

- Earnings of $1.7 billion decreased $2.5 billion, or 59 percent, from the second quarter of 2015.

- Earnings per share assuming dilution were $0.41.

- Cash flow from operations and asset sales was $5.5 billion, including proceeds associated with asset sales of $1 billion.

- Capital and exploration expenditures were $5.2 billion, down 38 percent from the second quarter of 2015.

- Oil-equivalent production was essentially unchanged at 4 million oil-equivalent barrels per day, with liquids up 1.7 percent and natural gas down 3.6 percent.

- The corporation distributed $3.1 billion in dividends to shareholders.

- Dividends per share of $0.75 increased 2.7 percent compared with the second quarter of 2015.

- ExxonMobil announced that drilling results from Liza-2, the second well in the Stabroek block offshore Guyana, confirmed a world-class discovery with a recoverable resource between 800 million and 1.4 billion oil-equivalent barrels.

- Production at the Julia Oil Field in the Gulf of Mexico started ahead of schedule with project costs under budget. The initial development phase, with a gross design capacity of 34,000 barrels of oil per day, uses capital-efficient subsea tie-backs to existing infrastructure and is located 265 miles southwest of New Orleans in water depths of more than 7,000 feet.

- The company started production at Point Thomson, the first company-operated project on Alaska’s North Slope. At full rate production, the facility is designed to produce up to 10,000 barrels of natural gas condensate per day and 200 million cubic feet of recycled gas. The recycled gas is re-injected for future recovery.

- The Taicang, China, lubricants plant expansion was completed in April, doubling the capacity of the facility. The expansion includes the addition of automated blending technology and a new state-of-the-art quality assurance laboratory. It improves the company’s ability to supply premium lubricant products to meet long-term demand growth in China.

- ExxonMobil is expanding its comprehensive slate of polyethylene products with the introduction of Exceed XP performance polymers. Developed through advanced catalyst technology, process research, and applications expertise, Exceed XP is designed to provide extreme performance in a variety of film applications.

Second Quarter 2016 vs. Second Quarter 2015

Upstream earnings were $294 million in the second quarter of 2016, down $1.7 billion from the second quarter of 2015. Lower liquids and gas realizations decreased earnings by $2.2 billion, while volume and mix effects increased earnings by $50 million. All other items, including lower expenses, the absence of a one-time deferred income tax impact related to the tax rate increase in Alberta, Canada, and favorable foreign exchange effects increased earnings by $450 million.

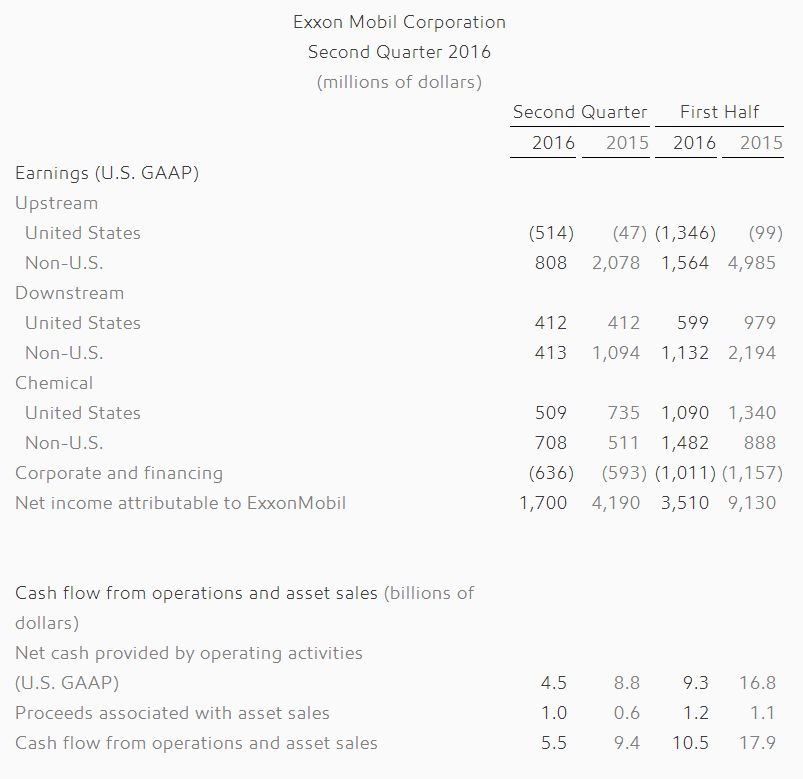

On an oil-equivalent basis, production was essentially flat with the second quarter of 2015. Liquids production totaled 2.3 million barrels per day, up 39,000 barrels per day. Project ramp-up was partly offset by field decline and downtime mainly resulting from the Canadian wildfires. Natural gas production was 9.8 billion cubic feet per day, down 366 million cubic feet per day from 2015 including field decline and divestment impacts.

U.S. Upstream earnings declined $467 million from the second quarter of 2015 to a loss of $514 million in the second quarter of 2016. Non-U.S. Upstream earnings were $808 million, down $1.3 billion from the prior year.

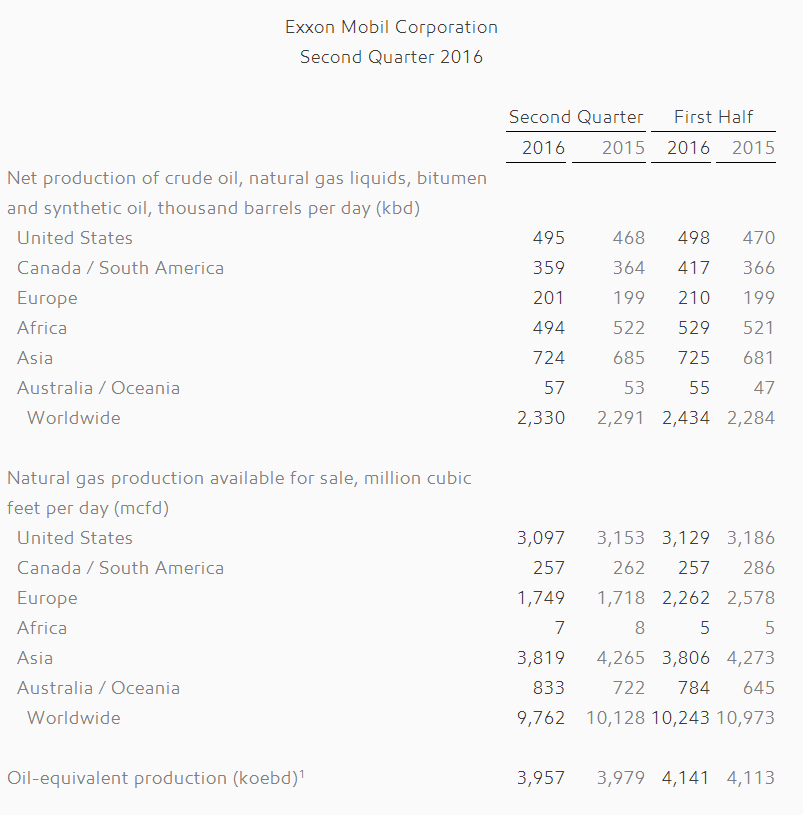

Downstream earnings were $825 million, down $681 million from the second quarter of 2015. Weaker refining margins decreased earnings by $850 million while favorable volume and mix effects increased earnings by $130 million. All other items increased earnings by $40 million, including lower maintenance expenses partly offset by unfavorable foreign exchange effects. Petroleum product sales of 5.5 million barrels per day were 237,000 barrels per day lower than the prior year due in part to asset management activity.

Earnings from the U.S. Downstream were $412 million, flat with the second quarter of 2015. Non-U.S. Downstream earnings of $413 million were $681 million lower than last year.

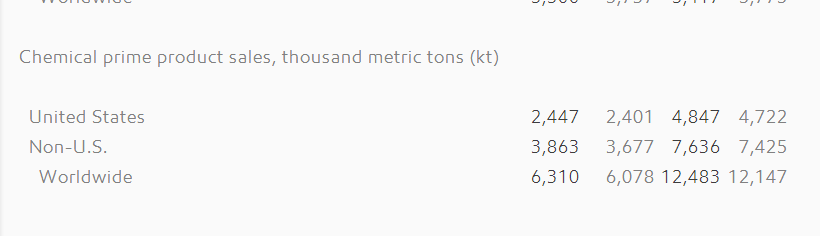

Chemical earnings of $1.2 billion were $29 million lower than the second quarter of 2015. Margins increased earnings by $150 million. Volume and mix effects increased earnings by $70 million. All other items decreased earnings by $250 million, due to the absence of asset management gains in the U.S. partly offset by lower expenses. Second quarter prime product sales of 6.3 million metric tons were 232,000 metric tons higher than the prior year's second quarter.

U.S. Chemical earnings were $509 million, down $226 million from the second quarter of 2015 reflecting the absence of asset management gains. Non-U.S. Chemical earnings of $708 million were $197 million higher than last year.

Corporate and financing expenses were $636 million for the second quarter of 2016, compared to $593 million in the second quarter of 2015.

First Half 2016 Highlights

- Earnings of $3.5 billion decreased 62 percent from $9.1 billion in 2015.

- Earnings per share assuming dilution were $0.84.

- Cash flow from operations and asset sales was $10.5 billion, including proceeds associated with asset sales of $1.2 billion.

- Capital and exploration expenditures were $10.3 billion, down 36 percent from 2015.

- Oil-equivalent production was unchanged at 4.1 million oil-equivalent barrels per day, with liquids up 6.6 percent and natural gas down 6.7 percent.

- The corporation distributed $6.2 billion in dividends to shareholders.

First Half 2016 vs. First Half 2015

Upstream earnings were $218 million, down $4.7 billion from the first half of 2015. Lower realizations decreased earnings by $4.9 billion. Favorable volume and mix effects increased earnings by $20 million. All other items increased earnings by $180 million, primarily due to lower expenses partly offset by the absence of asset management gains.

On an oil-equivalent basis, production of 4.1 million barrels per day was flat compared to the same period in 2015. Liquids production of 2.4 million barrels per day increased 150,000 barrels per day, with project ramp-up partly offset by field decline and downtime mainly from the Canadian wildfires. Natural gas production of 10.2 billion cubic feet per day decreased 730 million cubic feet per day from 2015 largely due to regulatory restrictions in the Netherlands, field decline and divestment impacts.

U.S. Upstream earnings declined $1.2 billion from 2015 to a loss of $1.3 billion in 2016. Earnings outside the U.S. were $1.6 billion, down $3.4 billion from the prior year.

Downstream earnings of $1.7 billion decreased $1.4 billion from 2015. Weaker refining margins decreased earnings by $1.7 billion, while volume and mix effects increased earnings by $150 million. All other items increased earnings by $130 million, mainly reflecting lower maintenance expense. Petroleum product sales of 5.4 million barrels per day were 358,000 barrels per day lower than 2015 due in part to asset management activity.

U.S. Downstream earnings were $599 million, a decrease of $380 million from 2015. Non-U.S. Downstream earnings were $1.1 billion, down $1.1 billion from the prior year.

Chemical earnings of $2.6 billion increased $344 million from 2015. Stronger margins increased earnings by $380 million. Favorable volume and mix effects increased earnings by $170 million. All other items decreased earnings by $210 million, including the absence of asset management gains in the U.S. partly offset by lower expenses. Prime product sales of 12.5 million metric tons were up 336,000 metric tons from 2015.

U.S. Chemical earnings were $1.1 billion, down $250 million from the first half 2015 reflecting the absence of asset management gains. Non-U.S. Chemical earnings of $1.5 billion were $594 million higher than last year.

Corporate and financing expenses were $1 billion in 2016 compared to $1.2 billion in 2015, with the decrease due mainly to net favorable tax-related items.

During the first half of 2016, Exxon Mobil Corporation purchased 9 million shares of its common stock for the treasury at a gross cost of $727 million. These shares were acquired to offset dilution in conjunction with the company’s benefit plans and programs. The corporation will continue to acquire shares to offset dilution in conjunction with its benefit plans and programs, but does not currently plan on making purchases to reduce shares outstanding.

ExxonMobil will discuss financial and operating results and other matters during a webcast at 8:30 a.m. Central Time on July 29, 2016. To listen to the event or access an archived replay, please visit www.exxonmobil.com .

Cautionary Statement

Statements relating to future plans, projections, events or conditions are forward-looking statements. Actual financial and operating results, including project plans, costs, timing, and capacities; capital and exploration expenditures; resource recoveries; and share purchase levels, could differ materially due to factors including: changes in oil or gas prices or other market or economic conditions affecting the oil and gas industry, including the scope and duration of economic recessions; the outcome of exploration and development efforts; changes in law or government regulation, including tax and environmental requirements; the impact of fiscal and commercial terms; changes in technical or operating conditions; and other factors discussed under the heading "Factors Affecting Future Results" in the “Investors” section of our website and in Item 1A of ExxonMobil's 2015 Form 10-K. We assume no duty to update these statements as of any future date.

Frequently Used Terms

This press release includes cash flow from operations and asset sales, which is a non-GAAP financial measure. Because of the regular nature of our asset management and divestment program, we believe it is useful for investors to consider proceeds associated with the sales of subsidiaries, property, plant and equipment, and sales and returns of investments together with cash provided by operating activities when evaluating cash available for investment in the business and financing activities. A reconciliation to net cash provided by operating activities is shown in Attachment II. References to quantities of oil or natural gas may include amounts that we believe will ultimately be produced, but that are not yet classified as “proved reserves” under SEC definitions. Further information on ExxonMobil's frequently used financial and operating measures and other terms including “prime product sales” is contained under the heading "Frequently Used Terms" available through the “Investors” section of our website at exxonmobil.com.

Reference to Earnings

References to corporate earnings mean net income attributable to ExxonMobil (U.S. GAAP) from the consolidated income statement. Unless otherwise indicated, references to earnings, Upstream, Downstream, Chemical and Corporate and Financing segment earnings, and earnings per share are ExxonMobil's share after excluding amounts attributable to noncontrolling interests.

The term “project” as used in this release can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports. Exceed XP is a registered trademark of Exxon Mobil Corporation.

Exxon Mobil Corporation has numerous affiliates, many with names that include ExxonMobil, Exxon, Mobil, Esso, and XTO. For convenience and simplicity, those terms and terms such as Corporation, company, our, we, and its are sometimes used as abbreviated references to specific affiliates or affiliate groups. Similarly, ExxonMobil has business relationships with thousands of customers, suppliers, governments, and others. For convenience and simplicity, words such as venture, joint venture, partnership, co-venturer, and partner are used to indicate business and other relationships involving common activities and interests, and those words may not indicate precise legal relationships.

Estimated Key Financial and Operating Data

Other Financial Data