The scale of the Chinese LED package market grew 19% year on year to US$8.6 billion in 2014, according to the 2015 Chinese LED Industry Market Report by LEDinside, a division of TrendForce. The growth of the Chinese LED package market will slow down in the next few years as LED prices continue to fall. Its market scale is forecasted to grow at a five-year CAGR of 9% from 2014 to 2019, when it will reach US$13 billion. The general lighting sector will be the main growth sector, whereas LED display and LED backlight sector will post slower growth and even decline in some periods.

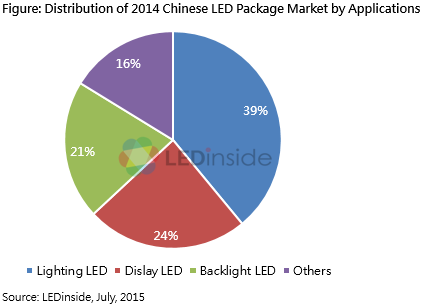

According to LEDinside's analyst Allen Yu, LED package for lighting application represented 39% of the Chinese LED package market in 2014. The market scale of LED package for lighting application in China also reached US$3.3 billion that year. The lighting market has become the largest LED application in the country. “The increasing LED lighting penetration in industrial and commercial lighting applications has helped the rapid growth in lighting LED products,” said Yu. LEDinside expects strong growth in the lighting LED market to continue as LED lighting products penetrates the residential lighting application market.

Based on LEDinside’s report, the top five domestic LED package companies in the 2014 Chinese general lighting sector were (in order) MLS, Honglitronic, Changfang, NationStar and Refond. Furthermore, the 10 companies listed in the ranking below accounted for only 24% of the market share, indicating low market concentration in China’s general lighting sector.

Yu added: “The main factors behind this relatively fragmented market situation are low market entry barrier and varied qualities of downstream products. However industry consolidation gradually will pick up its pace as technologies matures and the LED general lighting sector enters a period of capital and scale competition. The dominant companies will therefore become stronger while smaller companies drop out.”

China is currently the main global manufacturing base of LED lighting products, and OEMs/ODMs of brand vendors such as Philips Lighting, Osram Licht AG and IKEA are setting up factories there. The development surge in the LED lighting industry is driving the ongoing expansion of the Chinese market demand. Therefore, leading LED package manufacturers, such as Japan’s Nichia and Taiwan’s Everlight, are also proactively developing the country’s general lighting application market.

Consequently, the Chinese government has given strong support to the domestic LED industry. For the LED chip manufacturing in the upstream, the state has provided various subsidies. In the downstream market, major Chinese cities are driving the LED replacement demand and launching demonstration projects. In sum, state support in the upstream manufacturing and the increasing penetration of LED products in the downstream markets fuel the development of the Chinese LED package industry. Led by MLS and Honlitronic, China’s domestic LED package companies are experiencing a rapid rise and will continue to enlarge the scale of their enterprise as well as establishing a strong market position.