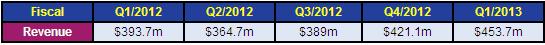

Analog semiconductor maker Skyworks Solutions Inc of Woburn, MA, USA, has reported improved results for fiscal first-quarter 2013 (ending 28 December 2012). Revenue was $453.7m, up nearly 8% on last quarter’s $421.1m and 15% on $393.7m a year ago (and exceeding the company’s own forecast of $450m).

On a non-GAAP basis, operating income was $114.8m, up from $103.6m last quarter. This yielded operating margin of 25.3%, up from 24.6%. Net income was $106.6m ($0.55 per diluted share, $0.01 better than guidance), up from $103.5m ($0.53 per diluted share). Operating cash flow has almost tripled from $50m to $148m. Capital expenditure has been cut from $31m last quarter (with depreciation of $17m) to $26.4m (with depreciation of $18.5m). Skyworks also invested $42m to repurchase 1.9 million shares of its common stock. Overall, during the quarter, cash and cash equivalents has grown from $307m to $378m.

“We are enabling anytime, anywhere communications across a diverse set of end-markets and applications,” commented president & CEO David J. Aldrich. “Skyworks is capitalizing on growing consumer and enterprise demand for ubiquitous connectivity spanning all modes of wireline and wireless communications,” he added.

“Our analog semiconductor solutions are increasingly at the heart of everything from smart phones to smart appliances to home security systems to satellites to medical sensors to hybrid vehicles,” noted Aldrich. “This market diversity - coupled with Skyworks’ leadership scale, product breadth and system IP - is setting the stage for continued market outperformance and shareholder value creation.”

Business highlights cited by the company included: developing high-voltage protection circuits for Boston Scientific heart defibrillators; introducing a 16-channel LED TV backlighting controller at LG and others; starting volume production of radiation-tolerant optocouplers supporting new Iridium satellites; capturing connectivity sockets within the Google Chrome notebook series; enabling the ‘world’s smallest’ 4G LTE data-card with a range of antenna switch modules; and launching camera flash drivers across Samsung’s Galaxy platforms.

Looking ahead to the fiscal second quarter, Donald W. Palette, VP & chief financial officer, commented, “Given [our] order visibility and specific product launches, we expect to continue to gain market share and capture additional content per platform in the seasonally-low March quarter. “Specifically, for Q2/2013, we anticipate revenue to be up 15% year-on-year with better-than-normal seasonality to approximately $420m, with non-GAAP diluted earnings per share of $0.47.”

Extended comments

“One of the overriding themes at this year's Consumer Electronics Show was the Internet of Things, which is comprised of sensors and embedded connectivity deployed across a seemingly endless range of devices that touch our everyday lives,” said Aldrich during the fiscal Q1 conference call for analysts. “We see this trend driving a proliferation of access points from conventional mobile devices, like smart phones, like tablets, to nontraditional devices like home appliances, medical devices, gaming consoles, industrial machinery, home entertainment systems, Smart Energy and security systems, just to name a few,” he added.

“Most network devices span a variety of communications protocols, including some mix of cellular, Wi-Fi, Zigbee, peer-to-peer, Bluetooth, and NFC on both licensed and unlicensed spectrum and across multiple operating frequencies. The design challenges within this environment require competencies across mixed-signal, analog and RF, including signal transmission and conditioning, power management, filtering and tuning,” Aldrich continued.

“At Skyworks, we are the experts in RF and analog system design, we're leveraging a global force of systems and applications engineers; secondly, we offer an unmatched technology portfolio that includes deep expertise in silicon on insulator or SOI, CMOS, gallium arsenide, BiFET, silicon germanium; and thirdly, we have the leading capability in advanced multichip module integration; and finally, we are the low-cost producer,” noted Aldrich.

“So, in closing, we’re quite optimistic about our prospects for the remainder of 2013 and beyond. Trends in the broader analog market are moving in our favor and our strategy of continuing to diversify and expand into new verticals, while maintaining a laser focus on operational execution is clearly working.”