As of Aug. 21, 2015, 14 Chinese manufacturers have released their financial results for the first half of 2015. Some have become more profitable, while others have continued to incur heavy losses. LEDinside takes a closer look into these companies financial performance.

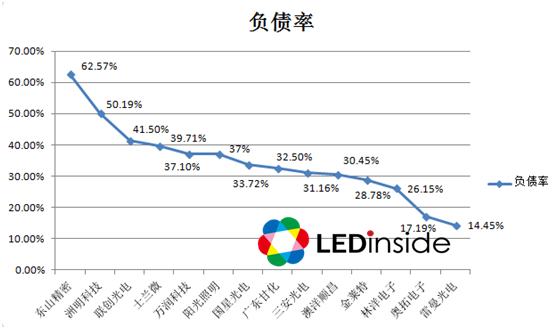

Most manufacturers debt ratio fall between 25% to 40%

Of the 14 manufacturers surveyed, 10 companies debt ratio fell in the 25% to 40% range. However, it could be noted that Silan Microelectronics and Yankong Lighting’s debt ratio increased, while Kennede Electronics (Kennede) and Linyang Electronics debt asset ratio was in the lower range.

However, there were a couple of exceptions. Suzhou Dongshan Precision Manufacturing (Dongshan Precision), reported the highest debt ratio of 62.57% during first half of 2015. Despite revenues and net profits climbing up to 27.43% and 143.51% respectively, the company debt continued to pile up. Other manufacturers in a similar situation included Unilumin and Lianchuang Optoelectronic Science and Technology (Lianchuang), which respectively respectively reported debt ratios exceeding 50% and 40%.

In comparison, Aoto Electronics and LEDman had the lowest debt ratio of 17.19% and 14.45% respectively.

A company’s debt ratio should not be too high or too low, and tends to vary across industries. However, manufacturers might be able to restore their debt ratio through their capital operations.

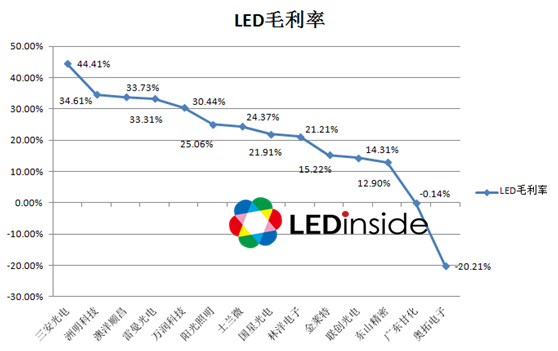

Huge differences in LED display gross margin, Auckson Opto delivers lowest performance

In general, LED lighting applications had the highest gross margins during the first half of 2015, and there were minor differences in gross margins. However, disparities in gross margins became evident in LED display market, where gross margin differences reached about 14% between the most profitable and least profitable companies. Unilumin gross margin reached 34.61%, but Auckson Opto’s gross margin was a mere 20.21%.

In the upstream LED chip market, San’an Opto claimed top spot with its LED gross margin of 44.41% for the first half of the year, up 7.30% compared to 2014.

Additionally, Guangdong Wuchuan Hongtai Sugarcane Chemical Equipment, which has a LED subsidiary, saw its gross margin fall to a mere 0.14%, while Dongshan Precision, Kennede, and Lianchuang’s gross margin was also in the lower point of 12.90%, 15.22% and 14.31% respectively.

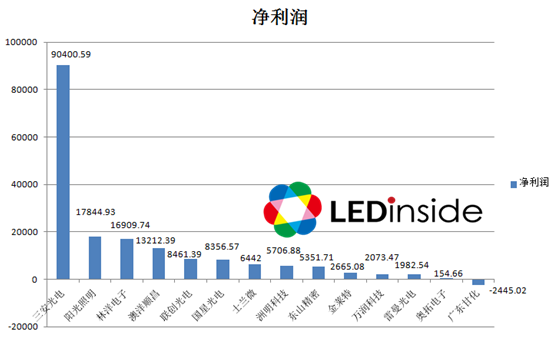

San’an Opto reports highest net profits for first half of 2015

In 2015, the 14 LED manufacturers combined net profits reached RMB 1.77 billion (US $28 million). San’an Opto took top spot with a net profit of RMB 904 million. The company had the highest net profit across industries, while LED package companies had a slightly lower profit. Auckson Opto, Yankon Lighting, and Linyang Electronics net profits even reached above RMB 100 million, while the three companies net profits were separately RMB 132 million, RMB 178 million and RMB 169 million.

Due to more restructures in the industry, LED display demands declined. Auckson Opto’s net profits for the first half of 2015 dropped lower than RMB 10 million to a mediocre RMB 1.55 million.

Worth noting Hongtai Sugarcane Chemical Equipment profits have continued to slide in 2015. Its profits reached RMB 6.21 million in 2014, but its accumulated losses for first half of 2015 reached RMB 24.45 million. The company’s performance was affected by its LED subsidiary Dali Power, which has been unable to reach economics of scale.