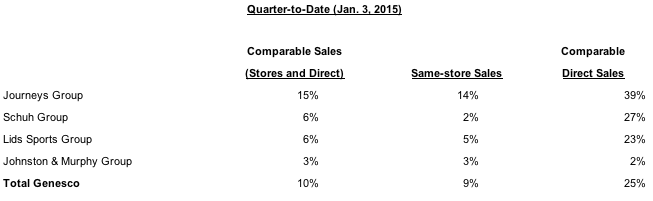

Genesco Inc. announced that comparable sales, including both stores and direct sales, increased 10 percent for the quarter-to-date period ended Jan. 3, from the equivalent period last year. Same store sales increased 9 percent and sales for the company's e-commerce and catalog direct sales businesses increased 25 percent on a comparable basis for the period.

Comparable sales changes for each retail segment and the total company for the period were as follows:

Robert J. Dennis, chairman, president and chief executive officer of Genesco, said, "While we are pleased with the strong overall comparable sales trend through the Holiday season, which has continued into January, due to lower gross margin, lower than expected non-comparable sales, and exchange rate pressure in some of our businesses, we are maintaining our most recently announced expectations for adjusted earnings per share in the range of $4.75 to $4.85 for the fiscal year ending January 31, 2015. We are particularly pleased with the performance of the Journeys Group, which is currently benefiting from a combination of favorable fashion trends and stellar execution. While we experienced better than expected comparable sales in the Lids Sports Group, the Group's non-comparable sales were lower than expected and the comparable sales have been driven in part by promotional pricing to manage inventory levels. Additionally, we are cautious about the balance of the quarter for Lids because results will depend in part on the performance of certain teams. The comparison to last year's Seattle Seahawks' run to the Super Bowl may be difficult to match."

The company's adjusted earnings per share expectations do not reflect expected non-cash asset impairments and other charges, partially offset by a gain on a lease termination in the first quarter of the year, which are expected to be approximately $0.08 to $0.09 per diluted share for the fiscal year. They also do not reflect a charge of $0.15 per diluted share in the first quarter related to a change in accounting for bonus awards, or compensation expense associated with deferred purchase price for the acquisition of the Schuh Group in June 2011, which is required to be expensed because payment is contingent on continued employment of the payees, expected to be approximately $0.31 per diluted share for the fiscal year. The company believes that providing an adjusted earnings per share estimate not reflecting these items will benefit investors by facilitating comparison with the company's previously announced expectations, which also excluded these items. A reconciliation of the adjusted earnings per share estimates with the diluted earnings per share estimates calculated in accordance with U.S. Generally Accepted Accounting Principles is included as Schedule A to this press release.

Genesco plans to announce its fourth quarter and fiscal year 2015 results on March 12, 2015.

Genesco also announced that management will present at the 17th Annual ICR XChange Conference on Tuesday, January 13, 2015, at 10:00 a.m. (Eastern Standard Time).