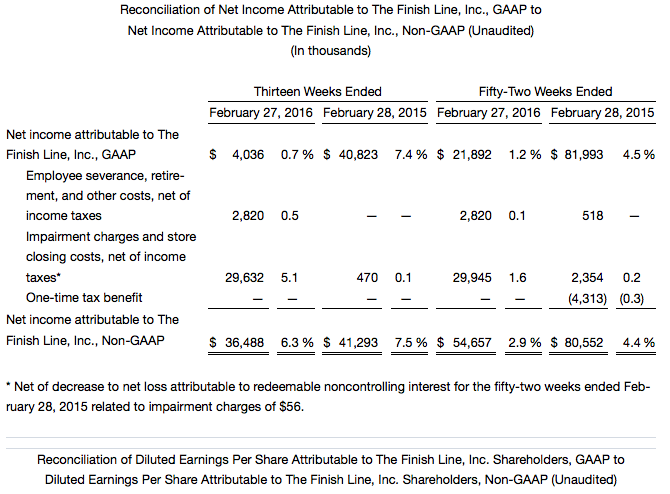

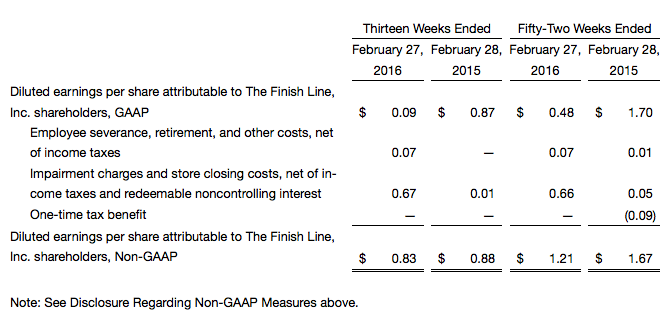

The Finish Line Inc. reported earnings for the fourth quarter before non-recurring items fell 11.6 percent to $36.5 million, or 83 cents a share. Earnings came in at the high end of its guidance calling for earnings between 78 and 83 cents a share. Finish Line comparable store sales increased 4.6

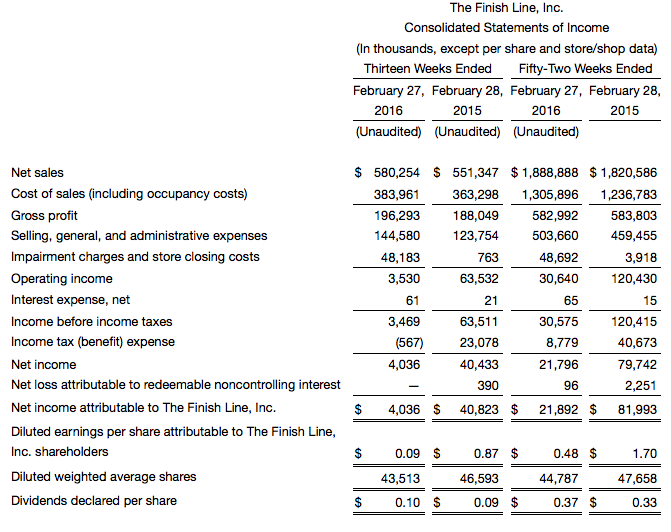

For the thirteen weeks ended February 27,

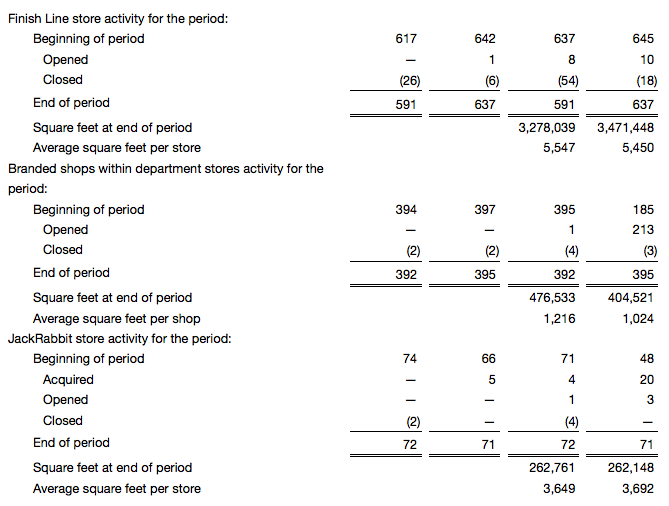

Consolidated net sales were $580.3 million, an increase of 5.2 percent over the prior year period. Finish Line comparable store sales increased 4.6 percent. On a GAAP basis, diluted earnings per share were $0.09. Non-GAAP diluted earnings per share, which primarily excludes the impact from the write-off of technology assets and store impairment charges, were $0.83.For the fifty-two weeks ended February 27,

Consolidated net sales were a record $1.89 billion, an increase of 3.8 percent over the prior year. Finish Line comparable store sales increased 1.8 percent. On a GAAP basis, diluted earnings per share were $0.48. Non-GAAP diluted earnings per share, which primarily excludes the impact from the write-off of technology assets and store impairment charges, were $1.21.“We worked diligently to improve digital fulfillment rates and flow new inventory to our stores during the fourth quarter which helped us achieve a mid-single digit comparable sales increase and adjusted earnings per share at the high-end of our guidance range,” said Sam Sato, chief executive officer of Finish Line. “In addition to achieving optimal performance from our supply chain, our top priorities are continuing to bolster our vendor relationships and fortifying the foundational strengths of the company through new leadership and improved processes. I am confident that elevating our execution across the organization will result in an enhanced customer experience and drive profitable growth and increased shareholder value over the long-term.”

Balance Sheet

As of February 27, 2016, consolidated merchandise inventories increased 9.6 percent to $376.5 million compared to $343.4 million as of February 28, 2015. The increase was driven in part by a seasonal build in merchandise inventories associated with an earlier Easter compared to the prior year. On a segment basis, merchandise inventories increased double digits at Macy’s and JackRabbit and mid-single digits at Finish Line.

The company repurchased 2.0 million shares of common stock in the fourth quarter totaling $34.3 million. For the full year, Finish Line repurchased 3.9 million shares totaling $79.9 million. The company has 2.3 million shares remaining on its current Board authorized repurchase program.

As of February 27, 2016, the company had no interest-bearing debt and $79.5 million in cash and cash equivalents, compared to $149.6 million as of February 28, 2015.

Non-GAAP Adjustments

During the fourth quarter, the company recorded $52.8 million in non-GAAP adjustments, of which $51.0 million was non-cash. These adjustments primarily consisted of a $33.3 million write-off of technology assets. The remaining $19.5 million was primarily related to store impairment charges.

Outlook

For the fiscal year ending February 25, 2017, Finish Line expects comparable store sales to increase in the 3 percent to 5 percent range and earnings per share to be between $1.50 and $1.56.

Annual Meeting July 14, 2016

The company’s Board of Directors has established July 14, 2016 as the date of the 2016 annual meeting of shareholders, with May 13, 2016 as the record date for this meeting.

The Finish Line, Inc. is a premium retailer of athletic shoes, apparel and accessories. Headquartered in Indianapolis, Finish Line has approximately 980 Finish Line branded locations primarily in U.S. malls and shops inside Macy’s department stores and employs more than 14,000 sneakerologists who help customers every day connect with their sport, their life and their style. Online shopping is available at www.finishline.com and www.macys.com. Mobile shopping is available at m.finishline.com. Follow Finish Line on Twitter at Twitter.com/FinishLine or Twitter.com/FinishLineNews and “like” Finish Line on Facebook at Facebook.com/FinishLine. Track loyalty points and find store and product information with the free Finish Line app downloadable for iOS and Android customers.

Finish Line also operates JackRabbit (previously referred to by the company as Running Specialty Group), which includes 72 specialty running stores in 16 states and the District of Columbia under the JackRabbit, The Running Company, Run On!, Blue Mile, Boulder Running Company, Roncker’s Running Spot, Running Fit, VA Runner, Capital RunWalk, Richmond RoadRunner, Garry Gribble’s Running Sports, Run Colorado, Raleigh Running Outfitters, Striders and Indiana Running Company banners.