Anheuser-Busch InBev is exploring the acquisition of competitor SABMiller, a deal that would lead to a $275bn merged entity which would produce one out of every three beers globally.

If the deal goes through, it would be one of the six largest acquisitions in history and the biggest deal in a year that had seen several mergers and acquisitions across several industries.

The merged entity would have annual sales of $73.3bn, making it three times more than competitor Heineken, reported The Associated Press.

SABMiller told The Financial Times, "No proposal has yet been received and the board of SABMiller has no further details about the terms of any such proposal."

The financial daily reported that AB InBev in a statement said that it has approached SABMiller over a combination of the two companies. "AB InBev's intention is to work with SABMiller's board toward a recommended transaction."

AB InBev owns brands such as Stella Artois, Budweiser and Corona.

As profits dip in Americas, AB InBev intends to push into Africa, which is considered the emerging beer market and SABMiller has significant hold here.

This move comes as multinational brewers are facing tough competition from craft beer makers, which is popular with millennial and younger population.

As per the rules of takeover in the UK, AB InBev will have time till 14 October to make a firm offer to SABMiller.

The deal is, however, likely to draw objection from regulators as the size of the two companies may stifle competition in several markets.

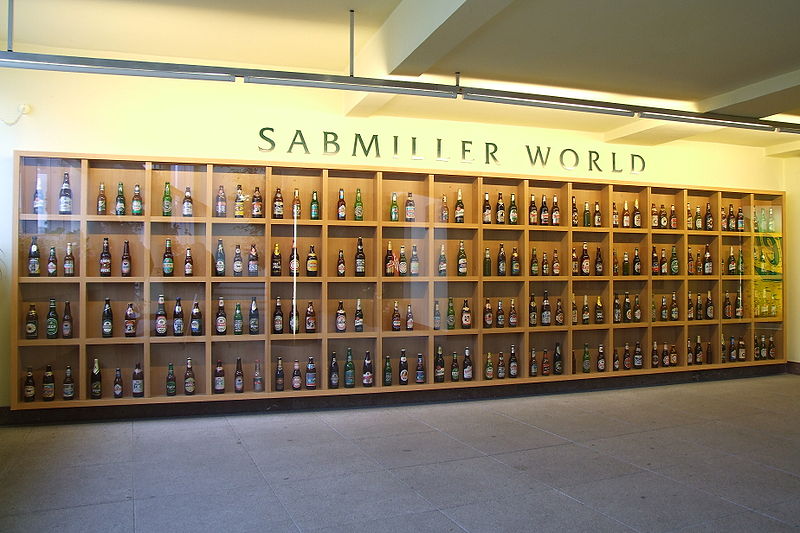

Image: SABMiller is yet to respond to Anheuser-Busch's approach. Photo: Courtesy of Pudelek / Wikipedia.